Layer 1 Blockchain Ecosystems: Overview

Written by Alchemy

Introduction

Since its launch in 2015, Ethereum has had tremendous growth due to its first-mover advantage. Ethereum mainly focuses on providing a way to enable smart contracts without the interference of a third party. This eliminates the need for centralization and provides a significant move towards decentralization.

Although Ethereum designed its systems to be flexible, it still suffers from problems such as heavy congestion and slower, expensive transactions due to parabolic growth in network effects.

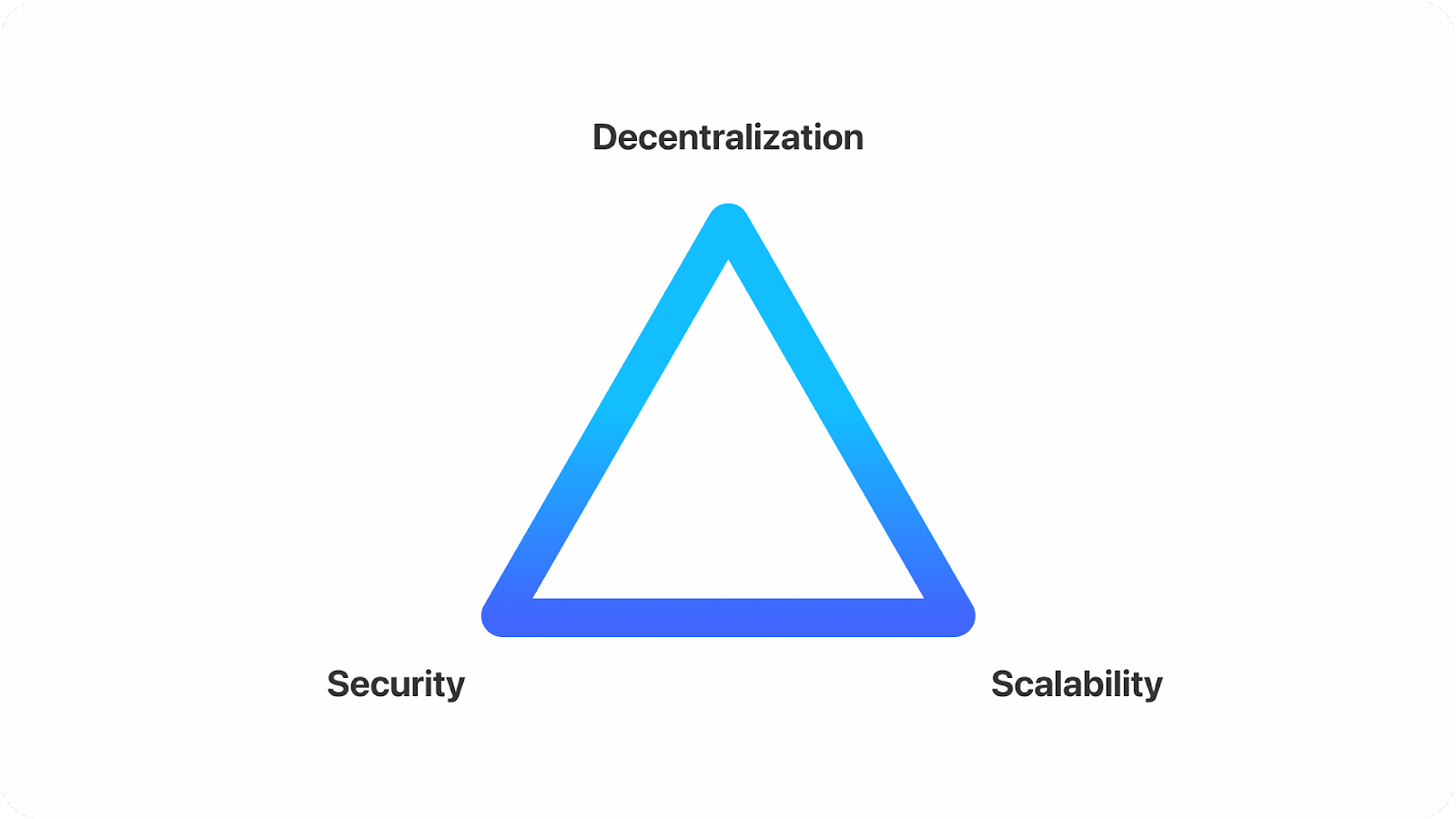

This problem is related to The Scalability Trilemma, a term coined by Vitalik Buterin (founder of Ethereum). The Scalability Trilemma refers to the tradeoffs crypto projects often face when optimizing the underlying architecture of their own blockchains.

