The Developer's Guide to Blockchain App Development Costs in 2025

Author: Kristine Chuang

You're probably here because you had an app idea and are wondering “how much would it cost to build that?”

And you did what any smart developer would do—you immediately asked ChatGPT, wondered if you could trust what it gave back to you, and then you started Googling for numbers from a source you can trust.

Good news: you don’t have to guess anymore. After 8 years powering the top crypto apps, and building a number ourselves, we have a pretty good framework for estimating what it really costs to build apps onchain.

TL;DR: The Quick Cost Breakdown

At a high level, you can think about bucketing app development costs into the following:

Basic token contract: Free - $200

Simple DeFi app (DEX, staking): $40,000 - $100,000

Complex DeFi protocol: $200,000 - $500,000+

NFT marketplace: $45,000 - $150,000

Enterprise blockchain solution: $100,000 - $300,000+

But here's the thing—these ranges are massive because the devil's in the details. Let's dig into what actually drives these costs.

The Hidden Costs Nobody Talks About

Before we dive into development costs, let's address the elephant in the room: gas fees and security expenses that can eat up your budget if you're not careful.

Gas Fees: The Silent Budget Killer

Deploying smart contracts isn't cheap. Every action on a blockchain—whether it’s deploying a smart contract, minting an NFT, or swapping tokens—requires computational power from the network. Unfortunately for devs, deployments and contract updates are often quite a bit more complex than a simple token transfer, and so gas fees can be high to match.

Here's what you're actually looking at for deployment costs in 2025:

Basic ERC-20 token deployment: $50 - $200

Complex DeFi protocol deployment: $5,000 - $15,000

Every contract update: $100 - $1,000

And that's just deployment. Every time your users interact with your contract, they're paying gas too. High gas costs mean fewer users. It's that simple, and many apps prefer to sponsor gas for their users to encourage user activity.

Pro tip: Start building on Layer 2 solutions like Polygon, Arbitrum, or Optimism. You'll pay cents instead of hundreds of dollars. Teams save up to 99% on gas costs just by choosing the right chain from day one.

Audits: The Security Tax

Security audits aren't optional—they're table stakes. In a PVP environment, where hackers are all too happy to drain an app contract’s vault and take user funds, it’s critical that you prioritize security. There’s no redemption for apps that lose all of their funds in one fell swoop.

Here's what reputable audit firms actually charge in 2025:

Basic audit (simple contracts): $5,000 - $15,000

Comprehensive audit (DeFi protocol): $15,000 - $40,000

Enterprise-grade audits: $100,000 - $200,000+

Skip the audit to save money? Sure, if you want to risk being the next protocol that loses millions to a reentrancy attack. Your call.

Breaking Down Development Costs by Project Type

1. Token Launches: The Gateway Drug (Free-$200)

Most teams start here. The best way to explore building onchain is to launch a token. And there are plenty of launchpads that make launching your token easy, with almost no costs or overhead, apart from the cost of the deployment itself.

Given token contracts are battle tested, you can use an out-of-the-box token contract that will come complete with mint, transfer, and burn functionality, and you only need to worry about customizing the cosmetics of the token itself and can skip on things like audit costs, unless your token has some bespoke functionality or contract requirements (that could then push your costs up to $10K).

2. DeFi Applications: Where Things Get Expensive ($40,000 - $500,000)

DeFi is where blockchain development costs explode. You're not just moving tokens around—you're handling people's money with complex financial logic.

Basic DeFi App (Staking, Simple DEX): $40,000 - $100,000

Smart contract development can run $15-30K, and auditing that contract can require another $10-30K on top. Then you need to build your frontend ($10-25K) as well as your backend ($5-15K).

Complex DeFi Protocol (Lending, Derivatives): $200,000 - $500,000+

Complex DeFi protocols usually involve multiple interconnected contracts, greatly increasing your development and audit costs ($80-150K for development, another $50-150K for audits). Then you’ll need to build out your front and backend ($40-80K). Complex protocols usually have more robust partner needs, whether that’s working with oracles or bridges ($30-60K), and you should expect ongoing maintenance costs of $5-15K monthly.

The Uniswap Reality Check: Building a Uniswap V3 clone isn't a weekend project. The concentrated liquidity math alone costs $50,000 in development time. And that's before you realize you need $10,000 monthly in infrastructure just to index the data properly.

3. NFT Platforms: Beyond JPEGs ($45,000 - $200,000)

Everyone wants to build the next OpenSea and capture transactional revenue on NFT trades. However, it’s not a cheap enterprise to build.

Basic NFT Marketplace: $45,000 - $100,000

For a basic marketplace, you’re looking at smart contract development for minting, royalties, escrow for trading, etc to cost between $15-25K. Toss in $5-10K for an IPFS integration. Then another $20-40K for your frontend marketplace, and $10-25K in backend systems to support all of your indexing and caching needs.

Advanced marketplace features like lazy minting, collection sweeps, auction mechanisms, cross-chain support, and creator tools can easily add 20-50% to this base cost.

4. Enterprise Blockchain: The Big League ($100,000 - $1,000,000+)

Private chains, banks, stablecoins. Whenever you have money moving at scale, you’re talking about enterprise budgets.

