Deposit Tokens for Banks: A Practical Playbook

Author: Alchemy

Banks face an inflection point: digital money is becoming programmable, and customers expect instant, auditable settlement across new rails. Deposit tokens—bank-issued, onchain representations of fiat deposits—offer a pragmatic path to deliver 24/7 settlement, programmable treasury, and new merchant and liquidity products while preserving banks' control over reserves, compliance and custody.

The regulatory landscape just shifted decisively in banks' favor. The GENIUS Act (July 2025) explicitly distinguishes tokenized deposits from payment stablecoins, preserving banks' ability to issue deposit tokens that pay interest, maintain deposit insurance, and operate under existing banking authority. Combined with major bank implementations already processing billions daily, deposit tokens are positioned to capture $100-140 trillion in annual institutional flows by 2030.

This piece explains why deposit tokens matter, the concrete technical and operational requirements for a bank-grade program, and how Alchemy's enterprise solutions accelerate secure, auditable deployments for companies like Kinexys by J.P. Morgan, Stripe, VISA, and more.

Why deposit tokens now?

Deposit tokens put cash where modern apps live: on programmable infrastructure. For banks, this unlocks immediate business value:

Real-time settlement and liquidity: move funds instantly across partners and markets without legacy batch cycles, 24/7/365

Programmability: enable automated sweeps, payroll, merchant payouts and treasury rules that run on deterministic contracts

New rails and products: tokenized money-market instruments, merchant acceptance, intra-bank liquidity and on-chain liquidity services

Competitive advantage over stablecoins: deposit tokens can pay interest, carry deposit insurance, and integrate seamlessly with existing banking infrastructure

These benefits come with strict requirements: determinism in settlement and reconciliation, controlled issuance and custody, robust KYC/AML, and operational SLAs that match existing payment rails.

