The Stablecoin Landscape Across Different Chains

Author: Uttam Singh

Stablecoins are the first crypto product to hit true, global product-market fit. What began as a tool for traders to move funds between exchanges has evolved into the most widely used application of blockchain technology - the onchain dollar.

As Robinhood CEO Vlad Tenev puts it, tokenization is an “unstoppable freight train” set to become the default for global stock access and reshape the financial system & stablecoins are the first step in tokenization.

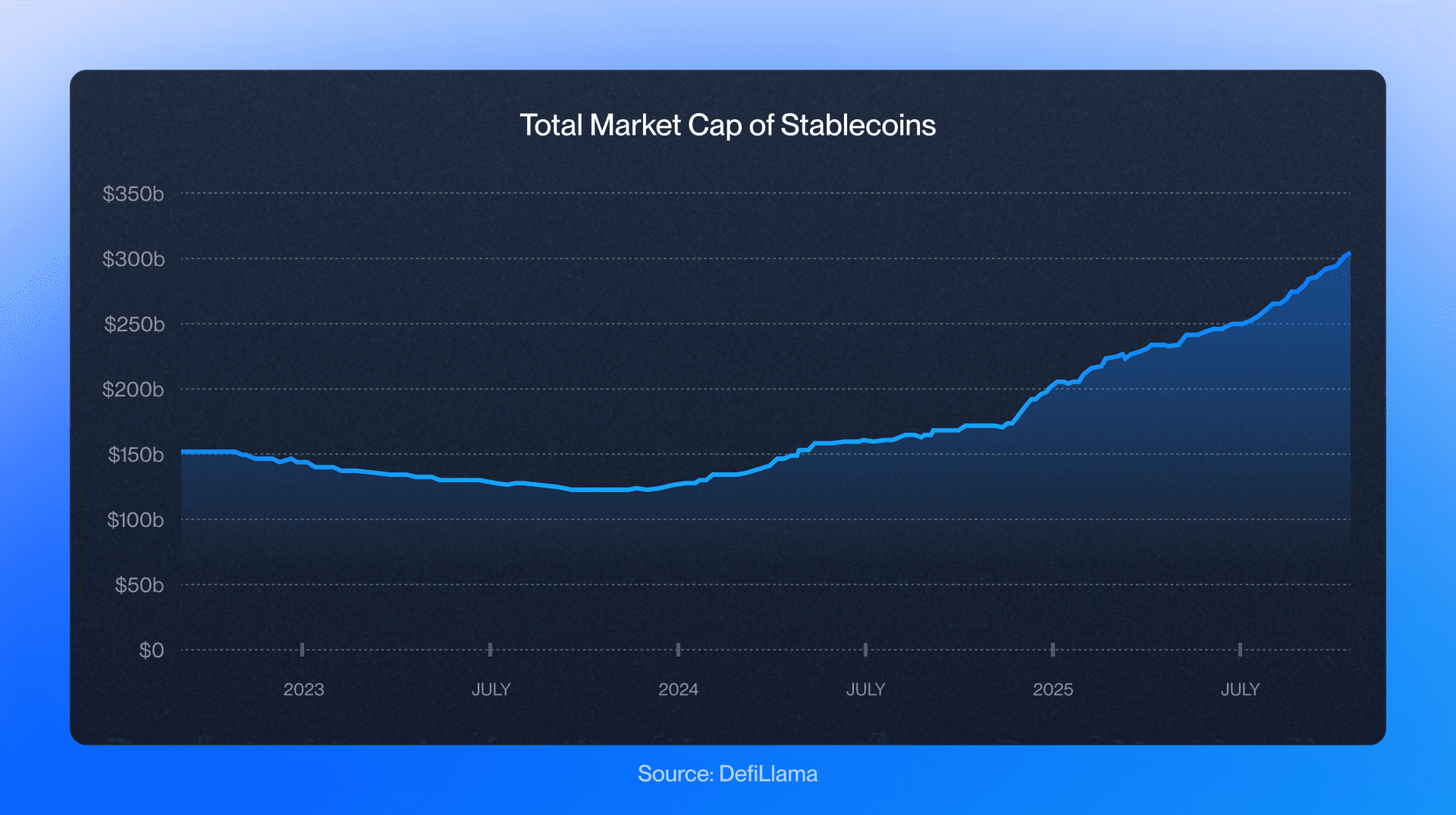

As of October 2025, more than $305B of stablecoins circulate across public blockchains, powering everything from global remittances to institutional tokenization. Over the past year, on-chain dollar transfers exceeded $15.6 trillion, reflecting both the scale and maturity of stablecoins as real financial infrastructure rather than speculative assets.