This has led to the growth of alternative layer ones, or L1s, that can provide another way to resolve the technical limitations through the current blockchains we face today.

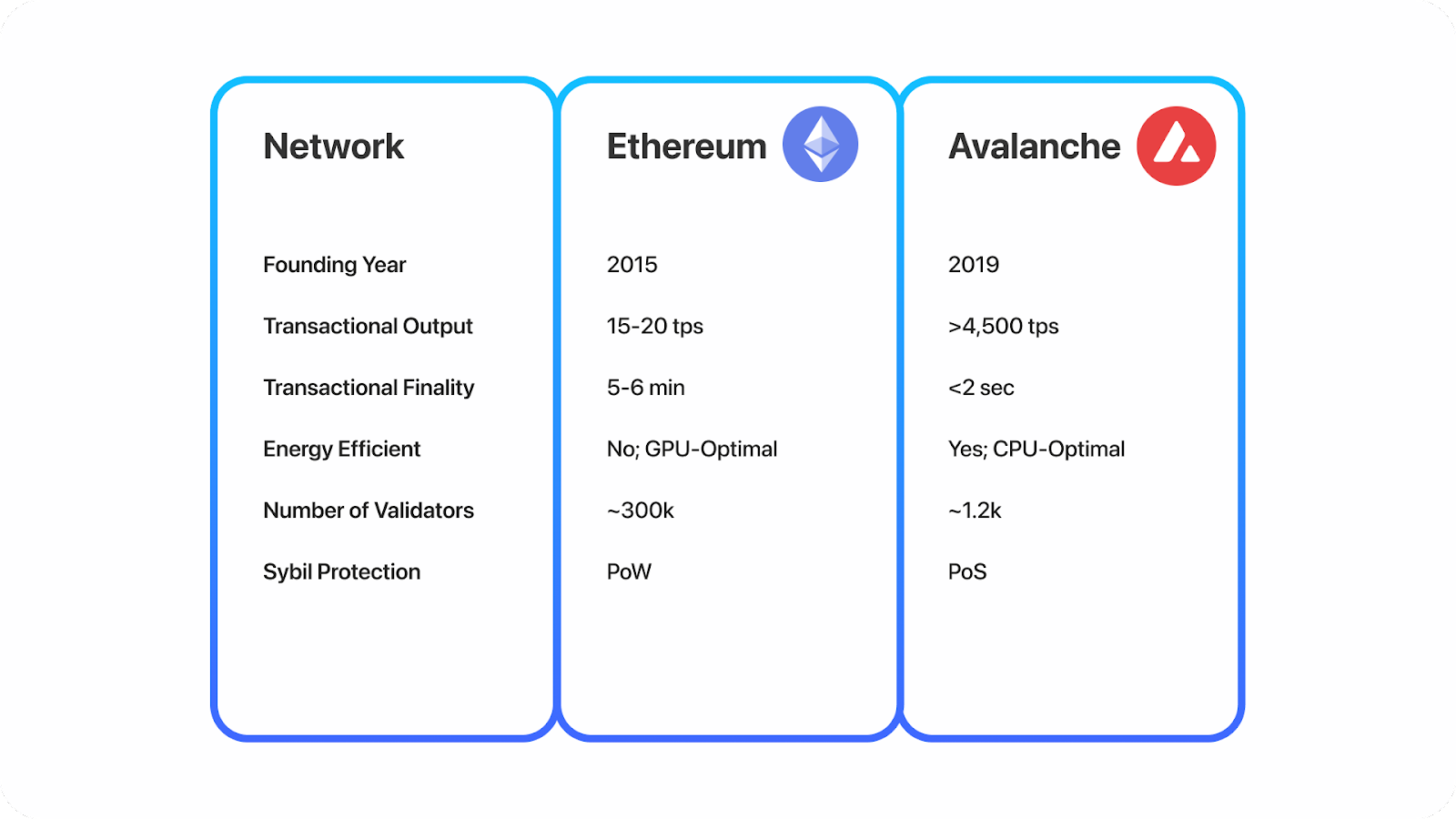

Avalanche

Avalanche is a blockchain platform designed for scalability and an open-source platform that is an alternative to Ethereum. Their consensus system makes them a faster and more efficient alternative. Ultimately, this helps them focus on better transaction speeds, gives them lower costs for transactions, and helps them be more eco-friendly.