Regulatory clarity: The GENIUS Act advantage

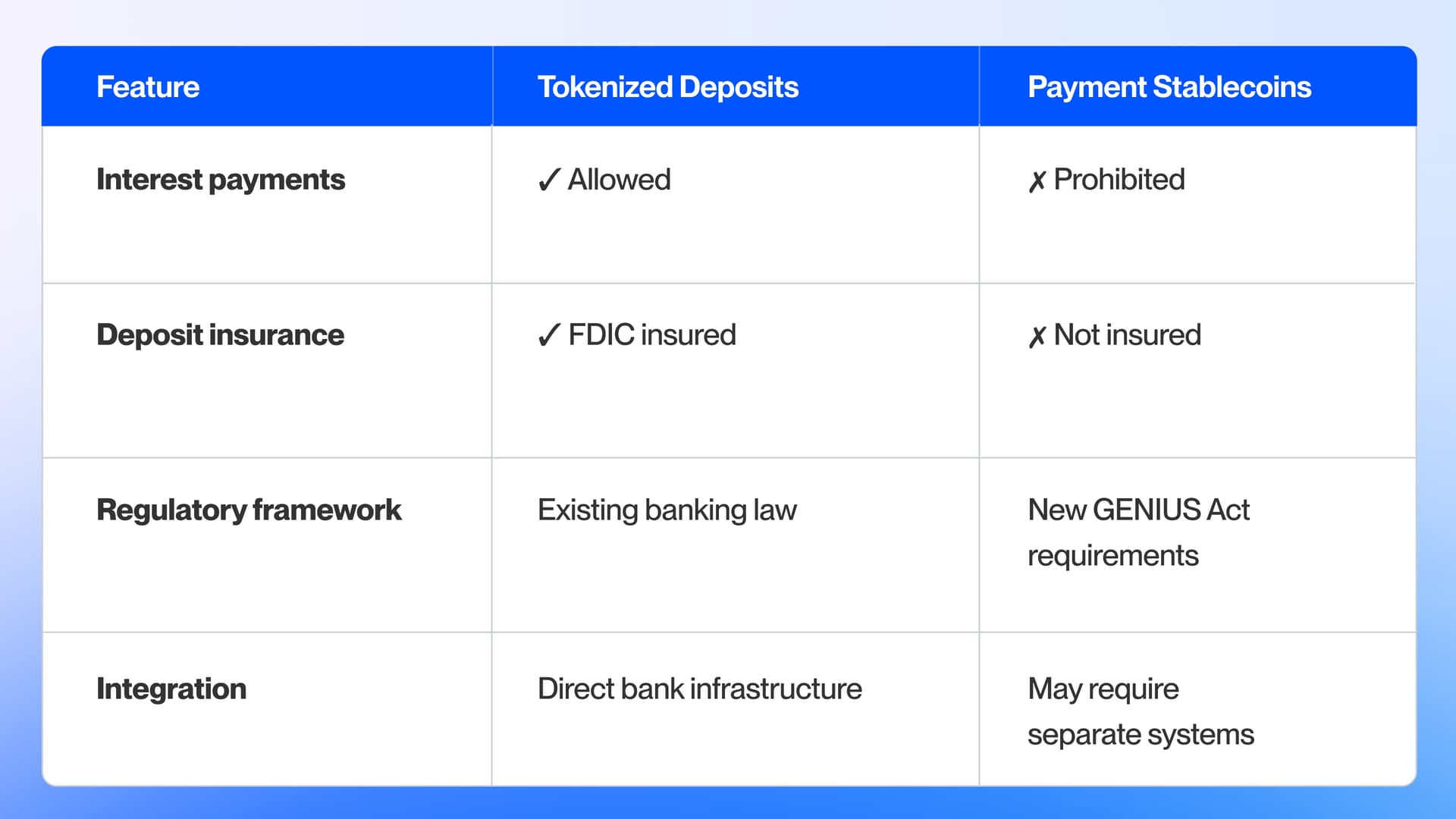

The GENIUS Act (July 2025)—the first federal US legislation on stablecoins—creates a critical distinction for banks: tokenized deposits are explicitly excluded from stablecoin regulation.

Banks can issue tokenized deposits under existing authority—no new licensing, no interest prohibition, no loss of deposit insurance. The FDIC is developing specific guidance for tokenized deposits through 2026, and state supervisors have called for clear federal-state coordination to support bank innovation.

This regulatory clarity is decisive. State banking supervisors report that banks consistently state clear guidance is "critical before they move forward with significant investments" in deposit tokenization. That clarity has arrived.

Deposit tokens vs. stablecoins: Why institutions are choosing banks

While stablecoins reached $300B+ in circulation, tokenized deposits are capturing institutional and wholesale flows that require safety, integration, and yield:

Why deposit tokens win for institutions:

Interest and yield - Can pay interest to holders (stablecoins cannot under GENIUS Act)

Deposit insurance - FDIC protected (stablecoins are not)

Seamless integration - Works within existing banking relationships, no siloed liquidity

Lower counterparty risk - Regulated bank liability vs. private issuer

Market momentum is accelerating:

JPMorgan: $10B+ daily in JPMD flows, now on Base public blockchain (December 2025)

Citi: Token Services integrated with 24/7 USD Clearing across 250+ banks in 40+ markets

HSBC: Tokenized Deposit Service live for corporate liquidity management

Hong Kong: Project Ensemble pilot with Standard Chartered, HSBC, Bank of China, BlackRock, Franklin Templeton