Fortune 100 companies are increasingly exploring stablecoins for cross-border payments and other product offerings, lending additional legitimacy to the sector. As more companies aim to issue their own stablecoins or adopt existing ones, competition for volume is likely to intensify. This competitive landscape could lead to decreased fees as issuers vie for market share, potentially benefiting end users while challenging profitability for stablecoin providers.

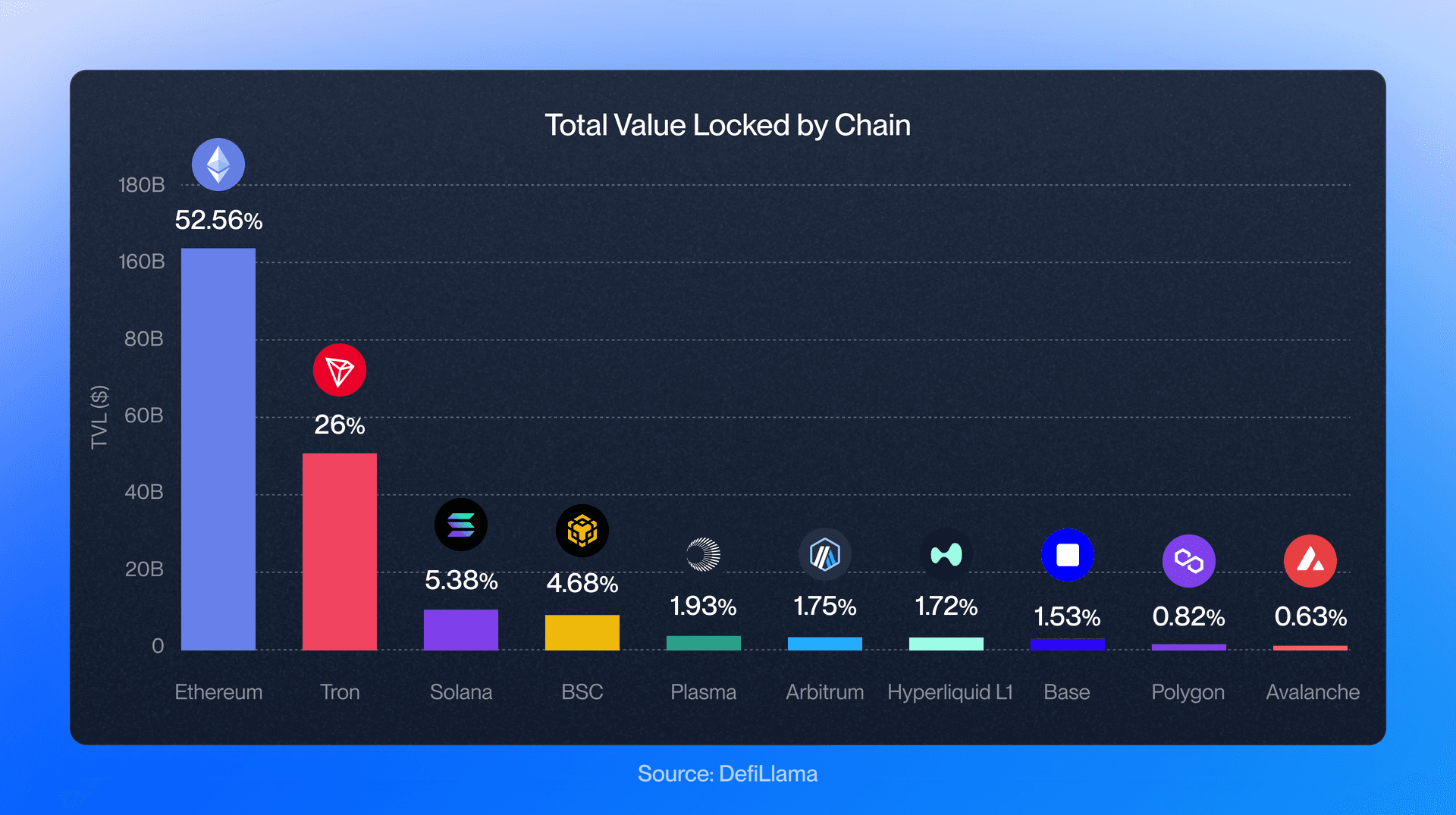

While Ethereum continues to anchor the market—with its L1 and L2 ecosystem accounting for well over half of all stablecoin supply—the landscape has become distinctly multi-chain. Solana leads for high-throughput payments, Tron dominates low-fee remittances in emerging markets, BNB Chain hosts exchange-linked liquidity, and a wave of new entrants like Base, Arbitrum, and Polygon extend Ethereum’s reach to cheaper settlement layers.

