Guide to DeFi

Written by Alchemy

For hundreds of years, traditional finance has largely remained stagnant, with large banks and corporations ultimately calling the shots.

Collect your paycheck, maybe put some into savings, earn a small amount of interest, rinse and repeat. Over the last several years, however, the rise in decentralized finance or DeFi has begun to dramatically transform the world of banking and finance, allowing people from all around the globe more options than ever before.

DeFi allows for many unique opportunities spanning lending and borrowing, insurance, margin trading, and more. If you've ever wondered what DeFi was and are curious about the potential opportunities, this article has you covered.

What is DeFi?

Before we look at the many ways decentralized finance is changing the game, some context is in order. Decentralized finance, or DeFi as it's most commonly called, relies on the use of blockchain technology to essentially create a peer-to-peer financial system that virtually anyone can be a part of.

Unlike centralized finance (such as banks, for example), decentralized finance is run using smart contracts, which limits the need for involvement from 3rd parties. DeFi is arguably the biggest challenger to the current banking system, and we're already seeing traditional banks begin to embrace the world of Web3.

Specifically, DeFi is growing in popularity due to the ability to generate higher interest rates compared to traditional savings accounts and allows populations in developing nations to become their own banks.

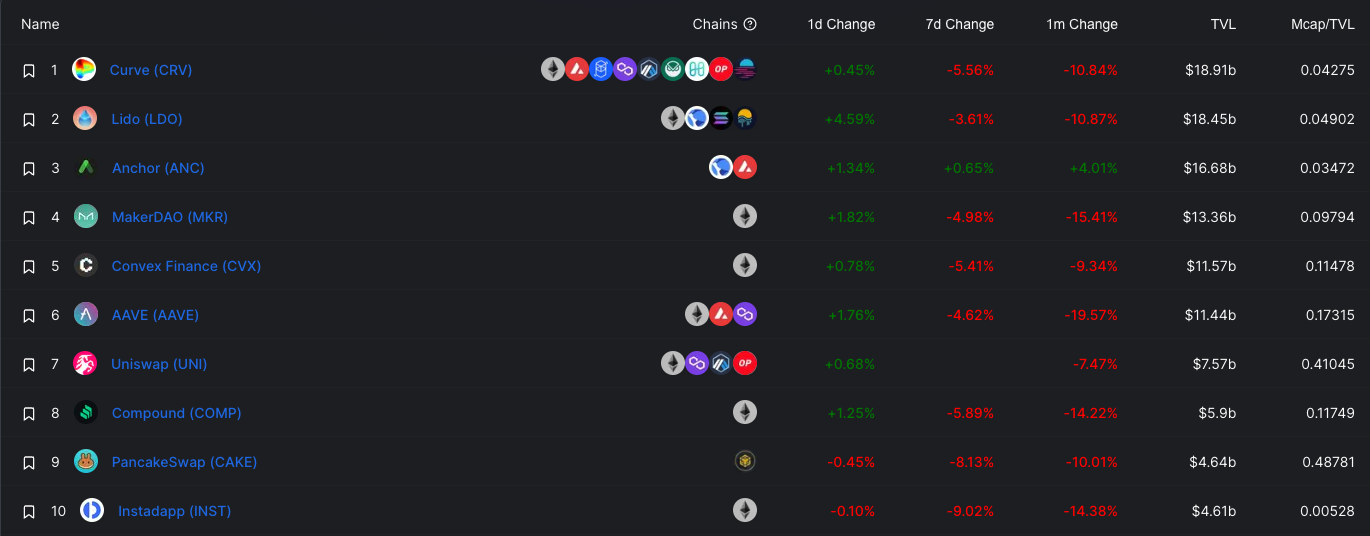

According to DeFi Llama, an aggregator for all things DeFi, the current total TVL is 198.54b at the time of this writing—not too shabby.

And here are the top 10 TVL rankings:

And these incredible numbers have naturally led to many startups and blockchain companies raising funds.

Thetanuts Finance, a decentralized finance platform, recently received $18M in seed funding to flesh out their platform. Bashoswap is developing a fully featured de-fi product for the Cardano-Powered decentralized exchange and launchpad. And last but not least, Nested raised $7.5 Million in Series A in the name of democratizing DeFi.