Just like Ethereum using ETH as its currency for transactions, Avalanche uses the AVAX token, which in turn also is the currency used for its own blockchain transactions.

Ava Labs launched Avalanche in September of 2020. Cornell researcher, Emin Gün Sirer, leads Ava Labs and aims to provide specific features geared towards onboarding developers from Ethereum so they can easily make the switch over to the Avalanche system.

Avalanche's Tools and Libraries

Avalanche provides a variety of tools for developers to use within its blockchain:

Abigen: Compiles solidity contracts into golang to deploy and call contracts programmatically. Some tools used to interact, monitor, and communicate the nodes within the network alongside Abigen include AvalancheJS, Avalanche’s Public API, Grafana Dashboards, and Postman Collections.

Avalanche Wallet SDK: A typescript library used for creating and managing non-custodial wallets.

Avalanche Local Simulator: A tool to help developers spin up local instances of the Avalanche blockchain.

Avalanche Network Runner: A shell client deploys local networks or communicates with nodes. It also does rapid launch test network environments.

Index API: Enables developers to index the Avalanche network.

Technical Differences in Development

Avalanche is Fast and Cost is Low

Avalanche supports the development of Ethereum dApps, which confirm several thousands of transactions.

The transaction speed is much faster than other blockchain platforms in the market. This is due to a combination of the network’s components, the Virtual Machine, Ethereum’s RPC calls, and much more. This speed enables a much better experience for users overall.

Deployment of customized Blockchains

Nodes within Avalanche must reach a consensus within a certain timeframe.

Easy Access to the Network

Ease of access to the network is better since Avalanche is able to handle millions of validators that are engaged constantly throughout the validation process. The blockchain doesn’t require any highly configured hardware for someone to join as a validator.

Hard to Perform Attacks

In order for an attack to occur within Avalanche, one must be able to hold at least 80% of the token. This would improve the vast security of the network itself.