Each chain now caters to different users and geographies: Western institutions and fintechs gravitate toward Ethereum and its rollups, while retail activity in Asia, the Middle East, and Africa increasingly flows through Tron and BSC.

In this blog, we map the stablecoin transformation chain by chain, examining where stablecoins live, where volume flows, and which institutions are building where.

Ethereum

Ethereum dominates the stablecoin landscape with supply higher than all other chains combined. Across Ethereum mainnet alone, the stablecoin market cap is about $161B, and the trailing-30-day transfer volume is roughly $2.09T, the largest of any chain by a wide margin.

Ethereum’s stablecoin user base is also broad and growing. In 2025, Ethereum has averaged around 720,000 unique stablecoin-sending addresses per week, with two recent weeks topping 1 million—fresh highs that are a clean, chain-agnostic signal of steady, global demand for on-chain dollars

Ethereum shows the broadest global footprint with especially strong Western working-hours usage, which points Western fintechs and asset managers plugging into the Ethereum L1 and its EVM ecosystem first.

In terms of tokens, USDT is the most popular stablecoin on Ethereum, with about 50–53% of Ethereum’s stablecoin supply (≈ $80–85 billion), followed by USDC at ~29% (≈ $45–50 billion). The rest is split among DAI, USDe, FRAX, GHO, crvUSD, and other stables.

Ethereum is also the preferred network for regulated issuers. BlackRock’s BUIDL fund, PayPal’s PYUSD, Ripple’s RLUSD, Société Générale’s EURCV and USDCV, and MetaMask’s mUSD all launched on Ethereum — confirming its role as the trusted foundation for tokenized money and on-chain finance.

Ethereum L2s

Arbitrum

Arbitrum is the leading Ethereum L2 in stablecoin supply, with ~$10B in stablecoins live on the network and about $154B in 30-day transfer volume.

In 2025, Robinhood launched tokenized U.S. stocks and ETFs for European users on Arbitrum, showing how mainstream fintechs are beginning to leverage public L2s for real asset settlement. With more institutions exploring tokenized assets, stablecoins on Arbitrum have become both collateral and settlement rails used in DeFi protocols, DEX liquidity, and now mainstream fintech applications.

Base

Base has quickly become the “commerce L2” — built for scale, payments, and consumer-facing apps. Its stablecoin supply sits around $4.6 billion, largely in USDC, backed by Coinbase’s liquidity network and a fast-growing developer ecosystem. Although transparent 30-day volume figures aren’t consistently published, Base has repeatedly ranked among the top chains by daily stablecoin throughput, reflecting strong organic usage.

In 2025, several major fintechs and enterprises began building directly on Base. J.P. Morgan's launched USD deposit token proof of concept on a Base L2 (supported by Alchemy), Shopify turned on USDC on Base inside Shopify Payments in June 2025, and Stripe followed by enabling USDC subscriptions on Base, putting stablecoin checkout, recurring billing, and payouts a click away for mainstream merchants.

Polygon (PoS)

Polygon still remains one of the top choices for institutional pilots on public chains because of its performance, scalability, EVM compatibility, and long track record of reliability. Today it carries around $2.7B in stablecoins with about $45–46B in 30-day transfer volume.

Across Ethereum and its L2s, these EVM ecosystems account for around $174B in stablecoin supply, about 56.5% of the total $307B market (as of Oct 16, 2025).

Solana

Solana has become one of the top three blockchains for stablecoins, with over $16 billion in circulating supply and nearly $500 billion in 30-day transfer volume. Solana’s fast block times and sub-second finality make it ideal for high-speed, low-cost stablecoin payments and settlement.

Institutional adoption has followed that performance. Visa began supporting USDC settlement on Solana in 2023, while PayPal expanded PYUSD to the network in May 2024 to speed up consumer payments. Together, these integrations have turned Solana from a DeFi chain into a true payment rail used by both fintechs and global merchants.

