The Enterprise Stablecoin Guide

Author: Uttam Singh

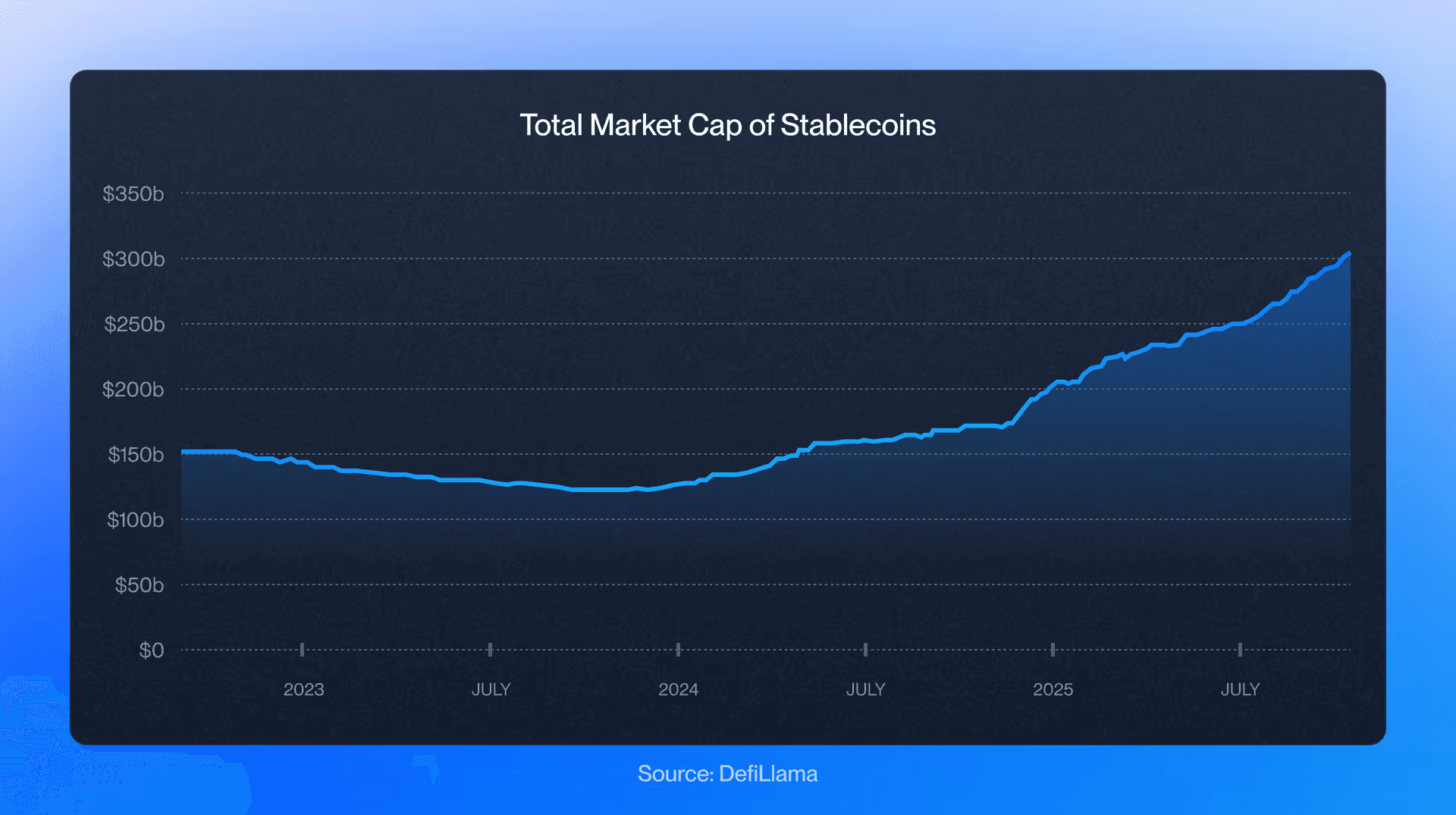

The stablecoin market crossed $300 billion in 2025, up from $205 billion at the start of the year. Nearly $100 billion in new supply appeared in under twelve months.

This acceleration signals something fundamental has shifted. The institutional projections reflect deep conviction. J.P. Morgan sees $500-750B in stablecoin market cap in the coming years. Citi's base case is $1.9 trillion by 2030. Standard Chartered has called for $2 trillion by 2028. Stablecoin issuers have become among the largest non-sovereign holders of U.S. government debt.

Why Traditional Payment Infrastructure Is Broken

To understand why stablecoins represent a fundamental shift, you need to see what's actually broken in the system most enterprises take for granted.