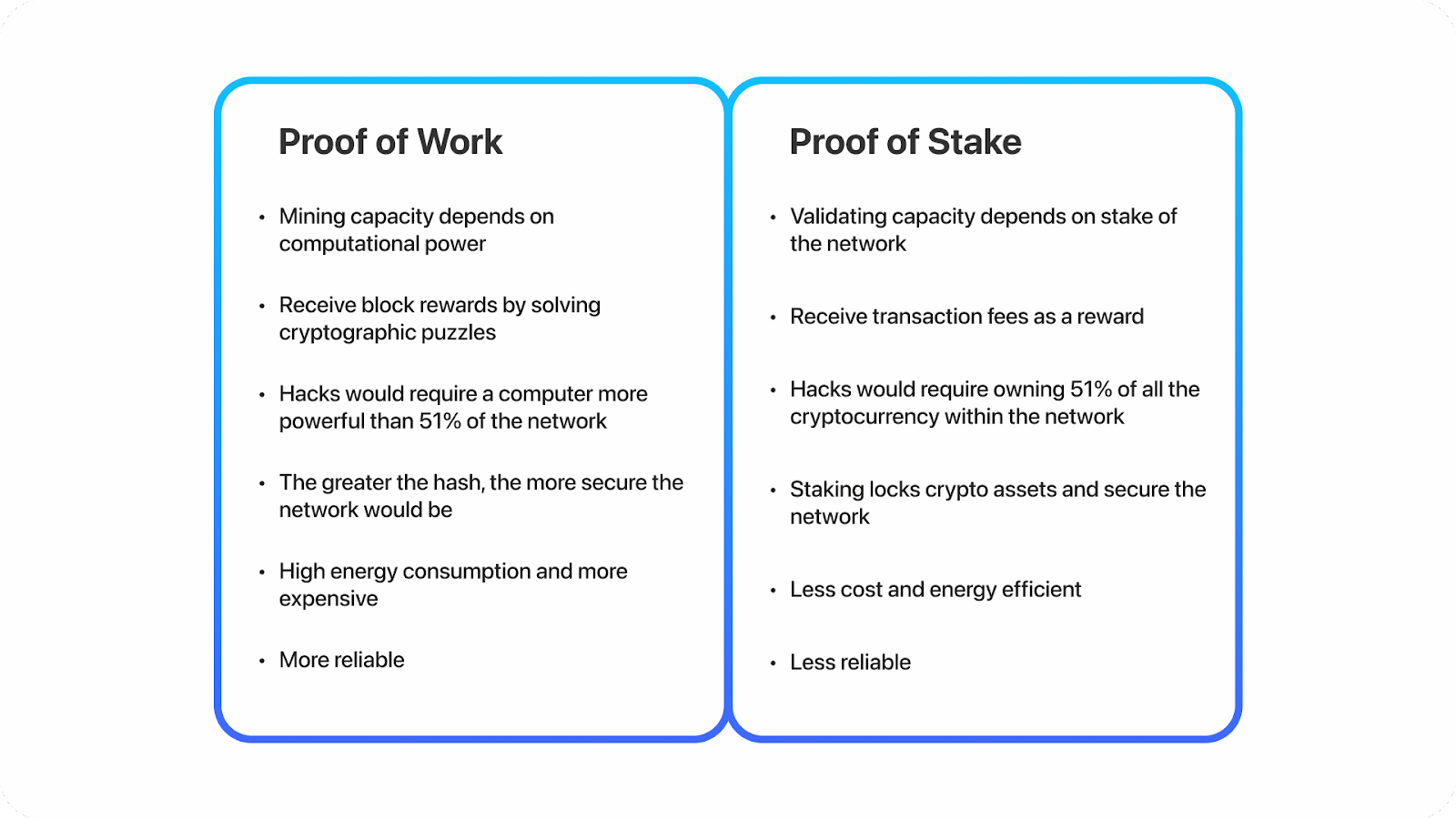

Avalanche’s Proof of Stake

Avalanche uses a Proof-of-Stake (PoS) system instead of Proof-of-Work (PoW), which Ethereum uses. Ethereum has more energy use and a lack of scalability due to its PoW system (for now).

Since Avalanche uses a PoS model, this allows holders of a token to lock investments in return for a chance to earn rewards. Transactions on Avalanche are verified by Stakers supporting the network.

Stakers are able to help the network prevent fraud by punishing those who don’t comply. Validators that don’t do their job can have their stake slashed, meaning a portion of their crypto held in stake can be lost. Overall, Avalanche’s PoS is much faster and cheaper, which provides a great reason to choose its blockchain over other models.

Primary Network

Avalanche is unique in the three blockchains that it uses to achieve superior robustness and functionality. The Primary Network, a special subnet, validates and secures these three blockchains, each of them serving a different role. These blockchains are as follows:

X-Chain (Exchange Chain): Used for issuing digital assets. Enables the creation and the exchange of assets within the blockchain.

C-Chain (Contract Chain): Also known as the Conversion chain, it’s used as the smart contract blockchain for Avalanche. This enables Ethereum developers to convert compatible applications and assets to Avalanche (Avalanche’s EVM). The protocols involved make the process faster, cheaper, and seamless.

P-Chain (Platform Chain): This blockchain is responsible for coordinating validators and monitoring subnets. This is where validators stake AVAX tokens to secure the network.

Challenges for Avalanche

The main challenge of Avalanche is that it faces stiff competition like Ethereum and other competing projects coming out in the future. In addition, it’s required that validators must stake 2,000 AVAX tokens in order to become a validator. Lastly, Avalanche does not punish validators that are considered negligent or have done malevolent behavior by making them lose their AVAX. This means there will never be a penalty with a decrease in the $AVAX cryptocurrencies staked to validate the network.

Metrics

Market Cap: ~$20b

TVL: $11.2b

Top dApps (Past 30 Days): Trader Joe, Pangolian Exchange, Sushi, NFTrade, Bogged.Finance, Kalao, Aave, Platypus, Kill Rich, Cradabra, etc.