Most of Solana’s stablecoin activity is concentrated in USDC and USDT, which together handle more than 90% of all stablecoin transfers onchain, roughly $10 billion in daily value. That stablecoin liquidity flows through wallets like Phantom (for mobile payments and swaps) and powers apps like Pump.fun (social and memecoin trading), making Solana one of the busiest networks for both retail and institutional on-chain dollar usage.

Tron

Tron is the workhorse of the stablecoin world and is the backbone for low-cost, high-frequency transfers, especially across emerging markets. It currently holds around $79 billion in stablecoins and records nearly $714 billion in 30-day transfer volume, ranking second only to Ethereum in total usage.

USDT overwhelmingly dominates Tron’s ecosystem, accounting for more than 95% of its stablecoin supply. The network’s consistently low fees (often less than a cent per transaction) have made it the preferred choice for cross-border remittances, merchant settlements, and peer-to-peer payments in regions such as Asia, the Middle East, Africa, and Latin America.

Independent reports in 2025 highlight how Tron-based stablecoins have effectively become everyday money rails in high-inflation and capital-controlled economies used for salary payments, import settlements, and even informal savings. This role as the “cash equivalent” of crypto gives Tron a unique position: it’s less about DeFi or speculation, and more about global, dollar-denominated utility at the edge of the financial system.

BNB Chain

BNB Chain (BSC) is the third largest stablecoin hub, with around $14 billion in stablecoin supply and roughly $59.5 billion in 30-day transaction volume. Its strength lies in its exchange-driven liquidity, anchored by Binance integrations and the rapid growth of FDUSD - a fiat-backed stablecoin issued by First Digital Labs, now the dominant non-USDT asset on the network.

According to analysis of $13.6T in stablecoin transactions done by Electric Capital, the data reveals geographic differences in how the world uses stablecoins across chains. In particular, BSC and Tron are heavily concentrated in Asian, Middle Eastern, and African markets, with minimal Western activity (<3% activity during Western working hours).

Hyperliquid

Hyperliquid is a new high-performance Layer-1 chain that grew out of the Hyperliquid derivatives DEX, and is now dominating the on-chain perpetuals market. The network holds over $5 billion in total stablecoin supply and commands an estimated 83% share of all on-chain perp trading volume.

Recently, Hyperliquid introduced USDH, a native stablecoin designed to serve as the core settlement asset across its ecosystem. USDH was launched through Native Markets after a governance vote where it prevailed over competing proposals from Paxos and Agora. This move solidified Hyperliquid’s intent to own its own payment and collateral layer rather than rely solely on external issuers like USDC or USDT.

By combining ultra-low latency with a vertically integrated stablecoin, Hyperliquid has positioned itself as both a trading platform and a self-contained financial layer. It’s a clear sign that next-generation appchains are no longer just DeFi venues, they’re building full economic stacks with native stable assets at the center.

Plasma

Plasma is a new stablecoin-native Layer-1 chain built specifically for payments and settlements. It launched its mainnet in late September 2025 and made an immediate impact surpassing $5 billion TVL within its first week, making it the 7th largest blockchain globally by total value locked.

At launch, Plasma attracted over $2 billion in day-one stablecoin liquidity, thanks to strong integrations with issuers and payment providers. The network rolled out its flagship consumer app, Plasma One, targeting emerging markets where users rely on stablecoins for daily transactions and remittances.

Plasma’s key differentiator is its focus on fee-free stablecoin transfers and built-in compliance tooling, allowing users and businesses to transact cheaply while remaining regulatory-friendly. It’s still early, but the approach signals a clear ambition: to specialize at the payments layer, making stablecoins as seamless to use as traditional digital cash.

The Future Is Stable-Coded

Stablecoins are no longer just for DeFi users: they’re becoming the foundation of global payments and digital finance. The next chapter is about adoption, not speculation. Whether its Ethereum continuing to assert its dominance as the leading stablecoin ecosystem, Tron dominating low-cost remittances across emerging markets, or newer chains like Hyperliquid and Plasma unlocking new stablecoin use cases, the demand for stablecoins is only getting louder.

As stablecoins move into checkout systems, payroll, and cross-border commerce, they’re blending into the world’s financial infrastructure. Better tooling and clearer regulation will only speed that process up. For builders, the stablecoin opportunity is wide open. The on-chain dollar is now everywhere, and Alchemy supports every major chain helping make it real.

Alchemy Newsletter

Be the first to know about releases

Sign up for our newsletter

Get the latest product updates and resources from Alchemy

By entering your email address, you agree to receive our marketing communications and product updates. You acknowledge that Alchemy processes the information we receive in accordance with our Privacy Notice. You can unsubscribe anytime.