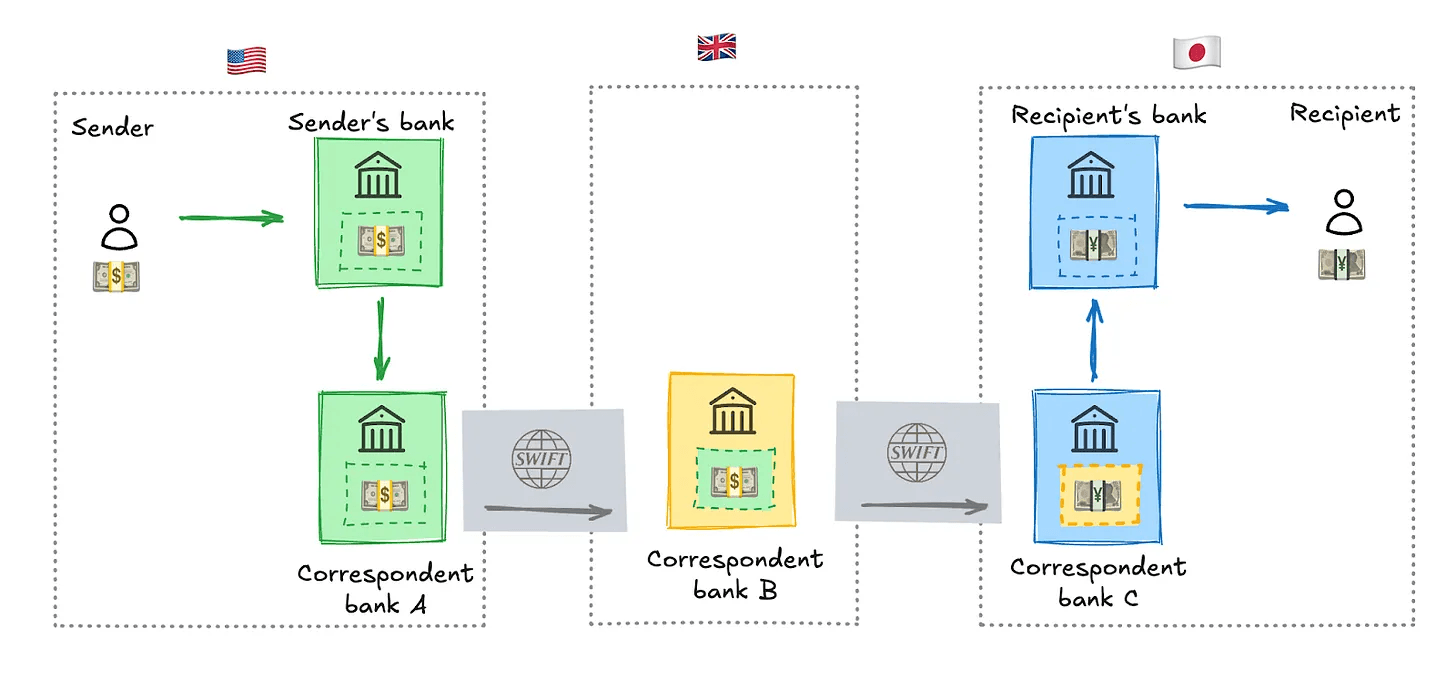

Consider a typical cross-border payment scenario. Your U.S. company needs to pay a supplier in Japan. You initiate a $500,000 wire transfer. What happens next reveals the underlying dysfunction.

The payment flow goes through your originating bank, often multiple correspondent banks using SWIFT messaging, and various clearing counterparties, all before finally reaching the destination bank. Each intermediary maintains its own ledger. Each performs its own compliance checks. Each takes its own cut. The whole process commonly takes 7-14 days to clear—that’s 7-14 days for information to travel and settle from one bank to another, a process which could be nearly instant. That delay creates significant risk and operational cost in its own right.

Further, the payment flow is not only slow, but opaque. Sometimes a customer needs to call the originating bank directly just to get an update on the status of their payment, and even then they may still be in the dark. On top of the time delay and the opacity of the system, there's foreign exchange risk involved across multiple counterparties. The average transaction costs 6.6% when you account for all the fees, spreads, and hidden margins. And the ability to access USD and yield-bearing accounts for those engaged in cross-border money movement is extremely low for all but the largest enterprises.

This isn't describing an edge case in the payments world. This is the system working as designed, built on infrastructure from the 1970s that was never meant to handle the speed and volume of modern global commerce.

