The Business Model of Rollups (Rollup Economics 2.0)

Author: Uttam Singh

Everyone talks about rollups as the future of Ethereum, but what does it really take to run one, but does the math make sense for businesses to launch their own rollup? The space is moving faster than anyone expected, yet it’s still unclear how these chains make money or cover their costs.

This piece dives into how rollups actually make money, the cost of running a rollup, the different revenue streams, and whether the model is truly sustainable. We’ll also look at how architecture and design choices shape these economics and what it all means for developers and infra teams building in the modular stack.

Key takeaways of the rollup business model:

The business model of a rollup ultimately comes down to three levers: how it earns, where it can add upside, and what it costs to operate.

Rollups core revenue = core per-tx fees (base fees + tips) and optional operator surcharge.

Add-on revenue: rollups can earn additional revenue through MEV, hosting L3s and DA resale, and stablecoin rev-share.

The main costs of running a rollup are data availability, validation (fraud infra or ZK proving), infra/RPC/monitoring/storage, ecosystem incentives, and any platform/licensing cut.

In short, you can think of these takeaways as a simple monthly P&L equation to understand a rollup’s business model:

Protocol surplus = core fees + add-on revenues − cost

Let’s break down the business model of a rollup in greater detail.

Core Revenue of a Rollup

Core revenue for a rollup comes from the L2 fee market the rollup sequencer controls. The sequencer executes transactions on the rollup and periodically posts their data to a data-availability layer. Revenue from sequencers primarily comes from transaction fees paid by users.

Each transaction pays an L2 execution fee (an EIP-1559 style base fee, plus an optional priority tip), a DA fee that reflects the bytes to publish upstream, and, if the rollup provider chooses, an operator surcharge embedded in the fee policy. Those fees accrue to a rollup’s fee vault, the data component largely passes through to pay your DA bill, so the real margin driver is execution gas plus any operator surcharge after data availability fees and operations costs.

For reference, in OP stack chains, there is a specific Sequencer fee vault which collects and holds transaction fees paid to the sequencer during block production.

Example: World is one of the largest onchain apps in the world, with over 30M users, and is powered by Alchemy rollups.

Additional Revenue Sources for Rollups

MEV / Ordering Revenue

With the right sequencing and ordering policy, a rollup can capture MEV as transparent chain revenue. MEV capture is a design choice & isn’t guaranteed income.

Example: Arbitrum Orbit recently launched Timeboost which replaces naive FCFS with an express-lane auction each round. Traders bid off-chain, proceeds go on-chain. The auction fees go to the Arbitrum sequencer, and are then distributed to the Arbitrum DAO and Developer Guild.

Timeboost crossed $3M+ in fees collected post-launch and has continued to ramp. If you run an Arbitrum chain, you can enable Timeboost and keep your chain’s auction revenue.

OP-Stack chains don’t have Timeboost, but you can still capture priority fees. The OP Mainnet sequencer will prioritize transactions with a higher priority fee and execute them before any transactions with a lower priority fee.

Stablecoin Economics (Yield/RevShare)

Treasury yields are 4–5% in 2025 across the short end, and issuers earn interest on reserves and often share it with distribution partners. Examples include:

Circle shares revenue with partners (e.g., Coinbase historically, Bybit reported), though terms vary and are not chain-wide by default.

Paxos ↔ PayPal (PYUSD) explicitly allows issuer → PayPal sharing of reserve earnings; users do not get the interest. That’s precedent for B2B rev-share on stablecoin programs.

If your chain becomes the home for a big stablecoin footprint, a negotiated rev-share can dwarf sequencer fees. For example, a $1B average stable float × 4% translates to $40M/yr. Even a more conservative 50/50 split between the stablecoin issuer and the ecosystem operator leads to $20M/yr for each party. It’s worth noting though that feasibility here depends on regulation and legal restrictions as well as distribution power.

L3 Chain Hosting & DA Resale

If an L3 settles to your L2 (parent chain), the L3 pays the parent-chain DA fees. For example, Arbitrum Orbit L3 pays fees to Arbitrum One, and an OP-Stack L3 pays DA fees to an OP L2.

As a rollup provider, you can sell DA and charge network fees - a “wholesale blockspace” business.

Owning the L2 means you own ordering economics (priority fees, auctions, flow partnerships). This is a big motivator for consumer fintechs to launch L2s - see Robinhood’s plan to spin up an L2 (Arbitrum stack) to bring its order flow onchain.

