How Does Liquid Staking Work?

Written by Ryan McNamara

Staking on the Ethereum network has become a popular choice for investors since the transition to a proof-of-stake (PoS) consensus mechanism. PoS design enables users to participate in securing the network by staking ETH in order to earn rewards.

Users need to stake a minimum of 32 ETH and navigate technical code in order to participate, making solo-staking an expensive venture.

Liquid staking has emerged as a far more accessible alternative to traditional staking on ETH, reducing technical barriers and empowering users to stake as little as 0.01 ETH to benefit from ETH staking.

What Is Liquid Staking on Ethereum?

Liquid staking platforms use novel mechanics to make ETH staking far more accessible for individuals.

These DeFi protocols allow users to deposit ETH to a staking pool and in return, users receive a liquid staking token (LST) representing their staked asset and accrued interest.

These LSTs can be traded freely and even used in other DeFi applications to earn extra yield.

This approach makes it possible for anyone to stake ETH while retaining full control of their capital. As a result, liquid staking services have seen incredible adoption in recent years.

Liquid Staking vs. Solo Staking

While liquid staking has become the go-to choice for most investors, some users may still prefer the autonomy offered by solo staking.

The fact that liquid staking requires only 0.01 ETH and minimal technical knowledge makes it the ideal choice for most participants. Additionally, the ability to retain control of one’s capital by holding LSTs makes liquid staking even more attractive.

In contrast, solo staking is a complex endeavor mostly used by large entities and those who can afford to lock up 32 ETH in order to run a validator node.

Solo stakers need to set up, run, and maintain their own validator nodes, which requires significant technical proficiency. Furthermore, stakers need to ensure their nodes are synced with the network at all times, making it necessary to invest in expensive hardware.

Solo stakers are thus generally power users with a deep understanding of the Ethereum network. Users who choose to solo stake may do so in order to earn higher rewards than those offered by liquid staking, while also minimizing reliance on third party platforms.

3 Notable Ethereum Liquid Staking Tokens

DeFi’s top liquid staking protocols continue to grow rapidly as more users recognize the value of this utility. These projects have entrenched themselves as leaders in the sector, offering users robust platforms to put their ETH to work.

What is Lido Staked ETH (stETH)?

Launched in December 2020, Lido has become the most popular liquid staking service in DeFi with a massive 8.1M ETH staked via the protocol. At the time of writing this accounts for more than 31% of all ETH staked.

Lido users can deposit ETH in exchange for the Lido Staked ETH (stETH). As one of the earliest liquid staking projects, Lido has been instrumental in increasing LST liquidity throughout the space.

Lido’s positioning as DeFi’s largest protocol highlights its continued success, with the project boasting $15B in total value locked. Stakers on Lido currently earn 3.8% APR returns on their ETH.

What is Rocket Pool ETH (rETH)?

Rocket Pool has gained significant traction in DeFi thanks to additional features that make it easier for anyone to run their own validator node.

While users can still mint rETH by staking as little as 0.01 ETH, the platform also lowers the threshold for users to run their own nodes through the use of minipools.

Users can deposit ETH and the protocol’s native token, RPL, in order to run their own nodes. Rocket Pool’s recent upgrade makes it possible for anyone to run a node by staking a minimum of 8 ETH, far lower than solo staking’s 32 ETH threshold.

Standard rETH stakers currently earn ~3.3% APRs, while validators accrue ~7.59% APR and RPL rewards.

What is Frax Staked Ether (sfrxETH)?

Stablecoin protocol Frax Finance entered the liquid staking arena in 2022 with a different approach to LSTs.

Instead of using one token to represent users’ staked assets and accrued interest, Frax’s model utilizes two tokens – Frax Ether (frxETH) and Frax Staked Ether (sfrxETH).

Users who stake their ETH to Frax receive an equivalent amount of frxETH, representing their staked capital. However, frxETH does not accrue rewards on its own.

Holders of frxETH can deposit their tokens to Frax’s sfrx vault in order to earn staking rewards in the form of sfrxETH.

This design isolates the non-yield bearing token (frxETH) and the yield-bearing token (sfrxETH) in order to give users more flexibility over their assets. In turn, sfrxETH holders earn higher rewards as yield is concentrated from the two-token design.

Will Liquid Staking Yield Change?

The benefits of liquid staking have been a key driver of ETH staking adoption. However, this also means that yields are increasingly compressed as more adopters share the rewards on offer.

With demand for ETH staking growing consistently, this trend is likely to continue.

Liquid Staking Finance (LSTfi) protocols have emerged to address this challenge. These projects empower LST holders to earn extra yield on their assets by putting them to work in blue-chip DeFi protocols.

What is LSTfi?

Ethereum’s DeFi landscape offers a multitude of opportunities for investors to generate yield.

Users can earn passive returns in numerous ways, such as providing liquidity to trading pairs (liquidity mining), or staking tokens to specific protocols. However, these activities incur significant time and gas costs when done manually.

