Smart Wallet APIs for Financial Institution Requirements

Author: Alchemy Team

The stablecoin market has surged to over $240 billion and is projected to hit $2 trillion by 2028 according to the US Treasury. Major banks including JPMorgan, Bank of America, and Citigroup are launching their own stablecoins, while Congress just passed the GENIUS Act providing comprehensive regulatory framework. Fiserv announced plans to launch their stablecoin across 10,000 financial institutions, and Stripe spent $1.1 billion acquiring stablecoin payment platform Bridge.

Read about J.P. Morgan's USD token deposit launch with Smart Wallets

The race is on for financial institutions to integrate onchain functionality without compromising security, compliance, or performance. We help to tackle these institutional challenges designed to meet enterprise requirements while dramatically simplifying integration.

The Problem When Traditional Finance Meets Crypto

Financial institutions integrating crypto rails are looking to unlock new revenue streams from crypto yields, enable instant global payments with no intermediaries, and monetize passive capital through 24/7 global markets. Smart wallets handle these requirements natively - programmable spending limits, automated policy enforcement, and instant, gas-free transactions.

Major institutions like JPMorgan are already leveraging smart wallet infrastructure for institutional deposit tokens, while payment processors use them to abstract away crypto complexity from end users. But implementing smart wallet infrastructure requires navigating significant technical complexity.

Stablecoins Require Smart Contract Expertise

When financial services interact with stablecoins like USDC, they're executing smart contract operations that require specialized blockchain knowledge. A simple stablecoin payment involves:

Wallet deployment checks and factory contract interactions

Multi-layered gas estimation across execution, pre-verification, and validation limits

Transaction batching for operational efficiency

Paymaster integration for gas sponsorship and fee optimization

Traditional banking infrastructure wasn't built for this complexity. Current solutions force institutions to either build extensive onchain expertise in-house or rely on consumer-focused tools lacking enterprise features like audit trails and compliance hooks.

The Performance Tax on Financial Operations

Every smart wallet transaction requires multiple blockchain calls that compound into operational inefficiencies:

Wallet deployment status checks

Account nonce management for transaction sequencing

Complex gas estimation across fee structures

Compliance policy validation

Transaction submission

For payment processors handling thousands of cross-border transfers or trading firms executing rapid strategies, these delays create competitive disadvantages. When processing high-volume flows, onchain latency impacts settlement times and regulatory reporting windows.

The Enterprise Integration Gap

Financial institutions operate in battle-tested environments—Java core banking, .NET trading platforms, Python risk management, Go microservices. The current onchain ecosystem, focused on TypeScript and browsers, creates fundamental integration gaps.

Payment processors need backend systems integrating compliance and AML with existing infrastructure. Asset managers require programmatic rebalancing with institutional custody. Trading firms need ultra-low latency execution with sophisticated risk management. These institutions shouldn't rebuild their entire stack to leverage programmable money.

Institutional-Grade Smart Wallet Infrastructure

JSON-RPC Simplicity for Enterprise Systems

The Wallet API abstracts blockchain complexity through four simple endpoints:

wallet_requestAccount- Deterministic smart accounts with custody integrationwallet_prepareCalls- Transaction preparation with automated gas optimization and compliance hookswallet_sendPreparedCalls- Submission with institutional failure handlingwallet_getCallsStatus- Status tracking with detailed audit trails

Dramatic Performance Improvements

By moving preparation logic server-side, we eliminate the latency tax so transactions happen faster. What previously required 5-6 separate RPC calls now happens in a single optimized request. Behind the scenes, our wallet server handles deployment checks, nonce management, gas estimation, and compliance validation.

For trading firms executing arbitrage or payment processors handling remittances, this latency reduction translates directly into competitive advantage.

Universal Language Support

The JSON-RPC interface enables financial institutions to integrate smart wallet functionality into existing infrastructure without architectural rewrites. Java banking systems, .NET trading platforms, Python risk tools—they all become first-class onchain citizens.