What banks must build

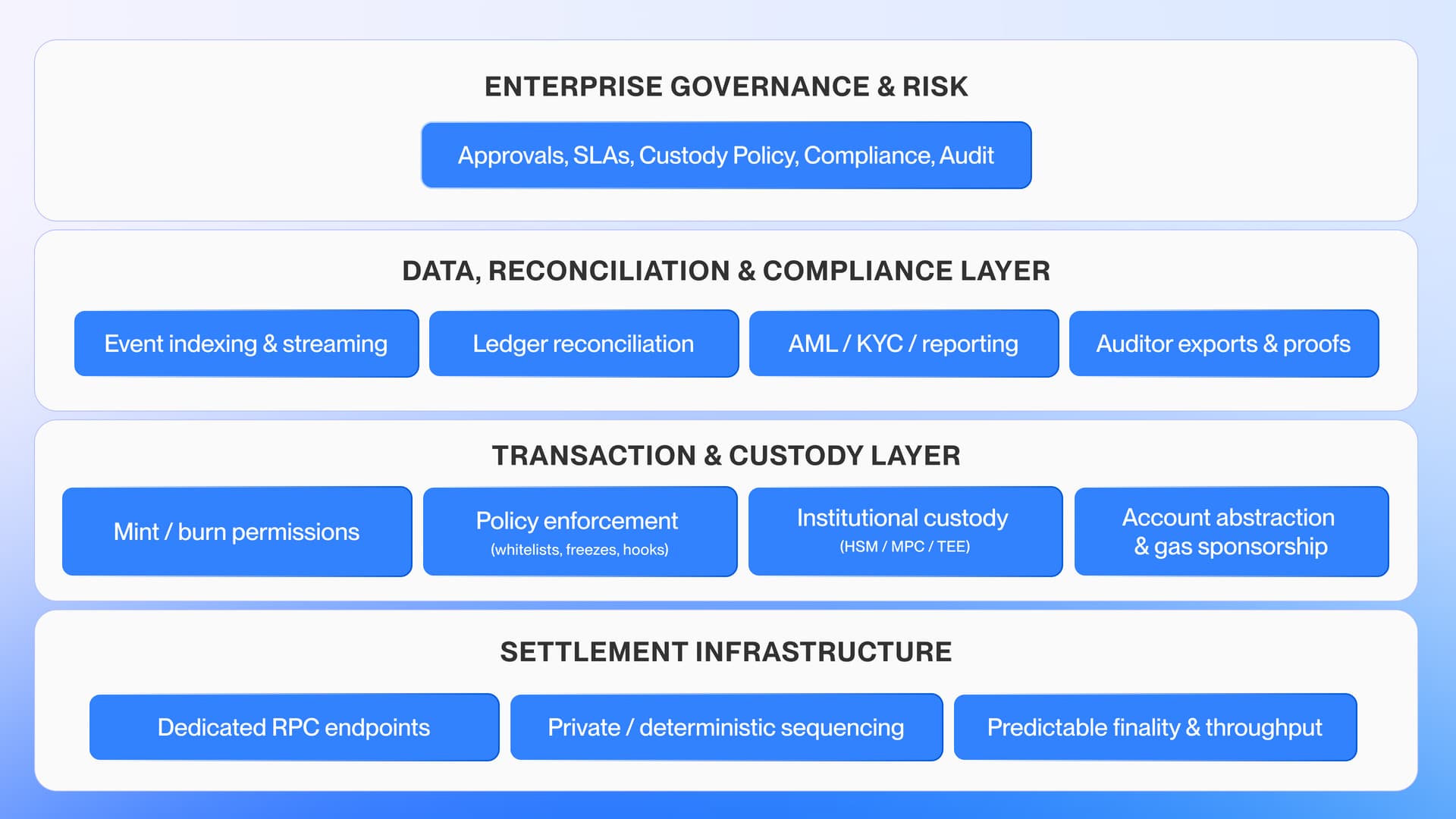

A production deposit-token program is an integration of three capability layers plus enterprise governance:

Settlement Infrastructure (Core RPC & Sequencing) — deterministic transaction submission, predictable confirmation/finality, and infrastructure isolation for high-value flows. Banks typically require dedicated endpoints or private sequencers and clear SLOs to meet payment-grade expectations. Alchemy's enterprise RPC and dedicated sequencing options are designed to deliver this isolation and SLA discipline for production settlement.

Transaction & Custody Layer — permissioned mint/burn, on-chain policy enforcement (whitelists, freezes, transfer hooks), and institutional custody (HSM/MPC/TEE, multi-signatures and governance). For the best client UX, banks also need account-abstraction and gas sponsorship so customers and merchants are free of native gas management. Alchemy's industry-leading gasless transaction infrastructure enables sponsored, gasless flows and integrate with standard custody models.

Data, Reconciliation & Compliance Layer — real-time streaming of mint/transfer/burn events, a deterministic reconciliation engine that maps on-chain events to the bank ledger, AML/KYC pipelines, auditor exports and proof-of-reserves. Alchemy's indexing and packaged data products accelerate reconciliation, compliance workflows and auditor-ready reporting.

Each layer maps to bank teams and controls: settlement to infra/SRE, transaction to custody/payments, and data to treasury/compliance.