1 Day Fees: $834,536.42

7 Day Avg. Fees: $758,107.12

Number of Validators: 1,249

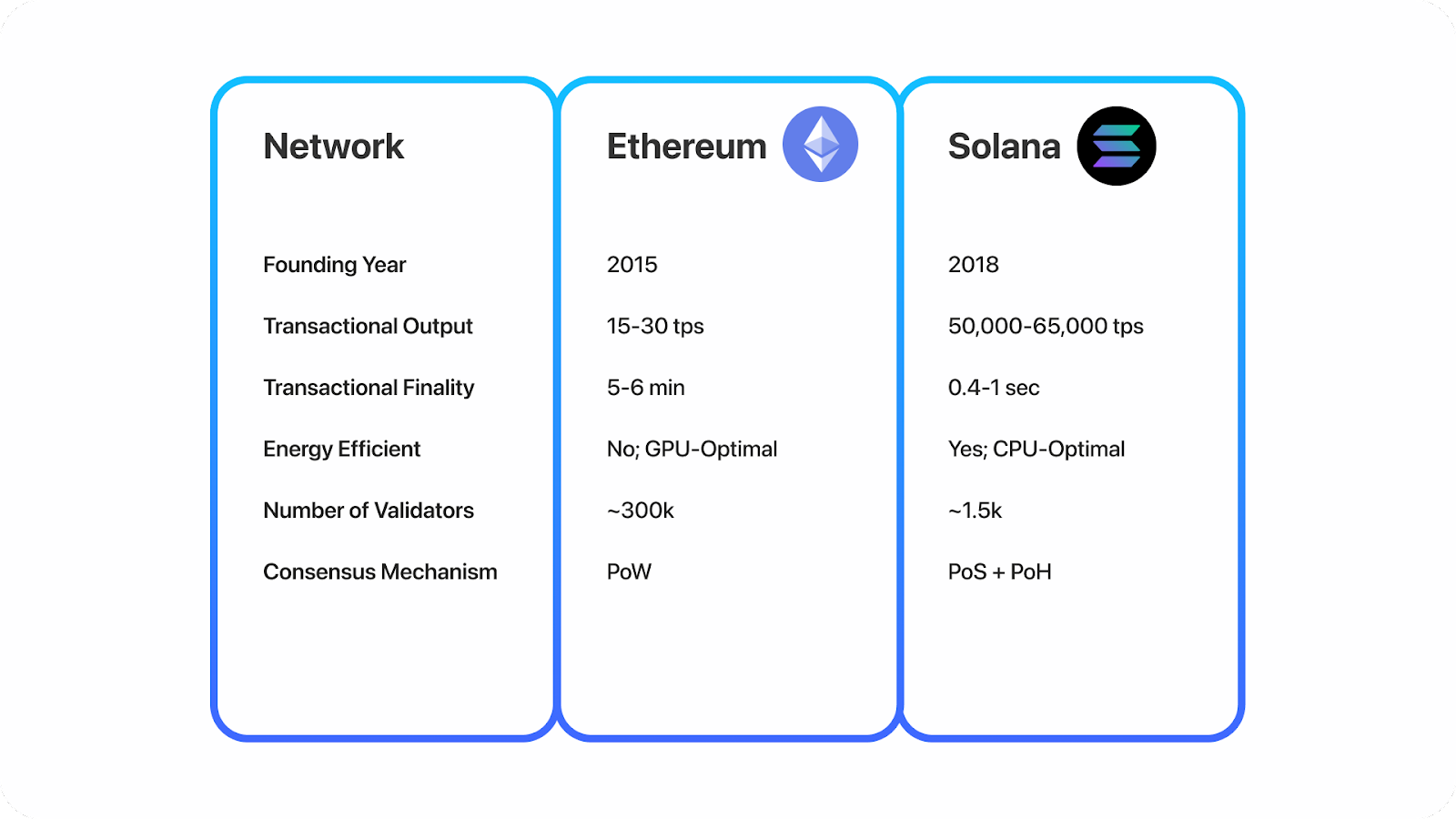

Solana

Introduction

Solana is one of the hottest blockchains currently in the market. Solana is unique in that it has a different consensus system compared to other blockchains called Proof of history (PoH). Just like Ethereum, Solana continues to attract developers and enables them to create high-potential projects in the space. Solana provides a “stateless” architecture and has become highly scalable due to its reduced memory consumption.

Anatoly Yakovenko founded Solana in 2017, after publishing a white paper on Proof of History. In 2018, Greg prototyped the first implementation of the whitepaper, which is open source. The project was originally named Loom but rebranded to Solana on March 28th. The project debuted as an ICO in 2020. Solana, now run by the Solana Foundation as Solana Labs, continues to be the main contributor.

Solana's Tools and Libraries

Solana currently provides its own Command Line Interface and Web3.js SDK that enables developers to communicate with the blockchain and programs from Solana itself (just like an API). Solana has many other tools that are open-source like a Solana faucet, a Metaplex Metadata Finder, and a Merkle Distributor. More tools are provided by Solana’s strong community here: https://soldev.app/library/tools. You can find out more about the community here: https://solana.com/developers

Technical Differences in Development

As Ethereum and other blockchains use Proof of Work or Proof of Stake consensus systems within their blockchains, Solana relies on a Proof of History consensus system. This use of PoH makes the blockchain much faster, scalable, and energy-efficient overall.