While this relatively new technology is clearly on the rise, it also comes with risk and for many has a steep learning curve. Exploding Topics has an excellent breakdown of how searches for DeFi related topics continue to increase significantly.

Stake, swap, yield: a primer

While DeFi continues to mature, there are already a few incredibly important concepts to understand, especially if you're looking to reap some of the rewards of decentralized finance.

Staking

Arguably one of the most important terms to know, the act of staking plays a critical role in the many opportunities DeFi presents for consumers and the crypto ecosystem as a whole.

In the simplest of terms, staking is the process of investing or "staking" your cryptocurrency assets for a specific period of time to earn rewards/interest. When you stake an asset, that asset is used to help support the blockchain network and confirm transactions. This is done through a series of smart contacts.

Very similar to traditional finance, when you put money in a savings account you're essentially agreeing to not use those funds on a day to day basis and as a reward you're given interest. The bank will then use your money to make more money for themselves. Staking is incredibly useful for generating passive income on your crypto, and is a relatively safe form to earn from your crypto holdings.

Depending on the specific crypto asset, you are required to stake your crypto for a specific period of time. Generally the longer you agree to stake, the more rewards you're able to earn.

Like with a savings account, it's generally possible to "unstake" your assets at any time, but you will then need to pay gas fees to remove your assets from the smart contract. As the risk of staking decreases, the reward for staking will likely decrease as well.

Coinbase has an excellent article that dives deeper into staking and its possibilities. Essentially staking allows you to earn a small amount of passive income for contributing to whichever blockchain network you're staking on.