Some cost drivers for these large enterprises include running a private or permissioned network ($20-50K in setup, another $10-50K in monthly maintenance and SLAs). Integrations with legacy systems may cost another $30-100K, compliance features can run another $20-80K depending on scope, and of course after all of enterprise needs, you still have to bake in costs associated with frontend, backend, and smart contract development, and any other deployment and audit costs.

The Costs of Blockchain Developers

Another lens for thinking about costs is your headcount. How much are you actually going to be paying the engineers who can build onchain apps. Let's talk about what blockchain developers actually charge in 2025, based on current market data:

Full-time Salaries (US):

Entry-level: $107,000 - $134,000

Mid-level: $135,000 - $170,000

Senior: $170,000 - $250,000

Staff/Principal: $250,000 - $400,000+

Freelance Rates:

Junior (1-2 years): $50 - $80/hour

Mid-level (3-5 years): $80 - $150/hour

Senior (5+ years): $150 - $300/hour

Specialized (MEV, ZK): $200 - $500/hour

The Offshore Option:

Eastern Europe: $40 - $80/hour

Asia: $25 - $60/hour

Latin America: $35 - $70/hour

But here's the catch—good blockchain developers are rare. The ones charging $25/hour? They're probably learning on your dime.

And it’s not just developers you need to budget for. If you’re building your infrastructure in-house, you’ll also need to account for setup and ongoing maintenance costs—typically requiring 2–3 dedicated infra engineers. On the flip side, if you use third-party providers like Alchemy, you can skip that overhead entirely and save the equivalent of those hires, while still getting production-grade reliability and scale from day one.

Chain Selection: The First Decision That Matters

We touched on this in the beginning, but choosing which blockchain to build on can have a dramatic impact on your development costs:

Ethereum offers maximum security, liquidity, and ecosystem benefits, but ongoing deployment and gas costs can be prohibitive. It's best for high-value DeFi and blue-chip projects that don’t need to worry about the cold start problem.

Layer 2s (Arbitrum, Optimism, Polygon) provide Ethereum-level security with 99% cheaper gas, though they have fragmented liquidity and bridge risks. Despite those risks, they're ideal for most builders in 2025.

Alt L1s (Solana, Avalanche, BNB Chain) are fast and cheap, but have different programming models, less robust tooling and infra, and smaller user bases.

Smart Strategies to Cut Costs (Without Cutting Corners)

Start with an MVP on an L2

Don't build your production DeFi protocol on Ethereum first. Deploy on Arbitrum or Optimism, prove the concept of your app, then migrate to the L1 if you find a need for it as you scale. Migrating an app is no joke, and you should plan as if you want to avoid that, but plenty of projects do it. You'll save 99% on gas during development by picking an L2.

Use Battle-Tested Libraries

OpenZeppelin contracts have secured billions of dollars. Don't rewrite ERC-20 from scratch. Your custom implementation isn't better—it's just more likely to have bugs.

Progressive Auditing

Start with automated tools (Slither, Mythril) costing $0 - $500. Get a preliminary review for $5,000 - $10,000. Save the full audit ($30,000+) until after product-market fit and your app is attracting enough capital to become a target for more sophisticated hackers.

Modular Architecture

Build your protocol in phases. Time to market often beats launching the perfect product, the latter of which is also more expensive to ship! Launch staking first, add lending later, integrate governance last. Each phase can generate revenue to fund the next.

The White-Label Option

For standard use cases (DEX, NFT marketplace), white-label solutions start at $10,000 - $30,000. You lose uniqueness but can ship 10x faster.

Real Cost Breakdowns from Shipped Projects

Case Study 1: DeFi Yield Aggregator

Development: $120,000 (4 developers, 4 months)

Audits: $45,000 (2 firms)

Infrastructure: $4,000/month

Total Year 1: $213,000

Case Study 2: NFT Gaming Platform

Smart Contracts: $35,000

Game Frontend: $60,000

Backend Services: $25,000

Art and Design: $30,000

Marketing Site: $10,000

Infrastructure: $2,000/month

Total: $184,000

Case Study 3: Enterprise Fintech

Private Network Setup: $40,000

Smart Contracts: $80,000

Integration Layer: $60,000

Dashboard and Analytics: $45,000

Compliance Features: $35,000

Infrastructure: $10,000/month

Total: $380,000

Maintenance Costs of Infrastructure

Your costs don't stop at launch. Running an onchain app has ongoing costs. You should be budgeting $1-10K in infrastructure spend, including nodes and indexing. On to of that, you should expect to pay $500-$5K in monthly gas fees for operations.

Then of course you may have more general operational expenses like community support ($2-6K monthly), bug fixes and ongoing updates ($5-15K monthly), and security monitoring ($2-5K).

Cost Optimization Checklist

Before you write your first line of code, ask yourself:

What ecosystem can you build on to minimize costs?

Are you using libraries and templates where you can to save development time?

Have you priced out gas costs for operations associated with your app?

Can you launch with 3 features instead of 10?

Is there a white-label solution that gets you 80% of the way there?