A practical, bank-grade token lifecycle

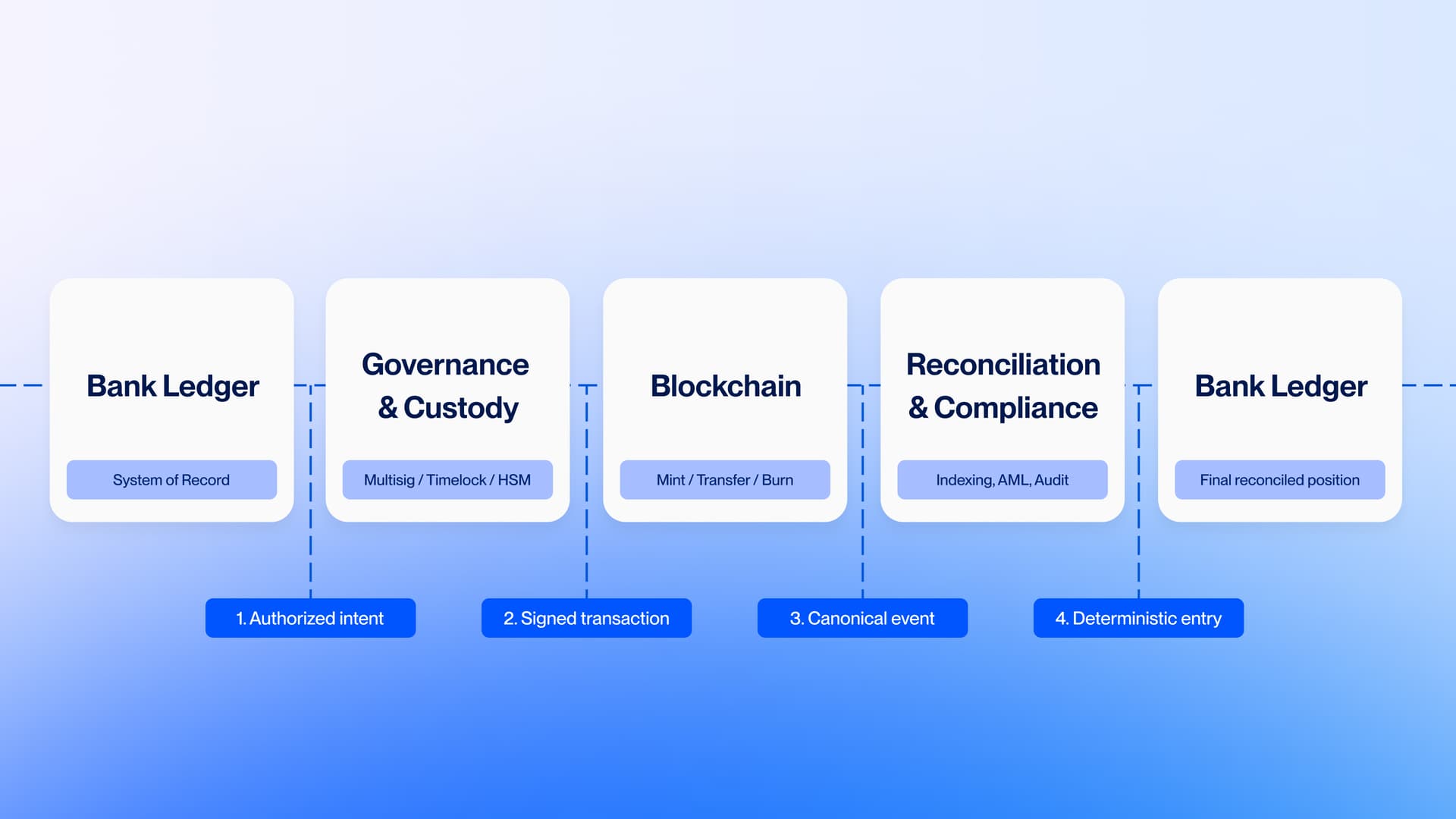

A reliable mint → transfer → redeem flow must make every action auditable and idempotent:

Mint (issue)

Off-chain: customer deposits fiat; bank credits ledger.

On-chain: bank creates a signed mint order (governed by multisig/time-lock); a custody system signs the transaction and a dedicated RPC/sequencer submits it; the data layer consumes the mint event and reconciles it to the ledger.

Transfer (payments / sweeps)

Transfers execute under contract-level policy (whitelists, spend limits) and should stream to AML/KYC tooling in real time. For customer convenience, banks can use account abstraction to sponsor gas so users don't manage native tokens.

Redeem (burn)

Customer requests redemption; bank checks off-chain reserves and governance approvals; custody signs the burn; the burn is confirmed on-chain and reconciliation debits the customer's fiat position.

Operational principle: every on-chain event must produce a single, auditable, idempotent entry in the bank ledger to avoid double-credits or double-burns.

Operational and risk controls

Banks must treat mint/burn as high-value payments and adopt full payment-grade controls:

Governance & approvals: multisig/time-locks for mint/burn and upgrade governance.

Custody: HSM/MPC/TEE with role separation and key rotation policies.

Compliance & monitoring: embed KYC/AML checks into onboarding and transfer hooks; stream events to AML engines; implement sanctions screening and velocity checks. Leverage reliable indexing and webhooks to feed compliance systems.