How Stablecoins Change Everything

Payments Without Intermediaries

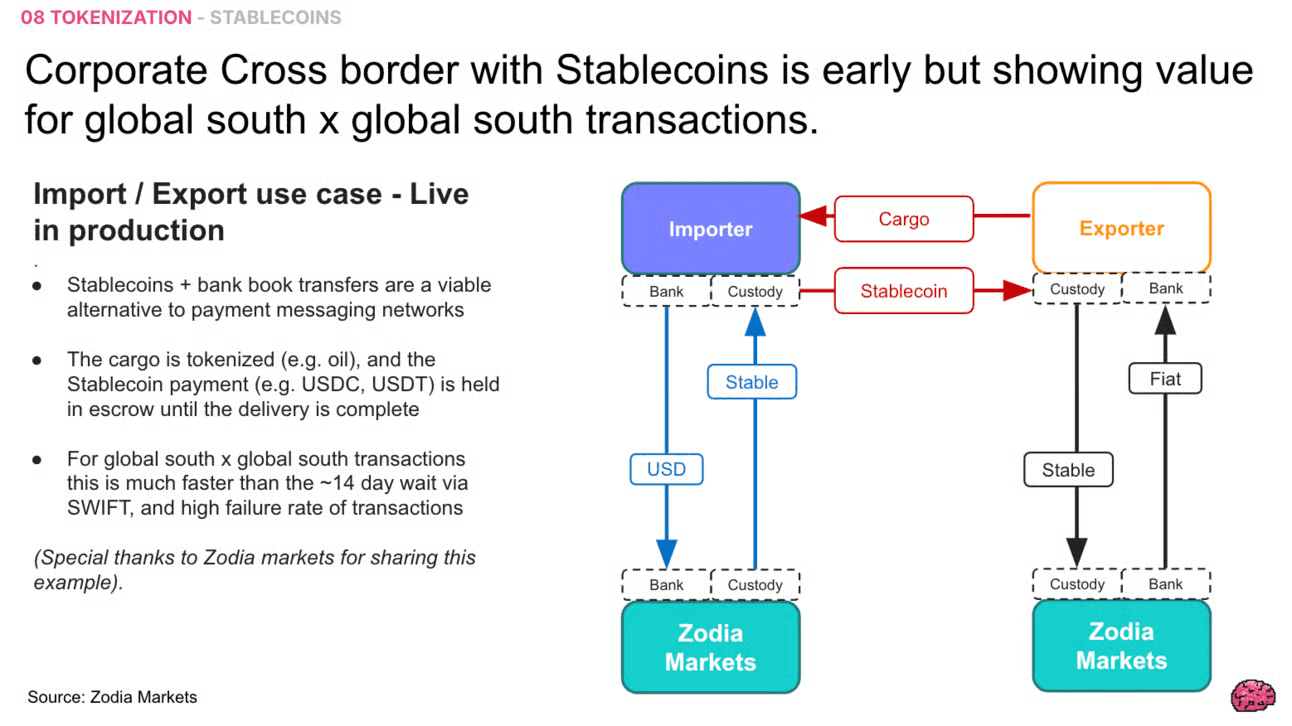

Stablecoins compress the payment stack and reroute who captures payment economics. Instead of value moving through a chain of intermediaries, with each maintaining separate ledgers and charging separate fees, settlement happens on shared blockchain infrastructure.

When your company holds USDC or USDT, you're holding a digital dollar that you can transmit to anyone, anywhere, without asking permission from a bank. Transactions settle in seconds, not days. Costs are a fraction of a percent, not 6.6%. Every step is visible on a public ledger that all parties can verify.

That same $500,000 payment to Japan becomes radically simpler. Your treasury system sends USDC directly to your supplier's wallet address. The blockchain network validates and settles the transaction in seconds. If your supplier wants local currency, they convert through a local exchange in a single transaction at competitive rates. Total time: seconds. Total cost: 0.1-0.5%, or even less sometimes.

The efficiency gains don't come from making the old system faster. They come from eliminating most of the old system altogether.

Money for the Internet

The deeper significance goes beyond cheaper, faster payments. Stablecoins represent the first truly internet-native form of money. They're programmable, composable, and integrate seamlessly with software systems.

Traditional rails won't disappear, but stablecoins will increasingly sit on top as the primary layer where businesses transact. Just as over-the-air TV, FM radio, and SMS still exist but aren't where the future of telecommunications is. The winners here will not be those who saw stablecoins as a cheaper rail, but those who see it as the foundation of a new financial stack.

When money becomes programmable code, entirely new capabilities emerge. Smart escrow eliminates third-party escrow agents in complex transactions. A $50 million equipment purchase can embed payment release conditions directly - funds transfer automatically when shipping documentation and inspection reports are verified onchain. No escrow fees, no manual verification, no trust required. For enterprises conducting thousands of transactions annually, this removes friction and cost & Atomic settlements eliminate counterparty risk in multi-party transactions. Complex swaps involving five parties either complete entirely or fail entirely—no partial execution, no settlement risk, no reconciliation nightmares. For financial institutions executing thousands of these daily, this reduces operational risk and capital requirements.

These capabilities don't exist in traditional finance because the underlying architecture can't support them. Stablecoins make them trivial.

Understanding Different Types of Stablecoins

While the value proposition of stablecoins is universal, under the hood not all stablecoins work the same way. The stability mechanism has profound implications for enterprise use, and you’ll need to be thoughtful about which types you choose to build or integrate with. Here are the 4 types of stablecoins.