Built-in Institutional Failure Recovery

The API automatically handles UserOperation failures with enterprise-grade recovery:

Intelligent retry management for pending operations

Detailed failure categorization for compliance reporting

Complete audit trails for regulatory examination

Automated recovery logic meeting institutional reliability standards

Enterprise Architecture Built for Financial Requirements

Custody-Agnostic Design

Our architecture recognizes that signing solutions are just one component of financial workflows. Whether using managed signers, hardware security modules, or qualified custodians, core wallet operations remain consistent.

This enables sophisticated institutional patterns:

Session key delegation for backend operations with frontend authentication

Multi-signature workflows integrating existing approval processes

Custodial integration maintaining operational efficiency

Verifiable Security Model

The API returns fully verifiable transaction data for institutional security validation. Like institutional trading APIs, we provide complete transparency into signed transactions while handling preparation complexity.

Real-World Financial Applications

Payment Processors and Remittance

Modern payment companies need programmatic wallet control for stablecoin-based cross-border payments:

Process thousands of daily transfers with sub-second confirmation

Handle complex compliance including AML, KYC, sanctions screening

Manage multi-jurisdiction liquidity across stablecoin pools

Integrate existing banking rails for fiat conversion

The Wallet API enables frontend user authentication with backend compliance validation and transaction processing in existing security environments.

Institutional Asset Management

Asset managers deploying onchain strategies require automation integrating with portfolio management systems:

Execute rebalancing strategies across DeFi protocols

Manage real-time risk limits and compliance constraints

Handle qualified custody requirements

Provide regulatory audit trails

High-Frequency Trading

Trading firms need ultra-low latency execution integrating with risk management:

Sub-200ms transaction preparation for competitive market making

Automated arbitrage execution across DEXs and CEXs

Real-time position monitoring and limits enforcement

Integration with existing trading infrastructure

Previously, these firms needed complex TypeScript bridges. Now they integrate directly into Python, Java, or Go systems with HTTP calls.

Implementation: Getting Started

The API follows a simple prepare-sign-send pattern integrating with financial workflows:

Request Account - Get smart account for custody address

Prepare Calls - Receive prepared UserOperation with gas calculations

Validate - Use existing compliance systems for transaction review

Sign - Use institutional signing (HSM, custodian, MPC)

Submit - Send with automatic retry and failure recovery

Monitor - Track with audit trails for regulatory reporting

# Get institutional smart account

curl --request POST \

--url https://api.g.alchemy.com/v2/YOUR_API_KEY \

--data '{

"jsonrpc": "2.0",

"method": "wallet_requestAccount",

"params": [{"signerAddress": "0xCUSTODY_ADDRESS"}],

"id": 1

}'

# Prepare USDC payment with compliance

curl --request POST \

--url https://api.g.alchemy.com/v2/YOUR_API_KEY \

--data '{

"jsonrpc": "2.0",

"method": "wallet_prepareCalls",

"params": [{

"from": "0xSMART_ACCOUNT",

"calls": [{"to": "0xUSDC", "data": "0xTRANSFER_DATA"}],

"paymasterPolicy": "INSTITUTIONAL_GAS_POLICY"

}],

"id": 1

}'The same pattern works in any language, enabling institutions to add programmable money to existing systems.

Looking Forward

As regulatory frameworks like the GENIUS Act mature, smart wallets will become standard for institutional onchain operations. Building on emerging standards ensures financial institutions can future-proof infrastructure while meeting current compliance requirements.

We're continuously optimizing for financial markets with sub-50ms response times, cross-chain operations, and advanced compliance integration—all while maintaining the simple interface that works with existing financial infrastructure.

Whether you're processing stablecoin remittances, deploying onchain treasury strategies, or integrating crypto markets, our API delivers the performance, security, and compliance you need with no complexity.

Start building today on crypto rails institutions trust.

Alchemy Newsletter

Be the first to know about releases

Sign up for our newsletter

Get the latest product updates and resources from Alchemy

By entering your email address, you agree to receive our marketing communications and product updates. You acknowledge that Alchemy processes the information we receive in accordance with our Privacy Notice. You can unsubscribe anytime.