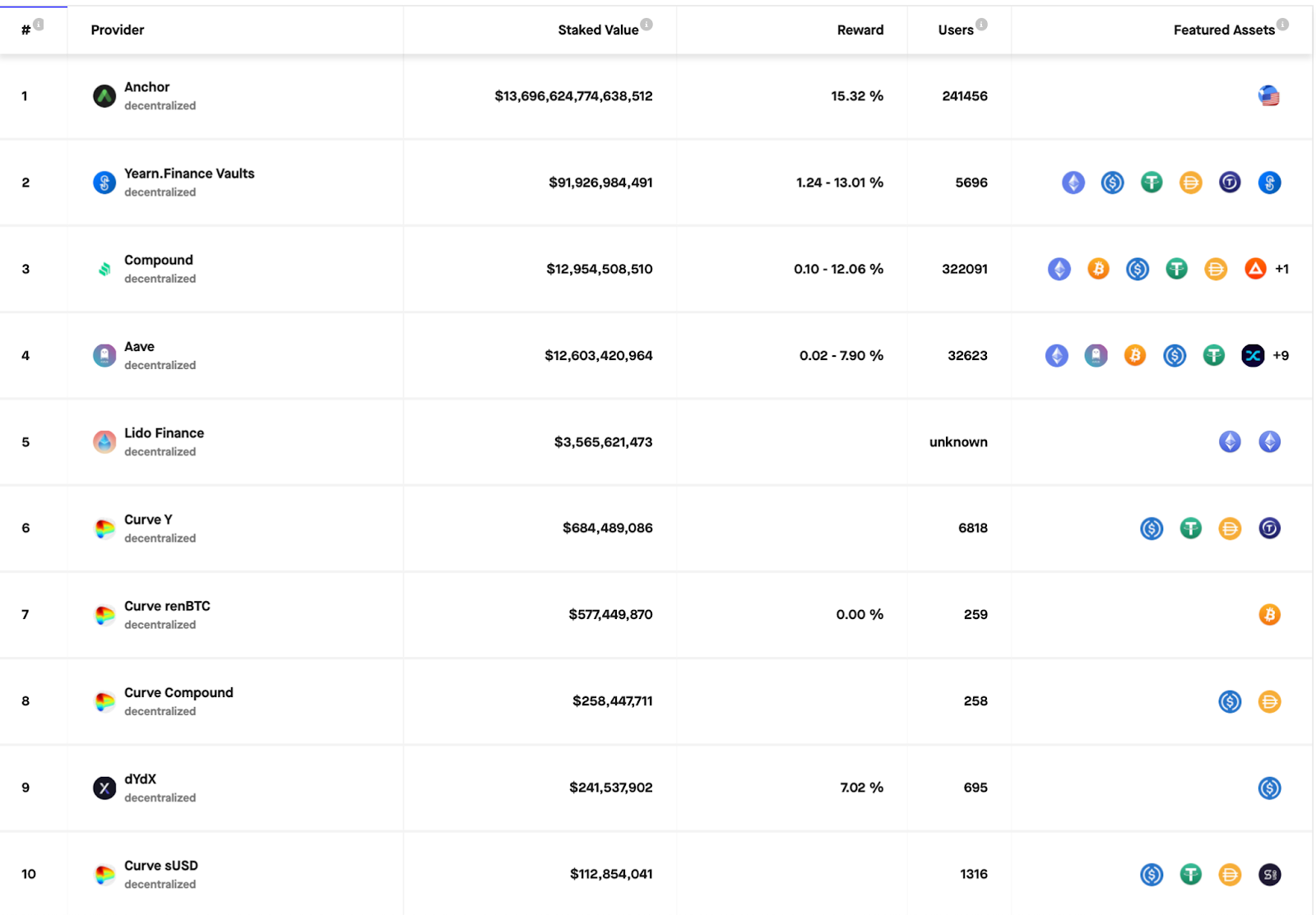

Staking Rewards is a great place to see the current rewards of various protocols.

Swapping

Swapping is another key concept to understand in the world of DeFi. Swapping occurs when you swap one crypto asset for another. As it relates to DeFi, swapping is typically done on decentralized exchanges, and not commonly seen on larger trading platforms such as Binance and Coinbase for example.

While it's common to see swapping and trading used interchangeably, they do differ in a few distinct ways. Swapping doesn't necessarily require for there to be an offer to sell the asset you're looking to buy. If you want to exchange Ethereum for Bitcoin on Coinbase for example, you would use an order book to determine the price and volume.

Swapping is valuable in the sense that you can exchange widely known cryptocurrencies such as Ethereum, for assets that may not have large trading volumes. The transaction occurs immediately, and doesn't require any other conditions to occur. A swap is quick and relatively straightforward, which makes it a good option if you're looking to acquire an asset in a time sensitive manner.

A swap is essentially an instant exchange between two non-native tokens without the need for a 3rd party using smart contracts. The benefit of swapping in many cases is you don't need to use an exchange that may require you to fill out information for Know Your Customer (KYC) regulations. Swapping won't always be the most cost effective, but it's incredibly useful for those looking to find up and coming crypto projects before they go mainstream.

Yield farming

While swapping and staking are relatively straightforward yield farming is a more sophisticated method to earn rewards from crypto which comes with higher risks but generally higher rewards as well.

Here's how Blockworks explains it:

"Yield farmers generally use decentralized exchanges (DEXs) to lend, borrow or stake coins to earn interest and speculate on price swings. Yield farming across DeFi is facilitated by smart contracts — pieces of code that automate financial agreements between two or more parties."

Yield farming is essentially the process of arbitrage across multiple networks and cryptocurrencies. Farming typically involves users lending tokens out in exchange for collateral or interest.

While yield farming can be lucrative and provide a higher interest rate compared to standard staking, it does come with significantly more risk. Furthermore, the act of staking and unstaking assets can be expensive due to fees, so that must be taken into account for optimal returns.

Due to the price volatility of crypto in general, farming yields change frequently and should not be considered a safe bet.