Fiat-Backed Stablecoins

Fiat-backed stablecoins maintain reserves of traditional currency to back each token one-to-one with that underlying currency. USDC and USDT, the two largest stablecoins, follow this model. Every dollar of stablecoin in circulation corresponds to a dollar of cash or short-term U.S. Treasuries held in reserve.

When you acquire USDC, Circle deposits an equivalent amount into segregated reserve accounts. These reserves are regularly attested by third-party auditors. When you redeem USDC, Circle burns the tokens and returns fiat currency.

This provides straightforward stability and regulatory clarity. The trade-off is centralized trust in the issuing institution and their reserve management practices. For enterprise treasury operations prioritizing predictability and regulatory comfort, fiat-backed stablecoins from established issuers are the clear choice.

Crypto-Collateralized Stablecoins

These stablecoins use other cryptocurrencies to support the stablecoin capital reserve, typically with over-collateralization to absorb the volatility of those crypto assets. DAI operates with this crypto-collateralized model, accepting various crypto assets as collateral at ratios like 150-200% that provide stability buffers.

This approach offers more decentralization (it keeps the stablecoin entirely on crypto rails), but in return, it introduces complexity and capital inefficiency. Smart contracts enforce the mechanics of collateral deposits programmatically. If the value of the reserve collateral drops too low, stablecoin positions will liquidate automatically to maintain the “peg” (a term used to describe the 1:1 conversion ratio between a stablecoin and a dollar).

For enterprises already deep in crypto-native operations or where decentralization is paramount, a crypto-collateralized stablecoin may make sense. For traditional corporate treasuries, the complexity and capital inefficiency make them less practical than fiat-backed alternatives.

Algorithmic Stablecoins

These stablecoins attempt to maintain stability through programmatic supply adjustments rather than collateral backing. When the stablecoin trades above $1, the protocol mints new tokens to increase supply and push the price down. When it trades below $1, it contracts supply by burning tokens to push the price back up. It's monetary policy in code, requiring no reserve capital.

The enterprise appeal was obvious. No billions locked in Treasury reserves. No custodian risk. No regulatory overhead of managing actual dollars. For banks and financial institutions, this promised stable digital currency without the capital requirements.

The reality proved fatal. TerraUSD's $60 billion collapse in May 2022 exposed fundamental flaws. Algorithmic stablecoins rely entirely on confidence. They work in bull markets but become death spirals when confidence breaks. Unlike fiat-backed stablecoins where you can redeem for actual dollars, algorithmic stablecoins have no fundamental floor.

For enterprise treasury operations, the lesson is clear. The capital efficiency is vastly outweighed by existential risk. No CFO will accept instruments that can lose 99% of value in 48 hours. The mechanism hasn't proven robust under stress and likely cannot, given its dependence on self-reinforcing confidence rather than tangible backing.

Yield-Bearing Stablecoins

An emerging category that passes Treasury yields directly to token holders. Traditional stablecoins like USDC and USDT earn 4-5% on their Treasury reserves, but Circle and Tether keep all those returns—generating billions in profit annually. Yield-bearing stablecoins distribute that yield to holders instead.

Why this matters for enterprises: Banks facilitating $10 billion in stablecoin transactions are watching $400-500 million in annual Treasury yield flow to Circle and Tether. Yield-bearing stablecoins let you capture that value. Corporate treasuries get 4-5% returns on operational cash with instant liquidity. Neobanks can offer 3-4% to customers versus 0.5-2% from traditional savings, creating powerful competitive advantages.

Examples include USDY from Ondo Finance and tokenized money market funds. Trade-offs include regulatory uncertainty and less liquidity than traditional stablecoins, but this is where significant value migration is happening.

Choosing the Right Blockchain Infrastructure

Alongside the different types of blockchains, you’ll also find that different stablecoins operate on different blockchain networks. The network choice can profoundly impact costs, speed, and risk. To dive into this in greater detail, read our piece on the stablecoin landscape.