Related articles

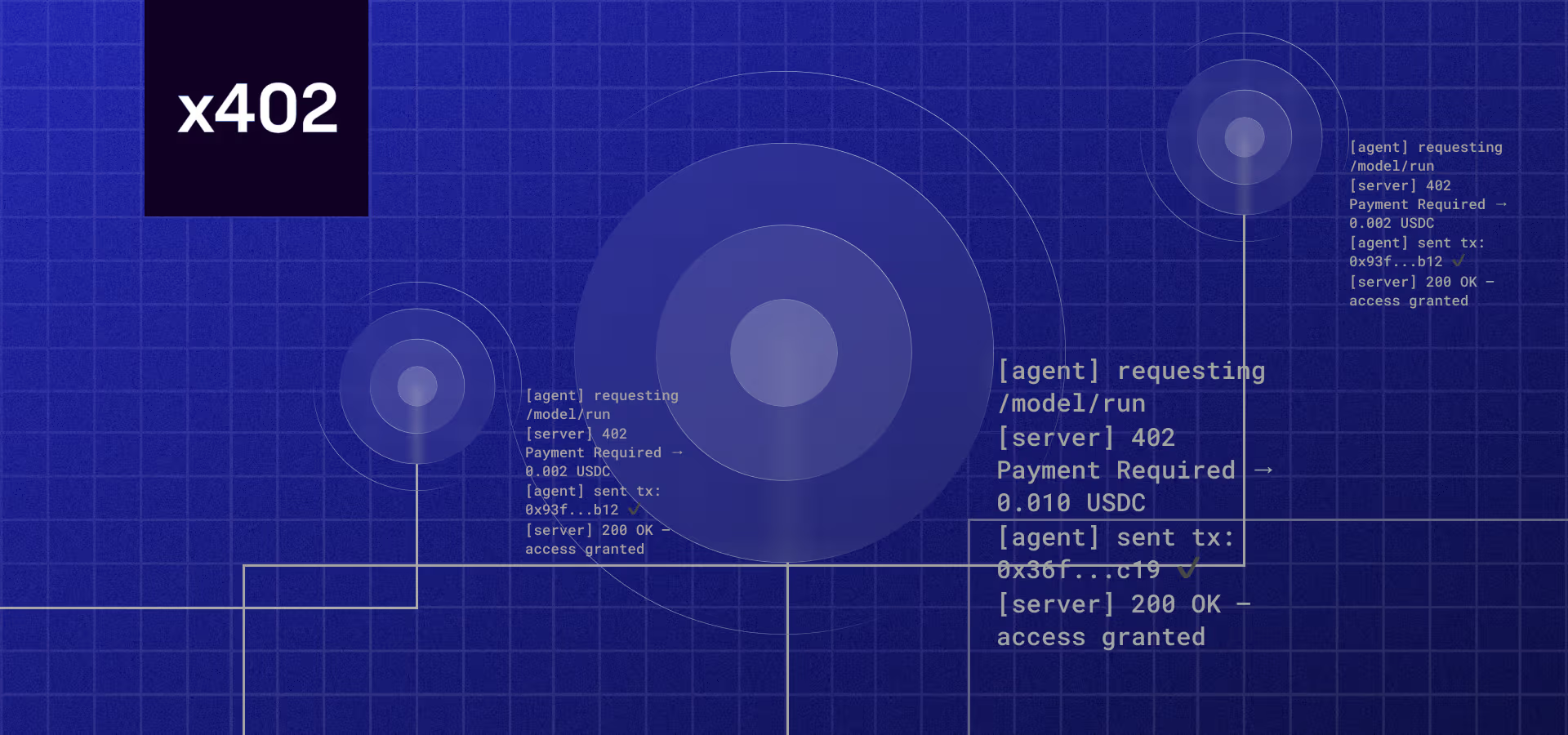

How x402 Brings Real-Time Crypto Payments to the Web

x402 revives the HTTP 402 code, so AI agents and apps can pay for API requests instantly using crypto: no accounts, no subscriptions, just seamless transactions.

The Stablecoin Landscape Across Different Chains

A data-driven look at where $300B+ in stablecoins actually live and move across major blockchains like Ethereum, Solana, Tron, and emerging L1s.

The Developer's Guide to Blockchain App Development Costs in 2025

Want to know what kind of budget you'll need to build an app onchain?