DeFi vs CeFi

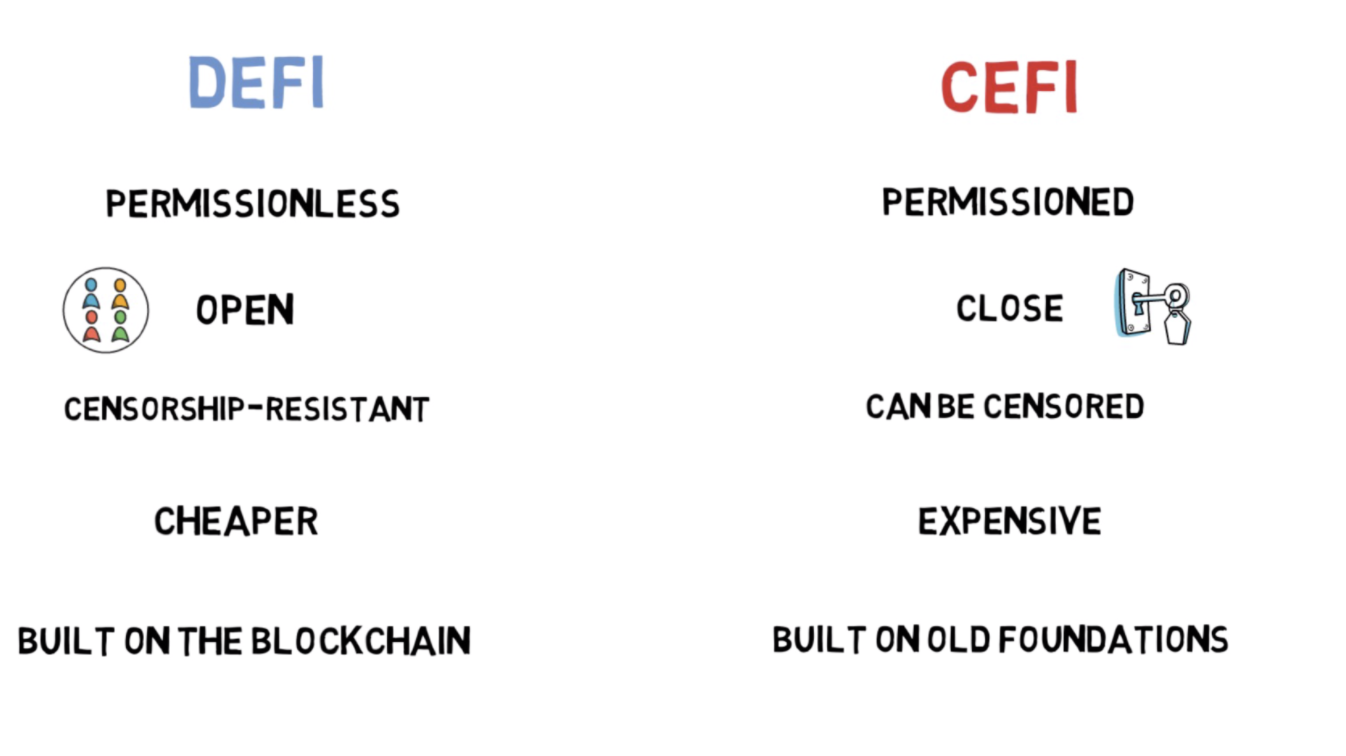

Although both traditional and decentralized finance have their pros and cons, comparing the two can be helpful to gain a better understanding of the landscape. Here's an excellent breakdown of how they compare.

While DeFi is permissionless, only needing the approval of two or more individuals to perform a transaction, centralized finance often has a few more steps.

Take for example trying to send money to a friend or family member overseas. With the current banking system, this often takes days, carries a pretty hefty fee, and is subject to other qualifications.

In a DeFi world, using crypto such as Bitcoin or Ethereum, you can send money to anyone, anywhere virtually instantly with significantly less fees.

As you can imagine, this can be incredibly helpful for those who regularly transfer money across borders or need funds in a timely manner.

With DeFi, the individual controlling the assets is ultimately the one who can determine where and how their money can be used.

Here's a great short clip that further breaks down the differences.

Of course, it's worth noting that even in the world of cryptocurrency, many popular exchanges such as Coinbase and Binance still fall under the umbrella of centralized finance.

If you hold Bitcoin on Coinbase for example, that Bitcoin is technically under the ownership of Coinbase. During the recent conflict between Russia and Ukraine, Coinbase made the decision to block addresses from Russia. In a true decentralized environment, Coinbase, nor anyone else would be able to block or hold your funds.

The value of centralized finance

While much of the discussion around DeFi is based on how it is better than CeFi, the reality is, CeFi still has a much needed place at the table.