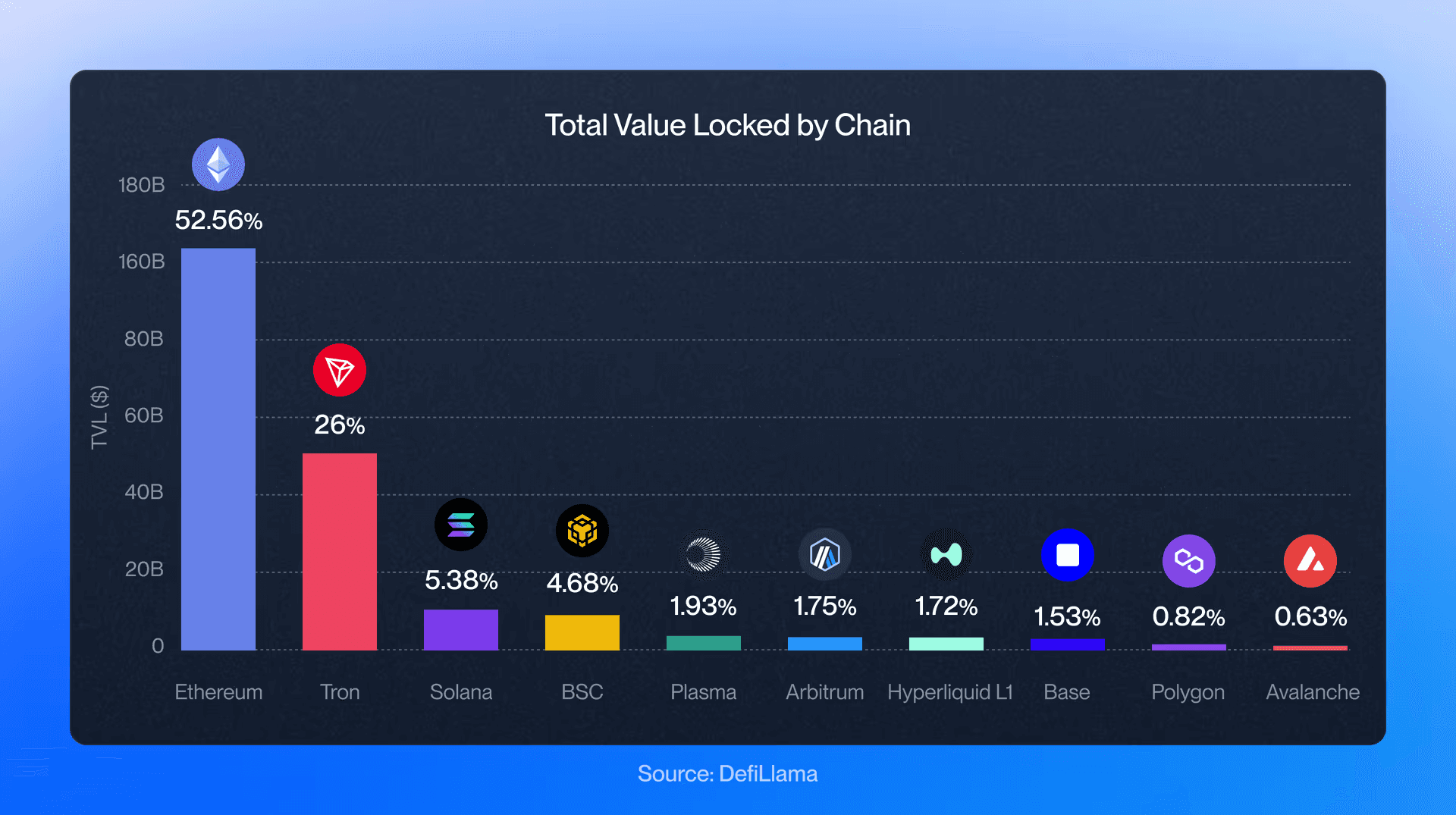

Ethereum Dominates

Ethereum remains the dominant platform for stablecoin activity, with the deepest liquidity and most mature ecosystem. It's the most battle-tested smart contract platform with nearly a decade of operation. Strong decentralization, established regulatory frameworks, and institutional comfort make it the default choice.

The trade-offs for that popularity and security are higher transaction costs and lower throughput. Ethereum mainnet transactions can cost $1-15 depending on network congestion, with settlement finality in 12-15 minutes. However, for large treasury movements where security and regulatory clarity matter most, these costs can be acceptable.

Layer 2 Networks Provide the Best Economics

Layer 2 solutions like Arbitrum, Optimism, Base, and Polygon inherit Ethereum's security while processing transactions off-chain. This delivers dramatically better economics: transaction costs are around $0.01-0.10, roughly 100x cheaper than Ethereum mainnet. Throughput reaches thousands of transactions per second with near-instant confirmation.

For high-frequency operations like regular supplier payments or payroll, L2s increasingly represent the sweet spot. You get Ethereum security with costs that make small transactions practical.

Solana Optimizes for Speed and Cost

Solana has emerged as the third-largest stablecoin ecosystem, growing rapidly through 2024-2025. It offers extremely high throughput at sub-cent costs with sub-second confirmation times. The trade-offs are lower decentralization and a shorter operating history than Ethereum.

For use cases where speed and cost are paramount, and where risk tolerance accommodates less battle-tested infrastructure, Solana makes sense. It's particularly strong for applications requiring near-instant settlement at massive scale.

Stablecoin’s Privacy Problem

All of these blockchain networks are public by design. Every transaction is visible to anyone with a blockchain explorer. For companies considering moving treasury operations onto stablecoin rails, this creates genuine competitive intelligence risks. Your cash flows become visible. Your vendors, your customers, your payment patterns, all exposed to competitors who care to look. That big payment to a logistics company in a new region? Your competitor just learned you're expanding there. Legal fees and consulting payments telegraph M&A activity. Your working capital management, liquidity positions, treasury operations, all analyzable by anyone running basic blockchain analytics.

