What is the Ethereum Beacon Chain?

Written by Alchemy

Unlike the Ethereum Mainnet, the Beacon Chain does not handle transactions or smart contracts. Instead, it coordinates the entire Ethereum network by managing its stakers (who validate the proof of stake blocks) and shard chains (split-up chains of the main network).

The Beacon Chain has always been a part of Ethereum founder Vitalik Buterin’s vision for the blockchain.

What are the features of the Beacon Chain?

We’ll delve into the key characteristics of the Beacon Chain, a crucial component of Ethereum 2.0.

What is Proof-of-Stake (PoS)?

First, the Beacon Chain introduces the Proof-of-Stake (PoS) consensus mechanism for computers in the blockchain network to validate transactions.

Ethereum previously used Proof-of-Work (PoW), which relied on using large quantities of energy to secure the network.

Proof-of-Stake relies on capital to secure the network, with validators (instead of miners) who are rewarded and punished monetarily based on their performance.

Introducing shard chains

While the Ethereum roadmap once planned for 64 "shard chains" to run in parallel, scaling the network's throughput.

Since then, the community has shifted its focus to scaling via a layer-2 centric roadmap.

Transition to proof of stake

We’ll discuss Ethereum’s significant shift from Proof of Work to Proof of Stake, a move that will have profound implications for energy efficiency and scalability.

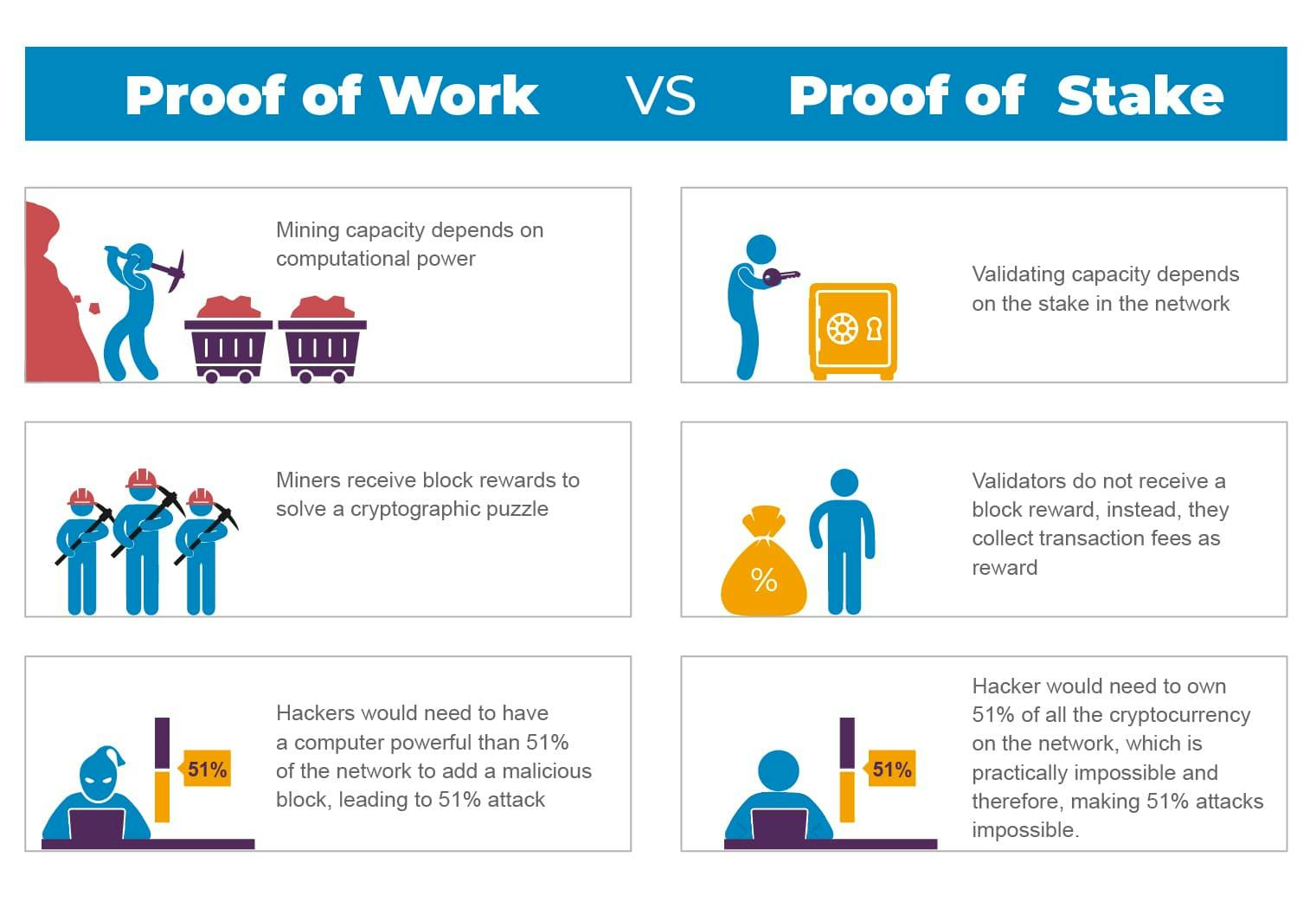

Understanding proof of stake (vs. proof of work)

Now, let’s delve into the specifics of what makes PoS the preferred choice for a consensus mechanism. In short, a consensus mechanism allows computers in a blockchain network to agree upon what transactions are valid.