Have you budgeted for audits and maintenance?

Can you use existing infrastructure services instead of building out your own?

The Bottom Line

Building a production blockchain app in 2025 costs anywhere from a few thousand dollars to over a million. At the end of the day, cost is entirely dictated by how complex the app is, and at what scale it operates.

As you map out your costs, define your MVP ruthlessly. Start simple, iterate based on user feedback, and build your way to that $500,000 DeFi protocol.

And don’t forget to leverage tools and services like Alchemy that can help you accelerate by abstracting away blockchain’s complexity, so you can focus on building great products.

Alchemy Newsletter

Be the first to know about releases

Sign up for our newsletter

Get the latest product updates and resources from Alchemy

By entering your email address, you agree to receive our marketing communications and product updates. You acknowledge that Alchemy processes the information we receive in accordance with our Privacy Notice. You can unsubscribe anytime.

Related articles

The Enterprise Stablecoin Guide

Deposit Tokens for Banks: A Practical Playbook

Major banks are quietly processing $10B+ daily in tokenized deposits. Here's how deposit tokens could capture $140 trillion by 2030 and a playbook to integrate for banks.

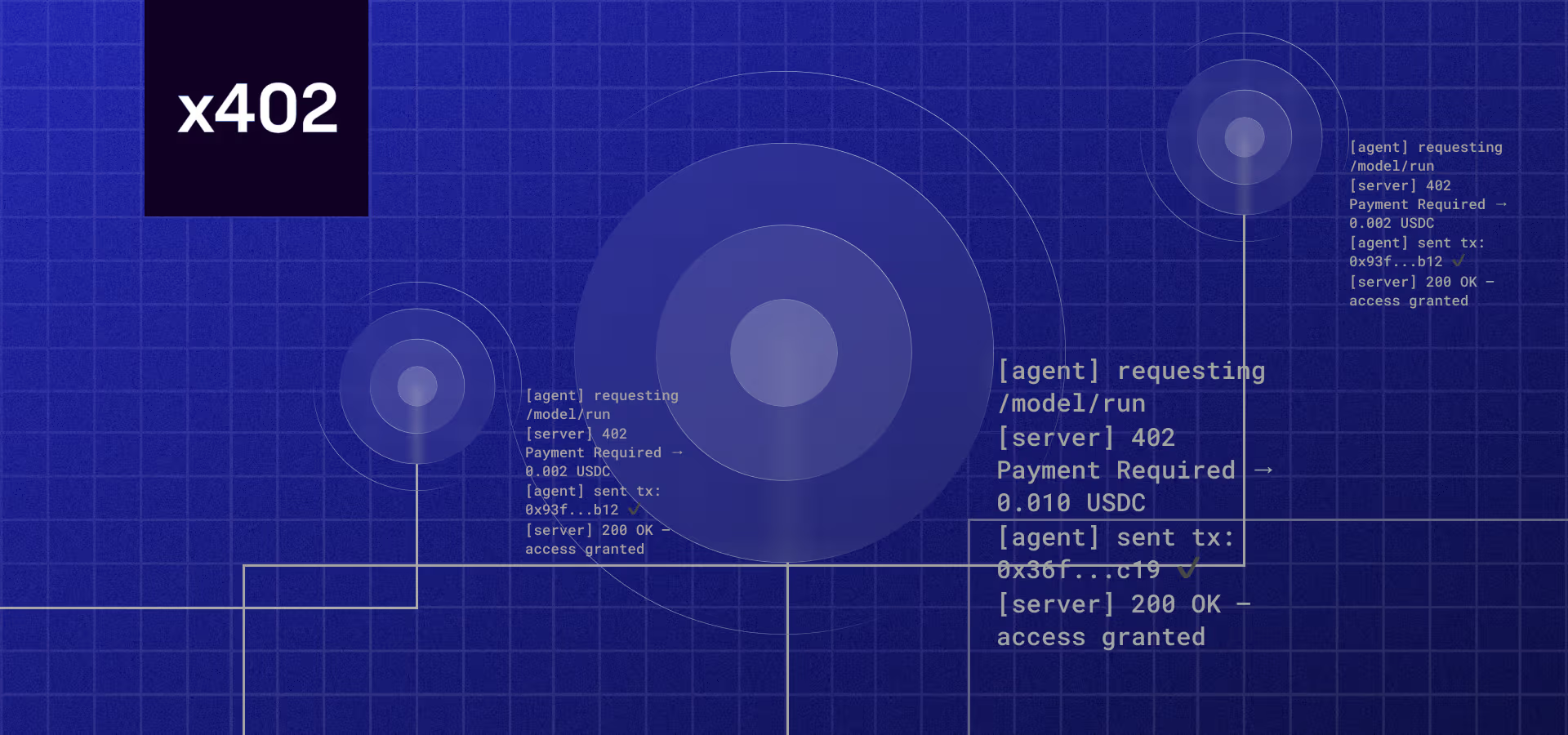

How x402 Brings Real-Time Crypto Payments to the Web

x402 revives the HTTP 402 code, so AI agents and apps can pay for API requests instantly using crypto: no accounts, no subscriptions, just seamless transactions.