Why Proof of History?

PoH, events, and transactions are hashed with the SHA256 hash function. This makes it easier for validators to track hashes in chronological order and process transactions as they come. Validators can process transactions without waiting for a block to be filled. Because of this, Solana has the ability to process more transactions per second.

Since the hashing process creates a clear and verifiable sequence of transactions, the validator can add the transactions to a block without the need for a conventional timestamp. Overall, it’s a way for validators to keep track of hashes in chronological order with Solana’s “delay function”, encoding time as data.

Turbine

Solana uses a protocol called Turbine that breaks down information into smaller bits, which enables the information to be easier to process. Solana is able to solve bandwidth problems and increase the capacity to process transactions this way.

Turbine is similar to Ethereum’s plans for Sharding.

Gulf Stream

Gulf Stream is another protocol Solana uses in order to push transaction caching and forwarding towards the edge of the network. Clients and validators forward transactions to the expected leader and allow validators to execute transactions ahead of time.

In addition, Gulf stream allows for smaller confirmation times, faster leader switch times, and reduced memory pressure on validators. This solution is not possible if networks have a non-deterministic leader or don’t have the ability to know initial conditions in order to predict an outcome.

Sealevel

For Ethereum, its EVM is considered single-threaded which means that only one smart contract can modify the state of the blockchain at a time. However, Solana is able to be parallel-threaded, meaning that smart contracts can be run without overlapping one another.

Solana uses Sealevel, which is a hyper-parallelized transaction processing engine that is used to scale across SSDs (solid-state drives) and GPUs (graphics processing units). This enables Solana to scale horizontally rather than vertically.

Pipelining

Pipelining is a technique Solana uses to make sequencing data inputs into hardware components. This results in enabling data to be verified and duplicated across nodes at a rapid rate. Overall, It’s made to be an effective CPU (central processing unit) design improvement.

Cloudbreak

Essentially, this is a horizontally-scaled architecture for Solana. Since scaling computing is not sufficient enough for Solana, memory, needed to store account information, becomes a bigger problem. Cloudbreak allows Solana to scale without the use of sharding. Solana made Cloudbreak to simultaneously utilize all hardware for indexing data, reading the database, and writing transaction inputs.

Archivers

Finally, Solana is able to store data through the use of Archivers. Archivers enable the network to offload data from the validators to the Achievers themselves. This is what allows nodes to duplicate information with very few hardware requirements. Archivers allow for the use of secure and efficient blockchain data on a distributed and public ledger.

Archivers are efficient at what they do because they only store small parts of the state itself. However, the networks will ask Archivers to prove that it's storing data they are supposed to store. This technique would be called Proof of Replication (PoRep).

Challenges for Solana

Like other blockchains, one challenge for Solana is that it needs to secure a strong position in the cryptocurrency world. Another challenge is staking centralization. Potential security risks exist if, say, a Standard Custody stakes a significant portion in Solana. Something going wrong with the Standard custody could bring down Solana’s blockchain.

In addition, a high concentration of Solana in one place is bad for the blockchain since having Solana gives voting power. Finally, liquidity and price data are important since a great deal of liquidity is on Project Serum, which made a tool on Solana called Serum DEX. Damage on Serum DEX could cause damage to Solana.

Recently, Solana suffered a network outage due to bots performing duplicate transactions excessively. This is an increasing problem, as network stability isn’t guaranteed within Solana.

Metrics

Market Cap: ~$30.5b

TVL: $7.2b

Top dApps (Past 30 Days): Raydium, MeanFi, Orca, Magic Eden, Solanart, Solend, Saber, Solsea, Wormhole, Mercurial, etc.

1 Day Fees: $108,723.89

7 Day Avg. Fees: $79,375.03

Number of Validators: 1,531

Terra

Introduction

Terra is a blockchain protocol that allows an abundant use of algorithmic stable coins. Stable coins are pegged to the price of any fiat currency, like the US dollar or Euros. Because of this, users on the Terra blockchain can save, exchange, or spend Terra stable coins. Terra provides more stability than other blockchains like Bitcoin, Ethereum, and other altcoins.

Throughout the Terra blockchain, the word Terra also refers to one of the two cryptocurrencies within the Protocol. The other important token within the Terra blockchain is called Luna. We’ll explain more about this later.