No serious business wants their financial operations exposed this way. No CFO will move meaningful treasury activity onto rails where every transaction is publicly analyzable. Competitive advantage often depends on information asymmetry. Bank accounts aren't public databases for good reason.

The good news is the industry built technology to solve this. Zero-knowledge proofs allow proving something is true without revealing underlying information. You can prove you have sufficient funds without revealing your balance. You can prove a transaction is legitimate without revealing sender, recipient, or amount.

Confidential transactions hide amounts while maintaining verifiability. Private channels enable off-chain transactions between regular counterparties with only periodic settlement hitting public blockchains. Privacy-preserving stablecoins are being built with confidentiality as a core functionality.

The emerging model replicates traditional banking privacy. Transactions visible on public blockchains with encrypted details. Authorized regulators can obtain decryption keys through legal process, maintaining the integrity of the financial system. But competitors and unauthorized parties cannot access transaction details, protecting the confidentiality of business information.

Privacy for enterprises doesn't mean hiding from regulators. It means protecting commercial confidentiality while maintaining regulatory compliance. As stablecoins move from crypto-native operations to mainstream corporate treasury, privacy infrastructure will shift from nice-to-have to table stakes.

Should You Build Your Own Stablecoin?

For most enterprises, using existing stablecoins makes sense. These established players have already invested hundreds of millions in regulatory compliance, reserve management infrastructure, custody relationships, and building liquidity across dozens of blockchains and exchanges. You plug into that ecosystem immediately without spending years navigating money transmitter licenses across fifty states, managing Treasury reserve operations, or building redemption infrastructure from scratch. The opportunity cost of building when you could be capturing payment savings and operational improvements right now is substantial.

But for certain organizations, issuing a proprietary stablecoin offers strategic advantages that justify the complexity and investment.

When Building Your Own Makes Sense

The decision to issue your own stablecoin should be driven by specific strategic imperatives, not technology enthusiasm.

You operate a closed-loop ecosystem. If you have a large network of suppliers, distributors, customers, or partners who primarily transact within your ecosystem, a proprietary stablecoin can capture value that would otherwise leak to external payment processors. Think of large retailers with extensive supplier networks, marketplace platforms with thousands of merchants, or conglomerates with complex inter-subsidiary transactions.

You want to capture payment economics. When customers and partners use your stablecoin, you control the payment infrastructure and capture economics that currently go to banks and payment processors. Every transaction on your rails instead of traditional rails translates to savings that accrue to your ecosystem. Circle and Tether generate billions annually from the float on reserves backing their stablecoins. Why let them capture that value on transactions within your ecosystem?

You need programmability specific to your business model. Generic stablecoins like USDC work for simple transfers. But if your business requires specific programmable features like automated royalty distributions, complex escrow arrangements, industry-specific compliance checks, or integration with proprietary business logic, building your own stablecoin lets you embed those capabilities at the protocol level.

You're building a financial services product. If you're a fintech, neobank, or financial services provider, a branded stablecoin becomes a product offering that differentiates you from competitors. It's not just infrastructure for your operations but a customer-facing service that generates revenue and deepens relationships.

You operate in markets with limited banking access. In regions where correspondent banking is expensive, unreliable, or unavailable, a proprietary stablecoin lets you create payment infrastructure independent of traditional banking relationships. This is particularly relevant for companies operating across emerging markets or in industries that banks find risky.

You want to build a moat through liquidity. A successful proprietary stablecoin with significant supply and usage creates network effects that become a competitive moat. Partners integrate with your payment rails. Customers hold balances in your stablecoin. Switching costs emerge. The stablecoin becomes infrastructure that's hard to displace.

The Real Advantages of Building Your Own Stablecoin

Building your own stablecoin delivers benefits that using third-party stablecoins cannot.

Revenue from reserves. This is the most immediate financial advantage. Stablecoin issuers hold reserves backing their tokens, typically in short-term U.S. Treasuries or cash equivalents. With Treasury yields at attractive levels, a stablecoin backed by Treasuries generates 4-5% annual returns. On $1 billion in stablecoin supply, that's $40-50 million annually in risk-free revenue. Circle generated over $1 billion in revenue in recent years primarily from reserve management. Tether's profits have been even larger.

Control over monetary policy within your ecosystem. You determine reserve requirements, redemption policies, minting controls, and fee structures. Want to offer zero-fee transfers to preferred partners? You can. Want to implement dynamic fees that adjust based on network conditions? You can. Want to create tiered service levels with different settlement speeds? You control the entire stack.

Direct customer relationships and data. When partners and customers use your stablecoin, you own the relationship and see the transaction data. This provides insights into payment flows, customer behavior, and ecosystem health that aren't available when transactions happen on someone else's infrastructure. That data informs business strategy, risk management, and product development in ways that opaque third-party payment systems never could.

Brand presence in every transaction. Your stablecoin carries your brand. Every wallet it appears in, every transaction it settles, every integration that supports it reinforces your brand presence. This is marketing that compounds with adoption. Compare to using USDC where Circle captures all the brand value from transactions you're facilitating.

