Where DeFi goes mainstream

Lightning-fast trades and one-click swaps for everyone with seamless UX that makes blockchain invisible.

Powering the best

$150B+

in transactions annually

99.99%+

guaranteed uptime

80%+

of top DeFi apps powered

One complete DeFi platform

Enterprise-grade performance, consumer-grade UX.

More trades at faster speeds

One-click DeFi operations

Instantly onboard and fund users

Proven reliability at global scale

Bring DeFi to everyone

Turn everyone into active DeFi traders with seamless user experiences

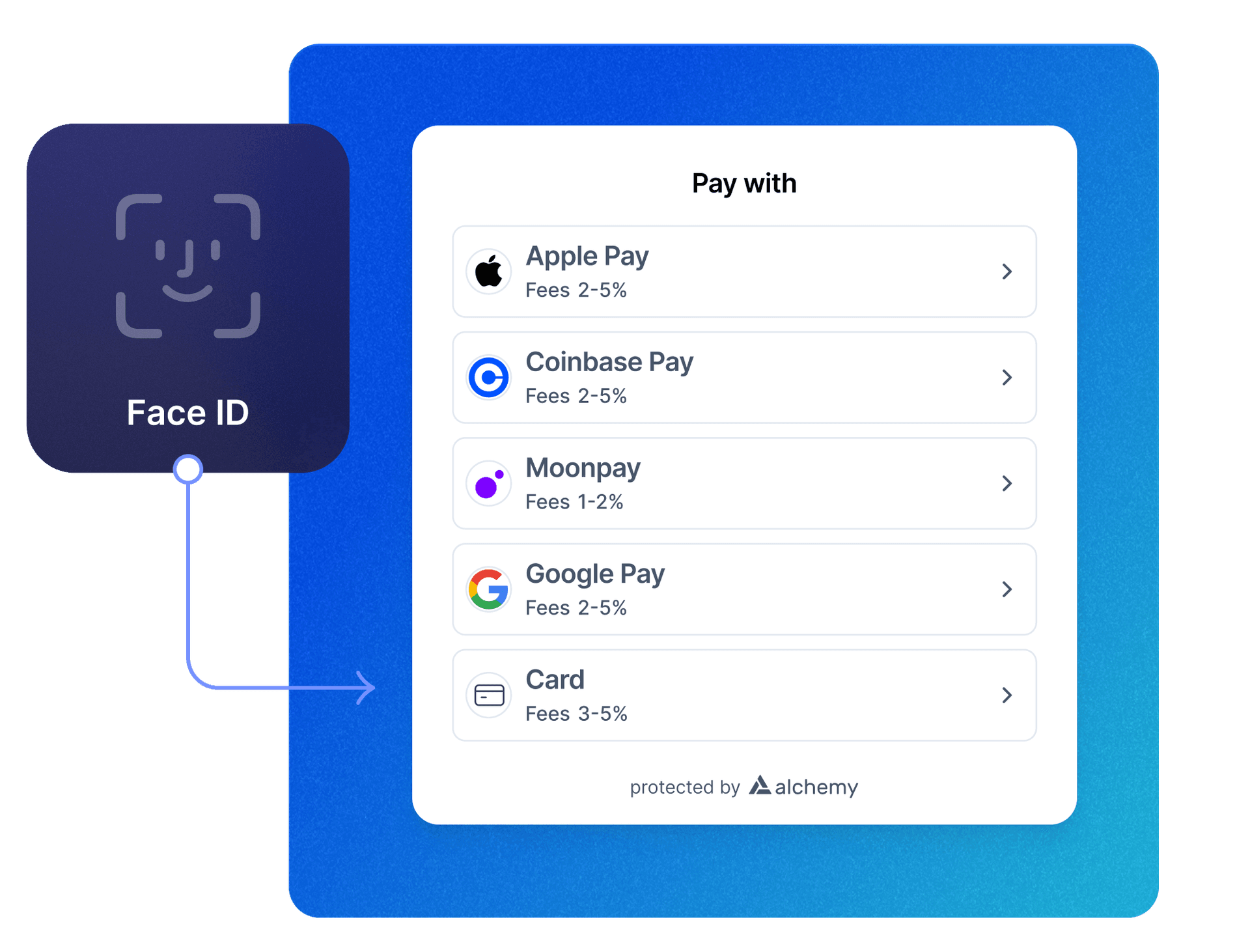

Seamless user onboarding

One-click funding

Gasless transactions

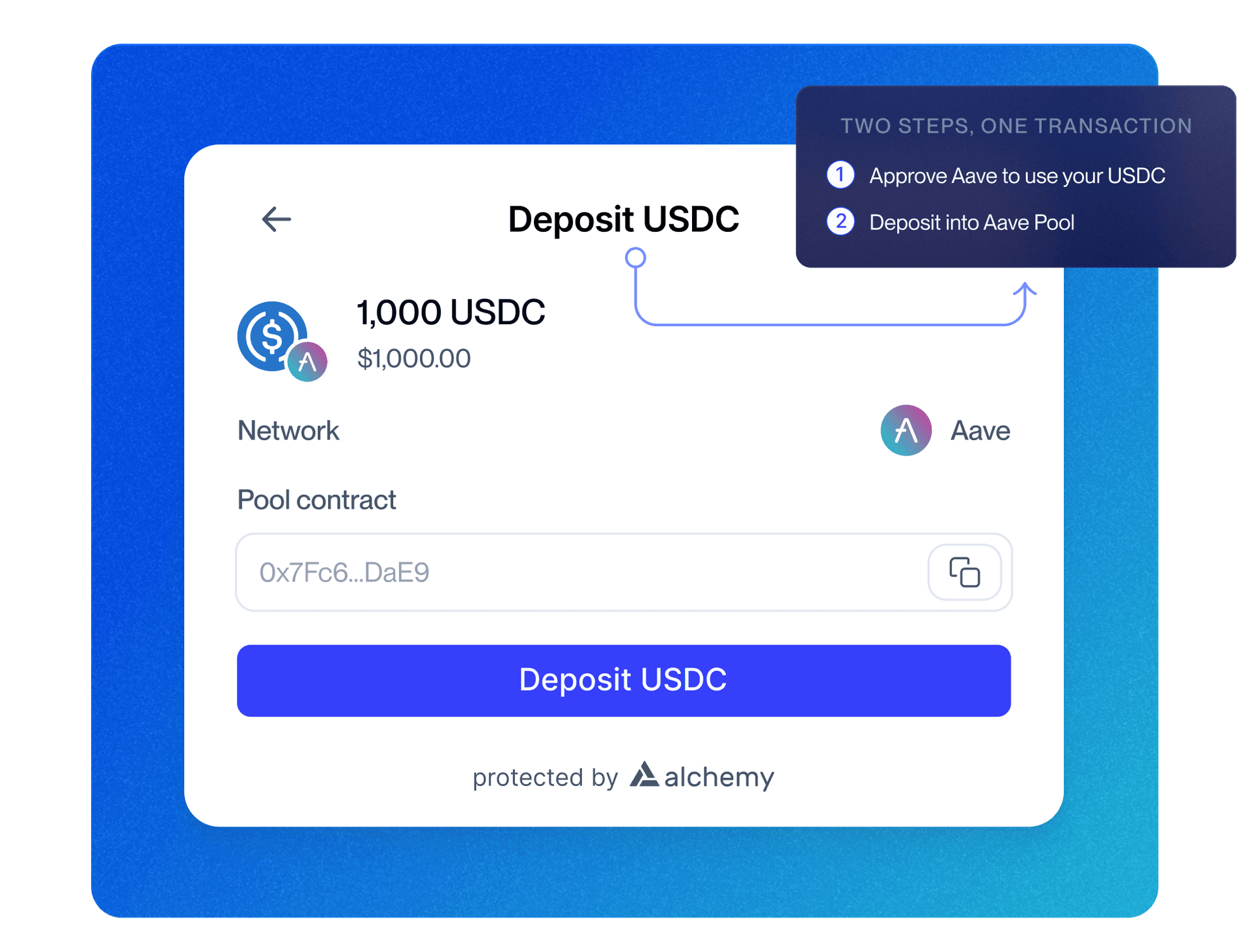

Batch transactions

Real-time balance updates

99.995% uptime

"The only solution that met our standard was 100% onchain session keys that do not rely on any external offchain third party, not even Stable."