Terra Labs made the Terra blockchain with the help of Terra Alliance (15 large e-commerce companies that have garnered large transaction volume and users in Asia). Co-founded by Daniel Shin and Do Kwan, they considered price stability and adoption to be important in taking the next steps towards massive adoption of cryptocurrency and blockchain infrastructure.

Terra's Tools and Libraries

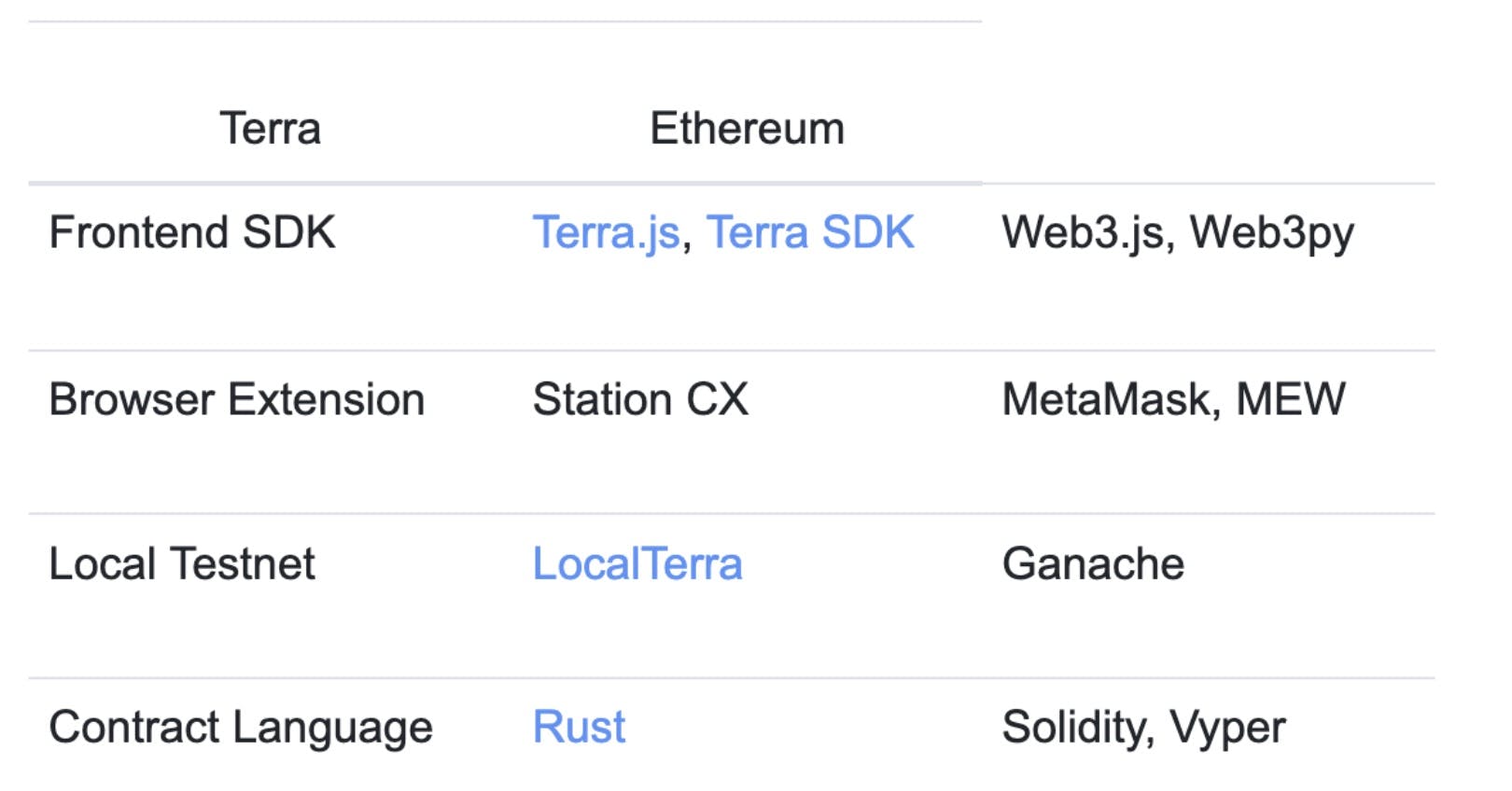

Terra provides the same tools as Ethereum, except it's made and provided by the protocol itself. Just like how Ethereum uses Web3.js and Web3py as a frontend python SDK, Terra uses Terra.js or the Terra SDK. In addition, Terra has a browser extension (Station CX) and its own local test net for experimentation on the Terra blockchain. Finally, instead of using Solidity, Terra uses Rust instead.