Costs of a Rollup

Data availability (DA)

DA is usually the biggest variable cost for running a rollup. On Ethereum, this is paid through blobs. The Pectra upgrade doubled the blob target from 3 → 6 per block and the roadmap pushes further via PeerDAS starting with Fusaka. (next upgrade)

Alt-DA (e.g., Celestia, EigenDA) can be cheaper per MB for many workloads while you still settle on Ethereum if your stack supports it. Celestia is a modular blockchain purpose-built for DA - it scales throughput while keeping verification lightweight through data availability sampling (anyone can check validity with a light node). EigenDA, built on EigenLayer, lets rollups outsource DA to Ethereum’s restaked validator set, offering Ethereum-aligned security with flexible bandwidth guarantees.

Model it simply: DA_cost ≈ MB_posted × $/MB

State Validation / Proofs

Optimistic. In the happy path you post outputs to the L1 and pay little gas. The real cost is operational: keep a proposer and a challenger online and tie up bonds during the ~7-day window. Disputes are rare, but when they happen you pay the L1 for the fraud-proof step.

ZK: You drop the challenge window and bonds, and instead pay a proving bill. Most spend is off-chain GPU/prover time; the on-chain verify is a single cheap call per batch.

If you’re on OP-Stack, projects like OP Succinct let you upgrade to a type-1 zkEVM rollup.

Infra & Operations

Running a rollup is running a 24/7 production system. Beyond the sequencer, you’re paying for batchers, RPC gateways, archive/state nodes, indexers, explorers, bridge, key management, storage, and multi-region failover. You also need observability (logs/metrics/traces), monitoring for both on-chain and off-chain signals, DDoS/rate-limit protections, rollback pipelines, and real incident response with on-call & shipping new features regularly.

Rollup service providers like Alchemy allow virtually any team to run their own chain regardless of their technical expertise, at a low upfront cost. With Alchemy Rollups you can just offload all of that infra and operational overhead and focus on providing a better UX & growing your community of onchain builders and users.

License / RevShare to Your Stack

OP Stack is MIT open-source, with fees only applying when joining the Superchain (2.5% of revenue or 15% of onchain profit). Arbitrum Orbit uses a Business Source License with an 'Additional Use Grant' allowing free L3s on Arbitrum One while requiring a 10% profit share for independent chains.

Go-to-Market Incentives & Developer Tooling

Ecosystem grants, airdrops, liquidity, developer tooling. These aren’t “unit costs,” but they’re very real cash/token outlays in year 0–2.

Sample Calculations for a New Rollup

If you’re looking for a back-of-the napkin way to approach the rollup business model, here’s a sample calculation you can use to think through whether the business model makes sense.

Core Costs:

Fixed Cost (per month, testnet + mainnet)

Fixed costs include sequencer, RPC, block explorer, bridge infra → $3,000–$3,500/mo

Total fixed costs: ~$3,000–$3,500/mo

Variables:

Variable costs include L1 settlement + DA fees + misc. These costs are typically low at early volumes → usually $100–$500/mo total

Total variable costs: ~ $100–$500/mo for small chains

If we set the total monthly cost (including fixed and variable) at $3,400, and if we anchor the net capture per tx (what the chain actually keeps) at $0.0012-$0.0020/tx, here is what a rollup’s monthly profit looks like as it scales onchain activity:

Notes:

You can have high chain revenue but low/negative onchain profit if DA costs are high or fees are underpriced.

You can improve onchain profit by (a) raising net capture per tx (fee policy, operator surcharge, ordering auctions), or (b) lowering onchain costs (cheaper DA, better compression, bigger batches, lower infra cost).

Conclusion

Rollups can be sustainable businesses, and they give teams the chance to stop paying rent to other chains and start capturing value directly. Instead of watching fees, MEV, and ecosystem activity flow upward to an L1, projects that run their own rollup get to own those economics and reinvest them back into their users and ecosystem.

If you're a planning to launch a rollup or if you deployed a rollup yourself and you want to migrate to a true white-glove, experienced rollup service provider, we’d love to speak with you! Learn more here.

Alchemy Newsletter

Be the first to know about releases

Sign up for our newsletter

Get the latest product updates and resources from Alchemy

By entering your email address, you agree to receive our marketing communications and product updates. You acknowledge that Alchemy processes the information we receive in accordance with our Privacy Notice. You can unsubscribe anytime.