Strategic flexibility and innovation. You can evolve the stablecoin as your business evolves. Add privacy features when your enterprise customers demand them. Implement cross-chain bridges to expand to new ecosystems. Build specialized redemption channels for specific use cases. Integrate directly with your other products and services. Third-party stablecoins evolve based on their priorities, not yours.

Reduced counterparty risk. Using USDC means trusting Circle's operations and reserve management. Using USDT means trusting Tether. Building your own means you control the reserves, manage the risk, and don't face exposure to someone else's potential mismanagement. For large enterprises moving significant value, eliminating this counterparty risk can be worth the operational complexity.

Managing Stablecoin Risks

Stablecoins introduce new risks that must be understood and managed. Pretending they don't exist is foolish. But letting risk aversion prevent capturing genuine advantages is equally problematic. Here are a few risks to keep in mind.

Custody and Security

Digital assets use cryptographic keys for ownership. Lose the keys, and you lose the assets permanently. No password recovery exists. Similarly, if private keys are compromised, attackers can drain wallets irreversibly with no recourse.

Mitigation here is relatively straightforward: use qualified institutional custodians like Coinbase Prime, Anchorage Digital, BitGo, or Fireblocks. These companies provide insurance, redundant security, and professional key management.

As a general rule of thumb, don't self-custody significant treasury assets. Implement multi-signature requirements, so multiple keys must authorize transactions. Use hardware security modules for key storage. Purchase crypto-specific insurance. Maintain comprehensive procedures with four-eyes principles and detailed audit logs.

Smart Contract Risk

Stablecoin functionality runs on smart contracts, code that executes autonomously. Bugs in this code can result in asset loss. Even audited contracts have failed catastrophically with hundreds of millions lost annually to DeFi exploits.

Mitigation means sticking to established protocols with years of operation. Use battle-tested stablecoins like USDC and USDT. Avoid newly launched or experimental systems for treasury operations. Review audit reports from reputable security firms while understanding audits find bugs but don't guarantee perfection. Limit exposure to complex DeFi protocols. For most corporate treasuries, simple stablecoin holdings are appropriate, not sophisticated yield farming strategies.

Counterparty and Issuer Risk

Fiat-collateralized stablecoins depend on issuers maintaining proper reserves. If Circle or Tether fails, stablecoin holders face potential loss.

Risk mitigation here involves choosing established issuers with multi-year track records and massive scale. USDC and USDT have proven resilience. Their collapse would require systemic failures. Review regular attestations from accounting firms that both publish. Diversify across multiple stablecoins to avoid single-issuer concentration. Monitor for de-pegging events where stablecoins trade off their dollar peg, as sustained deviations signal problems. Maintain direct redemption channels with issuers, not just exchange liquidity.

Regulatory Risk

Stablecoin regulation is still evolving and varies by jurisdiction. Today's compliant practices might become problematic as regulations change.

Mitigation for regulatory risk requires engaging compliance expertise from law firms specializing in digital assets. Implement robust KYC/AML procedures even if technically not required. Document everything comprehensively. If operating in regulated industries, consider proactively engaging regulators. Stay informed on regulatory developments across relevant jurisdictions. Build flexibility so you're not dependent on regulatory arrangements that might change.

Looking Forward Five Years

Despite these risks, the stablecoin trajectory seems increasingly clear. The stablecoin market cap will likely reach $1-2 trillion by 2030, representing 5-10% of global M2 money supply in developed economies. This makes them systemically important financial infrastructure, not a niche technology.

The majority of multinational corporations will have stablecoin treasury operations as standard practice. Enterprise treasury conferences will feature stablecoin strategy as normal practice, not exotic speculation. Regulatory frameworks in major jurisdictions will be comprehensive and well-understood. The regulatory risk that currently constrains some adoption will have declined dramatically.

Infrastructure will have matured significantly. User experiences will be dramatically improved from today. Custody will be institutionalized and commoditized. Integration with traditional systems will be standard. The technical complexity that currently feels daunting will have smoothed substantially.

New capabilities will emerge that aren't currently possible. Smart contract automation, programmable payments, and tokenized assets will enable treasury operations beyond what traditional infrastructure supports. The value proposition will extend beyond cost and speed to genuinely novel capabilities.

Companies without stablecoin capabilities will face material competitive disadvantages in international operations. Stablecoin fluency will be expected treasury competency, not exotic specialization.

This isn't speculative fantasy. It's extrapolating current adoption curves and institutional investment. The main uncertainty is speed, not direction. Traditional payment rails won't disappear, but they'll increasingly be utilities underneath a stablecoin layer where innovation, value creation, and competitive differentiation happen.

Want to Join the Stablecoin Adoption Wave?

If you take one thing away from this post, it’s that stablecoins are transforming the world of finance, and for financial services, the mandate is clear: get on stablecoin rails or fall behind.