Terra provides its own command line interface called Terrad to help interact with the Terra blockchain. Terra also has a core module called Terra Core. Terra Core enables users to reference implementation of the Terra protocol, written in Golang.

The blockchain can provide multi-sig accounts. A mult-sig account is a special key that can require more than one signature to sign transactions, which is useful for multiple parties wanting consent for transactions. Finally, Terra provides a faucet called Terra Testnet Faucet, which lets users receive tokens for the latest Terra testnet.

Technical Differences in Development

Terra functions differently compared to Ethereum and most other blockchains because its main role is to create algorithmic stablecoins. Terra aims to enable a decentralized economy and increase participation in new financial primitives to help innovate the concept of money.

Tokenomics

What makes Terra unique is that it is secured by a distributed consensus on a staked asset called Luna. This supports the stablecoins that are pegged to the fiat currencies algorithmically.

The protocol consists of two main tokens:

Terra: These are the coins that are pegged or tracked to the price of fiat currencies. For example, UST would be pegged to USD which is the currency for the United States. It’s common practice to name Stablecoins for their fiat counterparts. Users are able to receive new Terra tokens by burning Luna tokens. All Terra denominations exist in the same pool.

Luna: Mainly used for governance, staking, and mining, the Luna is Terra protocol’s native token used to absorb the price volatility of Terra. Staking luna rewards validators for recording and verifying transactions on the Terra blockchain. These rewards come in the form of fees. There is a correlation here: the more Terra is utilized, the higher in value Luna becomes.

Proof of Stake

Just like Avalanche, Terra uses a Proof of Stake consensus protocol, as opposed to Ethereum’s Proof of Work consensus protocol. Terra exists using the consensus mechanism currently used by Tendermint, securing its network through the use of validators.

Transaction Fees

The transaction fee in the Terra network is quite low, compared to that of Ethereum’s ecosystem. This is because of the price stability algorithm that ensures lower transaction fees and seamless cross-border transactions. Terra aims to eliminate the use of third parties in order to complete transactions without incurring high fees.

In addition, every payment gets a fee of only 0.6% within six seconds or less. This is a much better alternative compared to traditional credit card payments charging 2.8% or more.

Interoperability

The Terra blockchain is known to be built on top of Cosmos IBC (Inter-Blockchain Communication protocol). This enables Blockchain Interoperability; the ability for a network like Terra to see and access information on many blockchain systems, meaning that networks can communicate amongst themselves. For example, Terra is able to run on Solana, Ethereum, and other blockchains as more developers are beginning to use the protocol.

Challenges for Terra

The market cap of Terra is much smaller than Ethereum, so Terra still faces competition to reach a spot towards innovation in the finance economy. In addition, if Terra somehow does not peg to the price of fiat currencies, it could lead to huge risk, losses, and damage towards the protocol.

Terra subjects Validators and delegators to slashing if they don’t perform or if they misbehave in their role. An example of not completing a role as a validator or delegator includes signing twice on a transaction (Double signing), being unresponsive (downtime), or missing votes in the Oracle process.

Metrics

Market Cap: ~$33b

TVL: $23.13b

dApps: Mirror, Achor, Terraswap, Pylon, Terra Station, Chai, Mavalo, Spectrum, LoTerra, Preserver, etc.

Total Number of Validators: 305

Number of Active Validators: 130

Conclusion

Many of these Ethereum ecosystems provide a compelling reason for developers to build on top of a more scalable, interoperable network. But the challenges for these Layer 1 blockchains will play out as they face tough competition onboarding more users and tackling the scalability trilemma. Time will tell if Ethereum will be the main solution to mitigate scaling problems or if viable alternative L1s will begin to dominate the space in the future.

Related overviews

Learn how Japan's government is accelerating innovation and how companies are using blockchain technology.

Japan Airlines and Calbee, a Japanese Snack Food company, are using NFTs to promote tourism and brand loyalty.

WaveHack is the biggest web3 hackathon in Japan, and is being held from mid-April to the end of August 2024.

Build blockchain magic

Alchemy combines the most powerful web3 developer products and tools with resources, community and legendary support.