For one, we are far from mass adoption with cryptocurrency. Centralized platforms play a crucial role in both onboarding and security.

In a truly decentralized world, forgetting your seed phrase or password would result in the complete loss of funds. Compare that to forgetting your bank login in which you'd be able to easily reset in just a few minutes.

Furthermore, the business-customer relationship seen in many traditional banking situations does have value. There's a sense of security knowing you can quickly talk to an agent or get help if needed. Long standing customers of banks also often receive certain perks and rewards based on their banking history.

Although it's tempting to suggest DeFi is superior in every way, nuance is important. During the next cycle of crypto adoption, DeFi and CeFi working together is the best case scenario.

With that out of the way, let's look at three unique use cases of DeFi and the opportunities they provide.

3 unique use cases of DeFi

Stablecoins

Thanks to the likes of stablecoins, it's becoming easier for anyone to get exposure to crypto. Stablecoins are a unique type of cryptocurrency that are pegged to fiat currency such as the USD.

In the case of Tether for example, 1 Tether is equal to 1 dollar. This allows for consumers to quickly go from fiat to crypto and vice versa while being able to reap the benefits of cryptocurrency (speed, low cost transactions, etc.). In addition to Tether, USD Coin is another stablecoin that is growing in popularity.

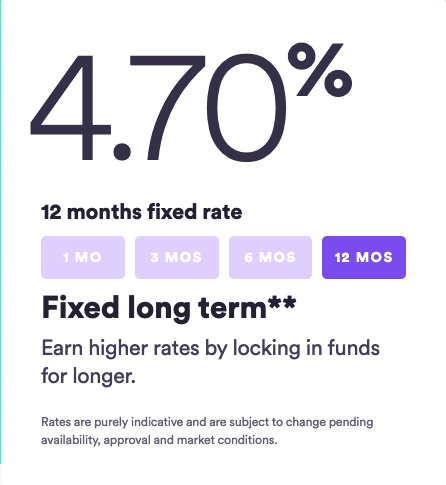

Because of stablecoins, consumers are often able to earn significantly higher interest rates compared to their traditional banks. As of this writing for example, USD Coin offers a 4.70% 12 months fixed rate. Compare that to traditional banks which offer interest rates in the range of .01%.

With much of the world facing a significant increase inflation rates across the board, earning more passively through stablecoins is incredibly appealing. Of course, while there is some risk to earning interest through crypto, the industry has matured to the point where that risk has been significantly reduced.