In PoW, all participating “miners” race to solve a complicated mathematical problem to verify new transactions, update the blockchain, and receive a reward. Although PoW is proven and secure, it is increasingly impractical due to its energy-intensive process.

In comparison, PoS solves this by semi-randomly (see more below) selecting only a few “validators” at a time to validate the transactions in the next block and propose that block to the blockchain. This is called “minting” blocks, as compared to “mining” in PoW.

PoS significantly reduces the computational power and energy needed to mint a new block because over 99% less people are competing at a given time.

How do you become a validator?

To become a validator, a node needs to deposit a certain amount of ETH into the Ethereum network. This is called “staking,” similar to a collateral or security deposit. For the upgrade, one has to stake a minimum of 32 ETH on the main Ethereum chain to run a validator node.

The size of the stake determines the chance that a validator will be selected for minting in a linear fashion. For example, if Alice stakes 320 ETH (wowza!) and Bob stakes 32 ETH, Alice’s node will have a 10 times higher chance of being chosen to mint the next block. Hence, the selection process is not completely random.

When a validator is chosen to validate the next block, they will first verify if all the transactions in the block are valid or not. Once everything looks good, the validator will change the state of the blockchain by writing that block onto the blockchain.

This information is then confirmed by a “committee” of at least 128 other validators in a process called attestation. If the block checks out, the initially chosen validator will receive a staking reward, which is made up of the fees that are associated with the validated transactions.

How are validators kept honest?

Trusting that stakers will behave as honest validators is crucial for PoS to function successfully, and there are several ways this is accomplished.

First, if validators approve fraudulent transactions, then they will lose a part of their stake, or get “slashed.”

This is partly why the stake is so high (32 ETH). If the stake is always higher than the staking reward, a staker will have no financial incentive to become a dishonest node because they will lose more money than they can potentially gain.

In addition, if a node wishes to exit its role as a validator, there is a delay of around 25 minutes before its stake and staking rewards can be withdrawn. Within this lock-up period, the validator may still be slashed, should the network find that they approved fraudulent blocks.

The Ethereum Foundation team has really thought this through by holding the validators accountable on all fronts!

PoS: A more secure and decentralized blockchain?

Another downside of PoW is that it encourages the use of mining pools. This is where miners team up and combine their computational power to increase their chance of solving the hash, after which the reward is distributed evenly across everyone in the pool.

This also creates the potential for bad actors to aggregate their mining pools and control more than 51% of the network’s total hashing power. Known as the 51% attack, this centralization of the blockchain could allow these mining pools to approve fraudulent transactions for their own gain.

Centralization goes against the most fundamental principle of blockchain, and PoS solves this issue. How?

Instead of relying on the aggregation of computational power from mining equipment, PoS chooses its validators depending on how much they stake. So, one would need to acquire over 51% of all the staked coins to initiate a 51% attack in PoS, making it highly expensive and impractical as this may cost up to hundreds of billions of dollars, depending on the coin’s value.

Furthermore, mining pools also enjoy the power of economies at scale. Under PoW, the revenue that an additional miner would potentially generate is greater than the cost of adding that miner to a big mining pool. Thus, this essentially makes the rich even richer.

In contrast, staking and becoming a validator is easier than mining, as people don’t need to start off by purchasing expensive mining equipment. As such, the Ethereum Foundation team hopes that this will encourage more people to participate in the network, thereby making it more decentralized and safe from 51% attacks overtime.

The Merge - Where are we, and what is next?

Ethereum successfully completed The Merge in September of 2022. Next, comes proto-danksharding and then full danksharding, which will optimize the mainnet as a base layer for additional blockchains to be built on top of.

This is a huge and exciting step in realizing the Ethereum vision of scalability, security, and sustainability, benefiting not only the users of the network but also creating a greener future for the blockchain space.

Related overviews

What is Blockchain Sharding and How Does it Relate to Ethereum?

Learn About Safe (Justified), Finalized, and Latest Commitment Levels

Learn How Ethereum Transactions are Propagated Across the Ethereum Network

Build blockchain magic

Alchemy combines the most powerful web3 developer products and tools with resources, community and legendary support.