Related articles

The Enterprise Stablecoin Guide

A practical guide to using stablecoins in enterprise payments—covering why legacy rails fail, which stablecoin types and chains to choose, privacy considerations, and when (not) to issue your own.

Deposit Tokens for Banks: A Practical Playbook

Major banks are quietly processing $10B+ daily in tokenized deposits. Here's how deposit tokens could capture $140 trillion by 2030 and a playbook to integrate for banks.

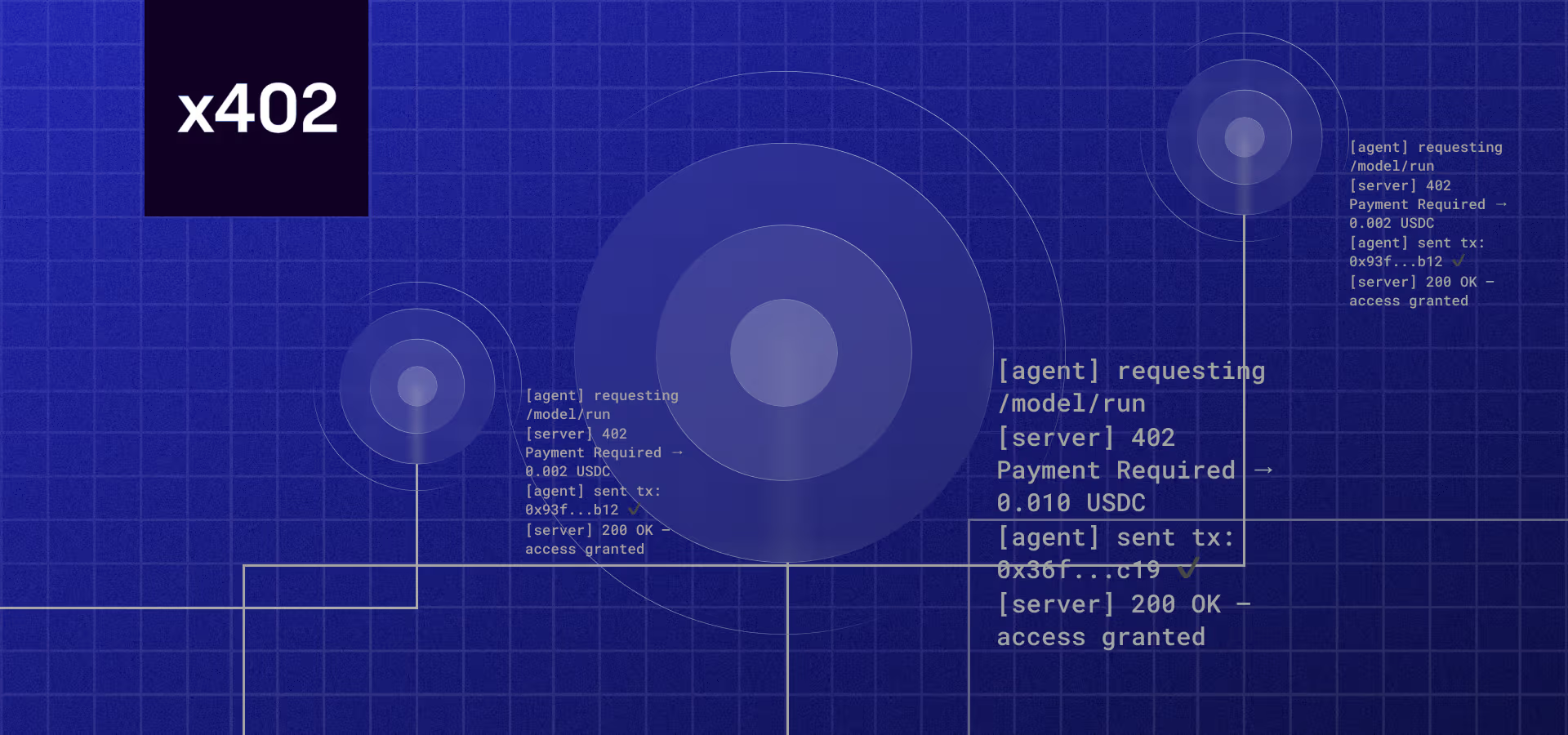

How x402 Brings Real-Time Crypto Payments to the Web

x402 revives the HTTP 402 code, so AI agents and apps can pay for API requests instantly using crypto: no accounts, no subscriptions, just seamless transactions.