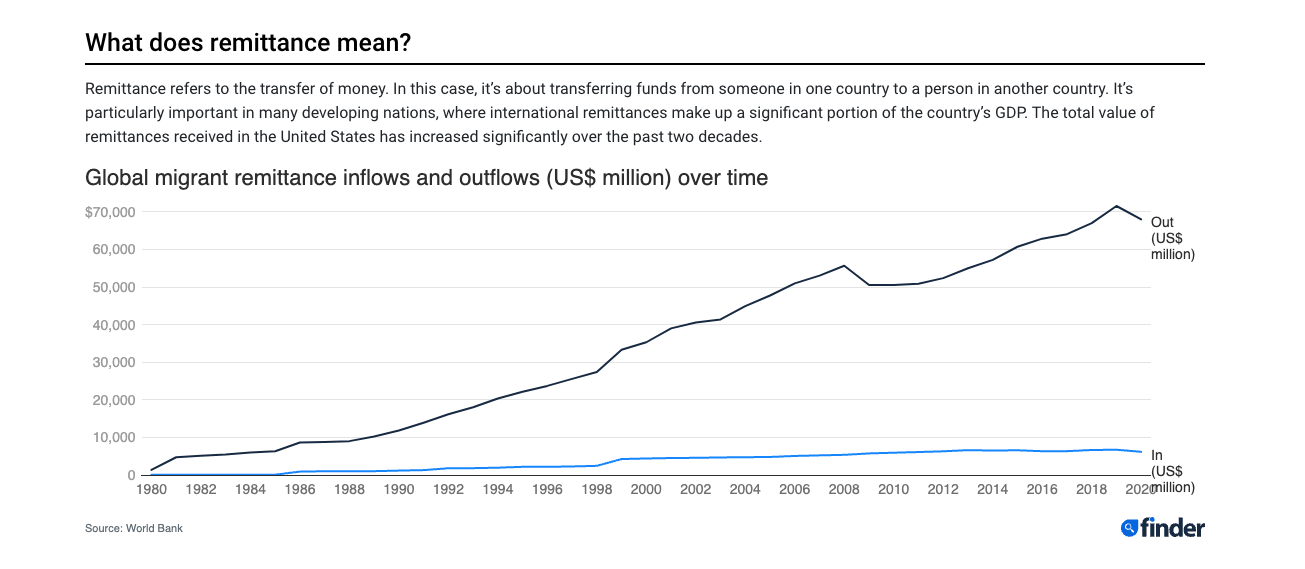

2. Money Remittance

Another benefit that DeFi unlocks, is the ability to send and receive money virtually from anywhere in the world. With many banks charging customers 10-50 USD per transaction to transfer money to international countries, that can quickly add up.

As Venezuelan Jose Maldonao, a journalist for Cointelegraph once shared, "Whether it's furniture, clothing or groceries — virtually everything can be purchased with cryptocurrencies."

Many individuals living in developing nations rely on the cheap transaction fees of cryptocurrencies to receive money from their family or friends abroad. The decentralized nature is also a bonus to help prevent overreach from overstepping governments as well.

In addition to money remittance, many developing nations that have been historically "unbanked" are getting exposure to crypto before having a traditional bank account.

Cryptocurrency is becoming increasingly popular in African countries for that specific reason. Chainalysis found the continent has seen an 1,200% increase in cryptocurrency payments from 2020 to 2021.

As crypto continues to become more user friendly, it's only reasonable to see more and more people from around the world relying on crypto to save on transaction fees.

3. Insurance

DeFi also presents some unique opportunities within the world of insurance. World famous investor Mark Cuban detailed a case in which decentralized blockchains could be used for insurance for his NBA team, the Dallas Mavericks.

Because of decentralization, there's the opportunity to significantly improve insurance products. Rather than having to jump through all the hoops of a traditional insurance claim, smart contracts with a specific set of rules will call the shots.

There's a massive benefit to knowing "If this… then this" happens without the need for any 3rd party to get involved. Insurance within the crypto trading world is also growing in popularity.

“Insurance is yet another part of traditional finance that can be reproduced in decentralized finance. It provides certain guarantees of compensation in return for a payment of a premium.

One of the most popular applications of insurance in the defi space is protection against smart contract failures or protection of deposits." says Finematics.

Overcoming challenges and the future of DeFi

While DeFi is still in its infancy, it's clear it will continue to play a large role shaping global finance, banking, and so much more.

For it to continue to thrive however, it must adequately address the valid concerns of security, most notably hacking. With billions of dollars being lost to exploits and hacks over the last several years, there's significant room for growth. Furthermore, because DeFi gives a lot more power and responsibility to its end users, exploits are especially costly. Losing entire life savings because of a hack, is something no crypto enthusiast should ever experience.

DeFi also faces an uphill battle educating new users to use DeFi safely. Again, in a DeFi environment you can't just call up your bank to get help.

For now, DeFi can be used to generate higher interest rates from your money, help you save on banking fees, and help millions around the globe take more control over their money.

Robert Stevens writing for Decrypt, said it best with his promising prediction:

“DeFi will interact with centralized finance. What if your credit score could be linked to a decentralized lending protocol? What if you could stake your house as collateral for a crypto loan? What if your high-street bank lets you buy and hold decentralized stablecoins? All these are in the works."

The future is bright, and here at Alchemy, we'll continue to help pave the way for innovation in crypto and blockchain technology.

Related overviews

DeFi AI agents are here. Build intelligent agents that automate, reason, and execute in DeFi using Alchemy.

Off-chain attacks caused 80.4% of 2024 crypto losses. Smart wallets offer better security, here's how.

Learn About Ethereum's Liquid Staking Token Ecosystem And The Top Players

Build blockchain magic

Alchemy combines the most powerful web3 developer products and tools with resources, community and legendary support.