Related articles

The Enterprise Stablecoin Guide

A practical guide to using stablecoins in enterprise payments—covering why legacy rails fail, which stablecoin types and chains to choose, privacy considerations, and when (not) to issue your own.

Deposit Tokens for Banks: A Practical Playbook

Major banks are quietly processing $10B+ daily in tokenized deposits. Here's how deposit tokens could capture $140 trillion by 2030 and a playbook to integrate for banks.

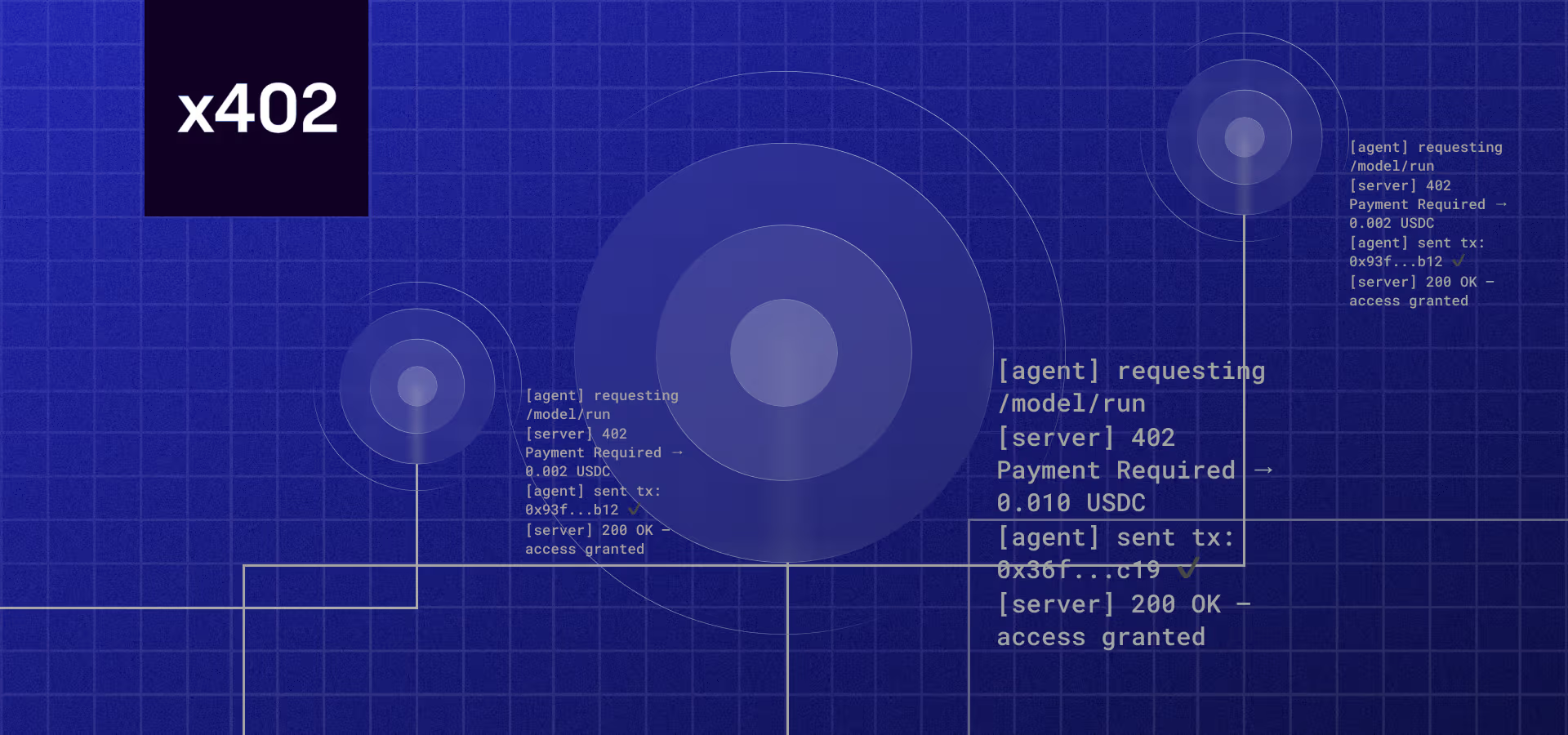

How x402 Brings Real-Time Crypto Payments to the Web

x402 revives the HTTP 402 code, so AI agents and apps can pay for API requests instantly using crypto: no accounts, no subscriptions, just seamless transactions.