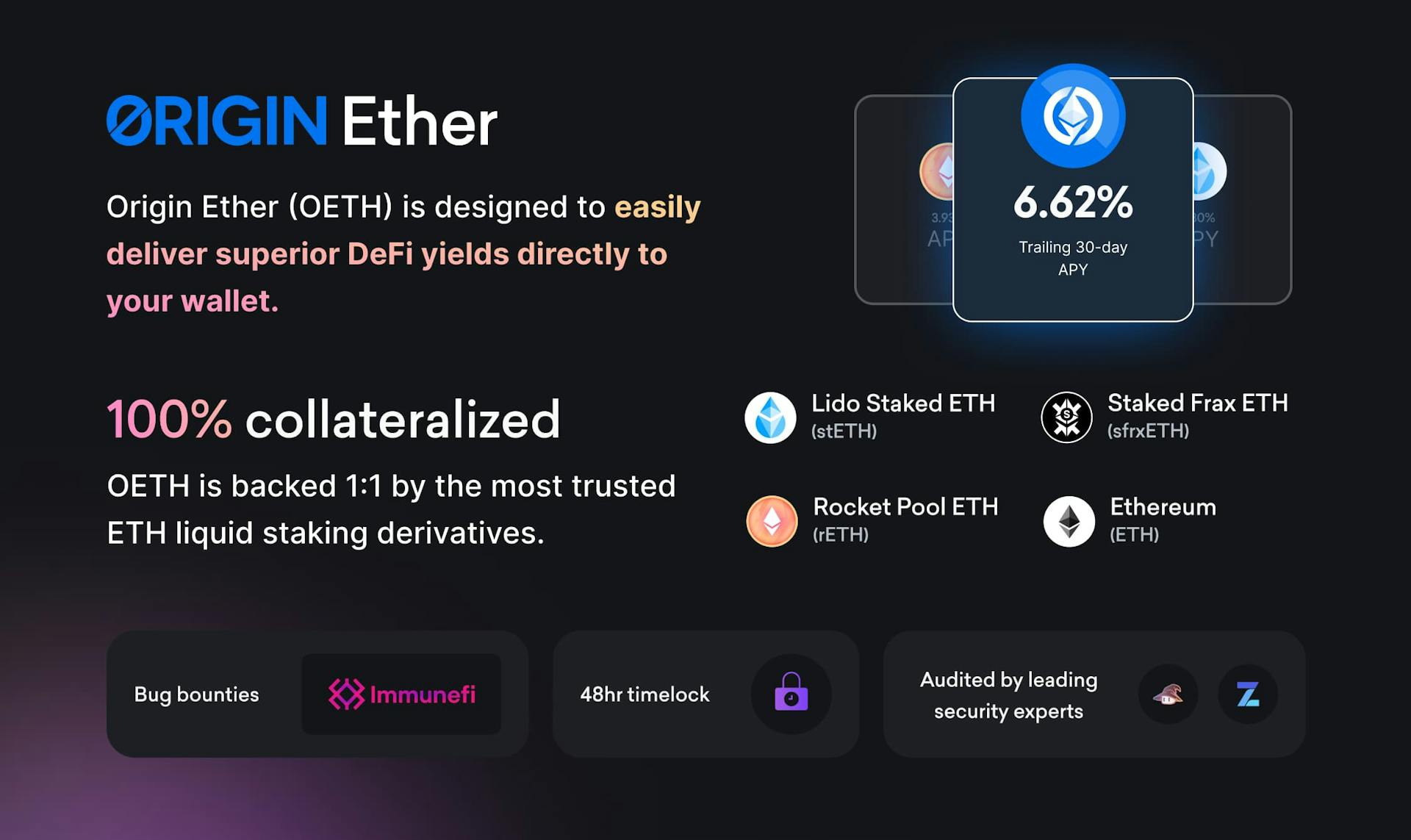

In contrast, LSTfi protocols like Origin Ether provide a seamless avenue to earn outsized yield. Users can deposit ETH, rETH, stETH, and frxETH in order to mint OETH, thus boosting yield while also allowing users to keep their capital liquid.

Origin’s strategies deploy deposited collateral to premier DeFi protocols, with yield distributed directly to holders’ wallets. As a result, users can enjoy significant returns without needing to lock up funds or pay excessive gas fees.

Should You Stake Ethereum?

While all investments carry risks, staking ETH offers one of the safest and lucrative yield opportunities in the space.

Ethereum has cemented its standing as the top smart contract network since launching in 2015. The network currently boasts a market cap of ~$220B, evidencing its widespread adoption.

At present, 21.43% of ETH has been staked to the network. While significant, this figure pales in comparison to other proof-of-stake blockchains, which regularly see >40% of tokens staked.

Coupled with the entrance of LSTfi innovators, these factors make ETH staking primed for tremendous growth in years to come.

Related overviews

DeFi AI agents are here. Build intelligent agents that automate, reason, and execute in DeFi using Alchemy.

Off-chain attacks caused 80.4% of 2024 crypto losses. Smart wallets offer better security, here's how.

Learn About The New Category of DeFi Protocols Building Yield-Bearing Strategies On Top of Liquid Staking

Build blockchain magic

Alchemy combines the most powerful web3 developer products and tools with resources, community and legendary support.