24/7 liquidity management: Unlike traditional banking with business hours, deposit tokens enable instant redemptions 24/7/365. Banks need real-time monitoring dashboards, stress testing for continuous redemption scenarios (e.g., 20-30% redemption in 4 hours outside business hours), intraday liquidity tools, and contingency funding plans. State banking supervisors have explicitly called for "updated liquidity risk monitoring and management expectations that account for the risks of always-on, 24/7 redemption."

SLAs & ops: define confirmation latency, throughput and reconciliation SLOs; run chaos tests; set P0/P1/P2 incident playbooks with 24/7 coverage. Alchemy's enterprise support is built around SLA-oriented production usage.

Economics & liquidity: determine gas sponsorship models, reserve and idle-cash strategies, and capital buffers/insurance for redemption stress.

Architecture choices and trade-offs

Fully on-chain (1:1 redeemable): greatest transparency; requires continuous reserve backing and frequent audits.

Hybrid model (off-chain ledger anchored on-chain): preserves regulatory control while leveraging immutability for proofs; reduces on-chain liquidity exposure. Alchemy's indexing products simplify creating auditor-ready anchor proofs.

Chain selection: Early implementations used private permissioned chains, but the trend is shifting toward permissioned tokens on public blockchains (e.g., JPMorgan's JPMD on Base). Token contracts enforce KYC and whitelisting while leveraging public infrastructure for interoperability and reduced overhead. Alchemy supports enterprise sequencing and dedicated RPC patterns across both public and permissioned network choices.

Proof point: enterprise readiness

Large banks are already processing billions daily in tokenized deposits, demonstrating that the technical and operational requirements for production deployment are achievable:

JPMorgan: $10B+ daily in JPMD transactions (December 2025), first major bank on public blockchain (Base)

Citi: Token Services integrated with 24/7 USD Clearing, serving 250+ banks across 40+ markets

HSBC: Tokenized Deposit Service live for corporate treasury operations

Hong Kong Project Ensemble: Pilot with Standard Chartered, HSBC, Bank of China, BlackRock, Franklin Templeton for money market funds and liquidity management

Getting started: a recommended pilot

Define token spec & controls: permissioned mint/burn, whitelist/transfer hooks, pause and upgrade rules.

Stand up settlement endpoints: provision dedicated RPC/sequencer with defined SLAs and run chaos tests. Alchemy provides enterprise endpoints designed for this purpose.

Implement custody & governance: HSM/MPC/TEE + multisig approvals integrated with signing workflows.

Deploy token contract & bundler: enable sponsored transaction flows for gasless UX. Alchemy's gasless transaction infrastructure accelerates this step and help model sponsorship economics.

Build 24/7 liquidity framework: real-time monitoring, stress testing, contingency funding, and round-the-clock operational coverage.

Hook up data & compliance: connect indexing/webhooks to AML engines and build reconciliation pipelines. Alchemy's indexing and packaged data products shorten time to audit readiness.

Establish interoperability: define multi-bank settlement protocols and ensure connectivity with other institutions.

Pilot and iterate: run a closed pilot with a small set of counterparties or merchants, tune governance, SLAs and reconciliation until production standards are met.

Inside the pilot: expect the tightest workstreams to be custody integration, 24/7 liquidity management, reconciliation APIs and SLO validation for the settlement layer. Alchemy's Gasless Transactions and support team can help align those pieces with operational runbooks.

Closing perspective

Deposit tokens are not a speculative experiment for banks. They are a practical evolution of how value can move with the speed, programmability and auditability required by modern finance. The GENIUS Act's regulatory clarity has removed significant barriers and created clear competitive advantages for banks over stablecoin issuers.

With major institutions processing billions daily and projections of $100-140 trillion in annual volumes by 2030, the market trajectory is clear. But success requires more than a token contract: it requires production-grade settlement, institutional custody, deterministic reconciliation, 24/7 liquidity management and enterprise SLAs.

Alchemy's proven industry-leading infrastructure is designed to meet the production requirements institutions demand: 99.99% uptime securing $150B+ in annual transactions, SOC 2 Type II certification, dedicated RPC endpoints with SLA guarantees, and easy-to-use APIs for gasless user experiences and real-time indexing for reconciliation and compliance. Alchemy helps teams industry leaders like Kinexys by J.P. Morgan, Robinhood, Stripe, Visa, VanEck, and Franklin Templeton deploy their digital asset strategies in months.

Want to explore a pilot?

If your bank is evaluating deposit tokens, we can help you design and run a pilot that aligns with your custody, compliance and SLA requirements. Contact us to get started.