Mario Cabrera-Founder & CEO of Stable

Execute at market speed

Unfairly fast DeFi infrastructure that wins trades and converts users.

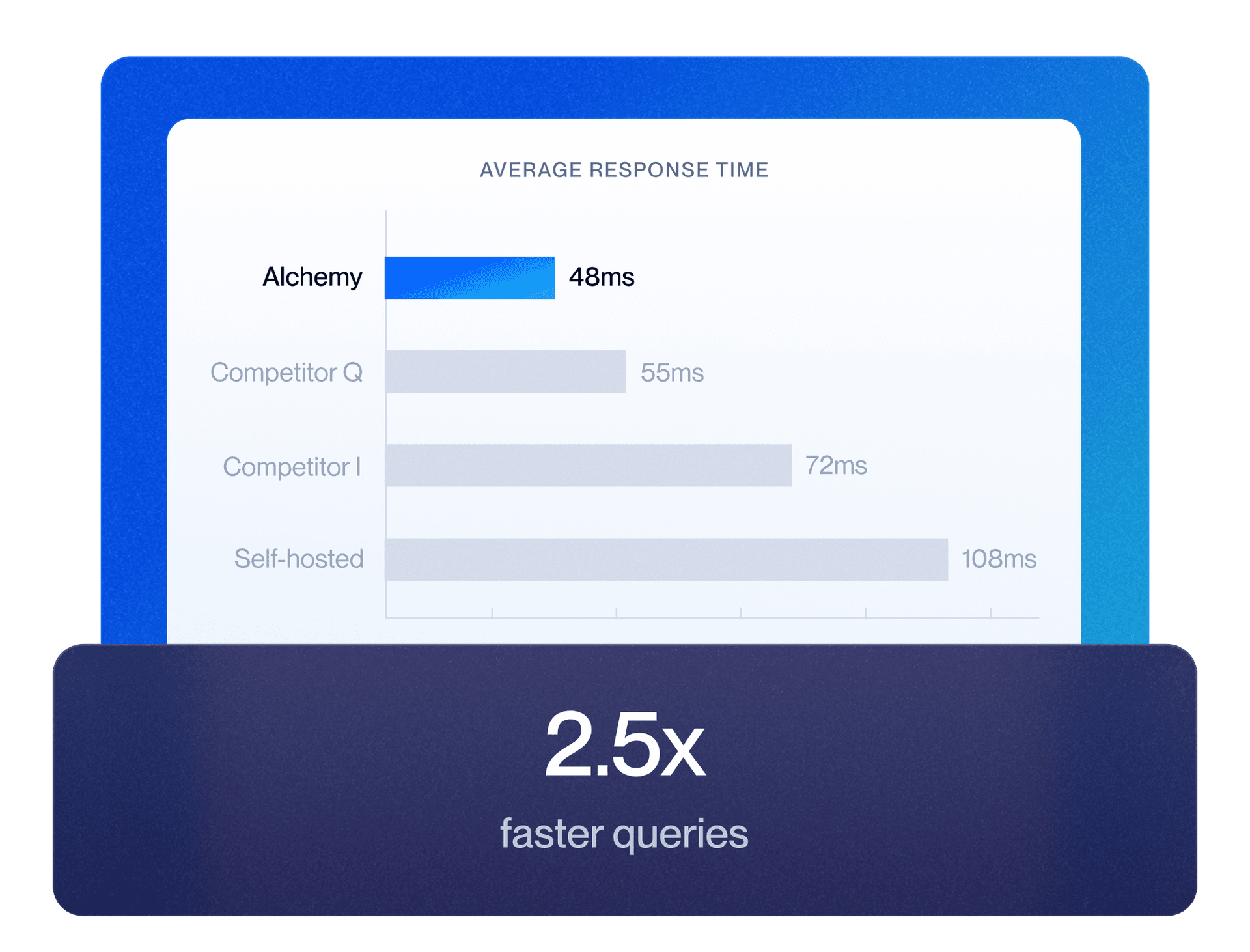

Ultra-fast transactions

Never miss trades with sub-50ms response times

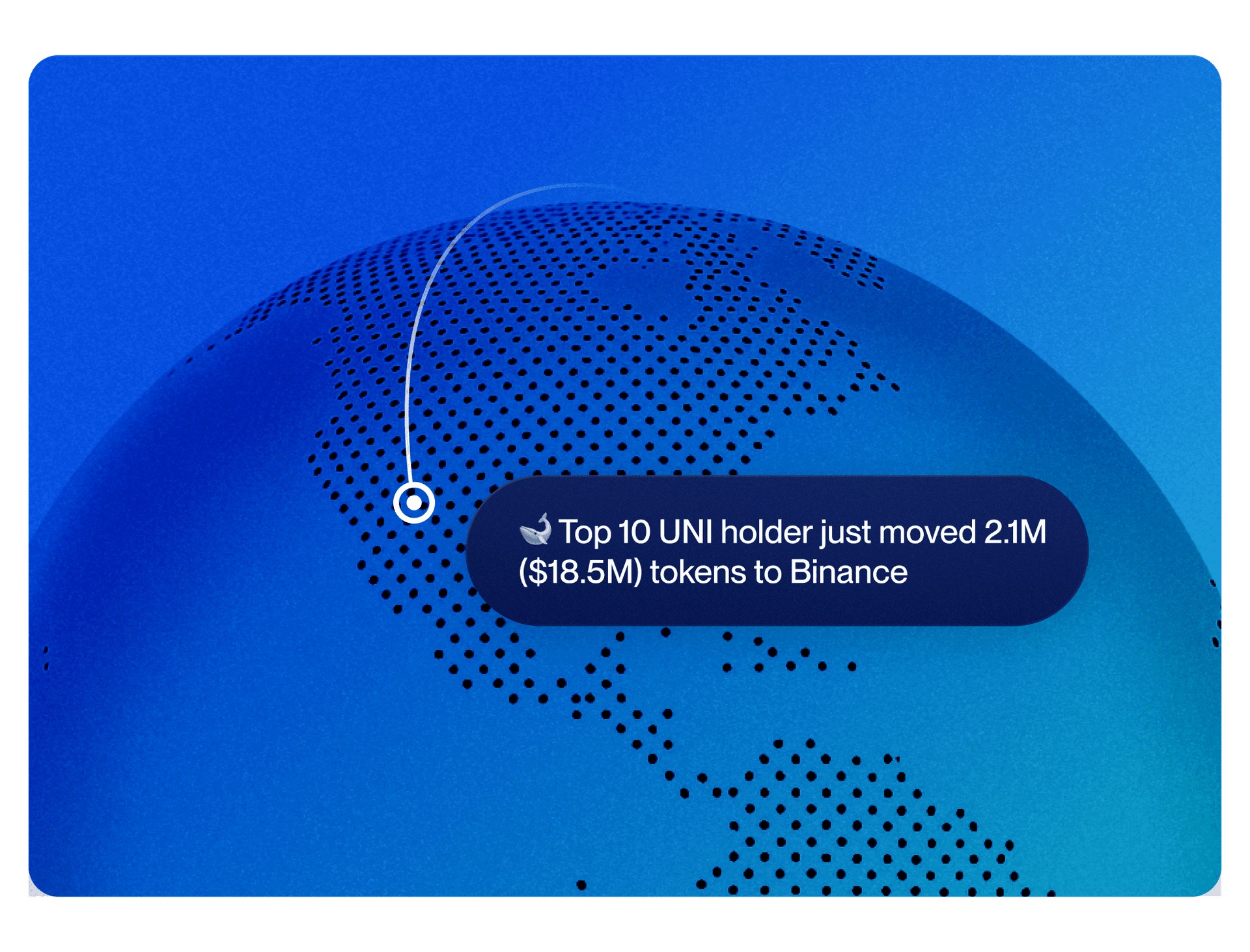

Real-time market data

Never miss a trade with block-perfect consistency for accurate price discovery

One-click DeFi flows

Batch approvals and enable unified cross-chain balances for instant execution

Headless transactions

Users swap and trade without ever leaving your app.

MEV protection built-in

Prioritize profits for users and prevent bots from frontrunning

Natively multi-chain

Access liquidity across 50+ chains with unified APIs.

Get in touch with us

Reach out to us for expert guidance on how Alchemy can help your institution or fintech application.