To learn more about how Alchemy products support stablecoins, view our payments page, and if you’d like to chat to learn more about how you can integrate stablecoins into your business, contact our sales team. We’d love to partner with you and advise you on how best to move forward.

Alchemy Newsletter

Be the first to know about releases

Sign up for our newsletter

Get the latest product updates and resources from Alchemy

By entering your email address, you agree to receive our marketing communications and product updates. You acknowledge that Alchemy processes the information we receive in accordance with our Privacy Notice. You can unsubscribe anytime.

Related articles

Deposit Tokens for Banks: A Practical Playbook

Major banks are quietly processing $10B+ daily in tokenized deposits. Here's how deposit tokens could capture $140 trillion by 2030 and a playbook to integrate for banks.

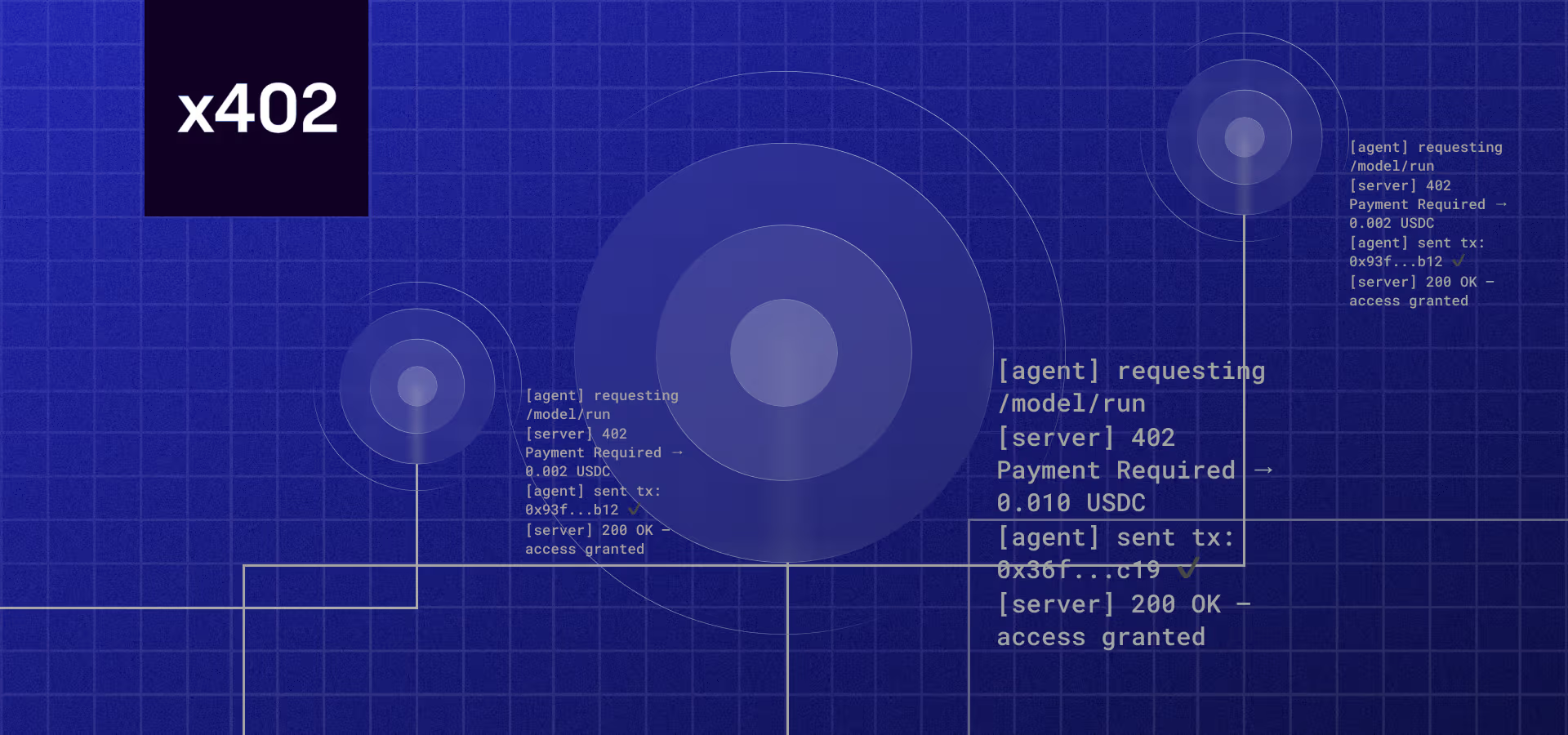

How x402 Brings Real-Time Crypto Payments to the Web

x402 revives the HTTP 402 code, so AI agents and apps can pay for API requests instantly using crypto: no accounts, no subscriptions, just seamless transactions.

The Stablecoin Landscape Across Different Chains

A data-driven look at where $300B+ in stablecoins actually live and move across major blockchains like Ethereum, Solana, Tron, and emerging L1s.