Alchemy Newsletter

Be the first to know about releases

Sign up for our newsletter

Get the latest product updates and resources from Alchemy

By entering your email address, you agree to receive our marketing communications and product updates. You acknowledge that Alchemy processes the information we receive in accordance with our Privacy Notice. You can unsubscribe anytime.

Related articles

The Enterprise Stablecoin Guide

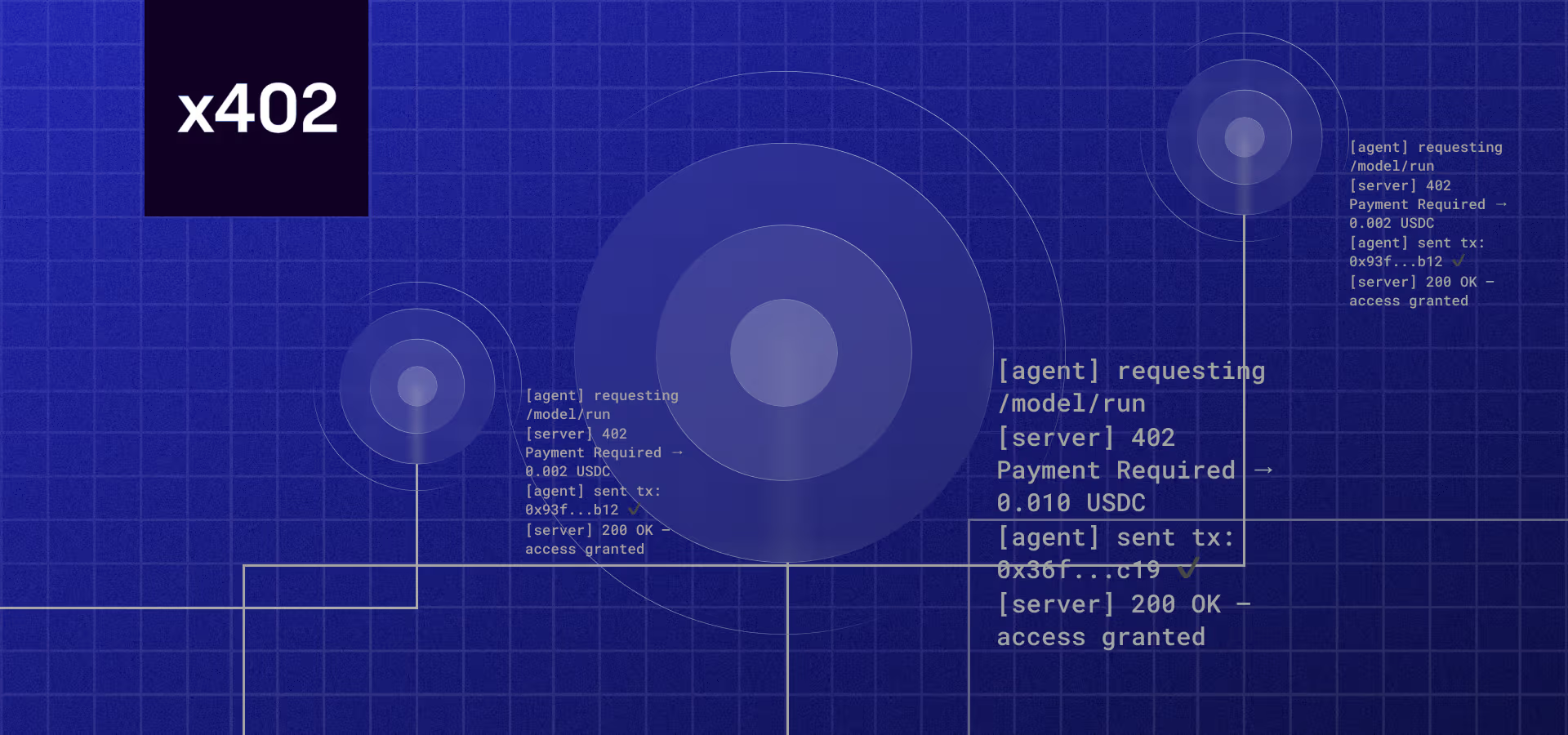

How x402 Brings Real-Time Crypto Payments to the Web

x402 revives the HTTP 402 code, so AI agents and apps can pay for API requests instantly using crypto: no accounts, no subscriptions, just seamless transactions.

The Stablecoin Landscape Across Different Chains

A data-driven look at where $300B+ in stablecoins actually live and move across major blockchains like Ethereum, Solana, Tron, and emerging L1s.