Web3 Development Report (Q2 2023)

Author: Alchemy Team

Web3 developer activity soars, driving 302% Q/Q growth in EVM chain contracts and rapid account abstraction adoption

Even as NFT and DeFi trading volume contracted from their all-time highs, web3 developer activity continued to climb in Q2 pointing to long-term ecosystem growth.

Smart contracts deployed on EVM chains including Ethereum, Arbitrum, Optimism, and Polygon were up 302% quarter over quarter. During the same time, Ethereum and wallet SDK installs – one of the leading indicators of ecosystem health – were up 7% and 22% respectively, reaching a new all-time high.

These three data points alone are encouraging, but there’s more to be excited about.

Get every insight from the Q2 2023 web3 development report.

In the 2023 Q2 blockchain developer report we aim to provide an objective snapshot of the web3 industry’s health by examining the trends and behaviors of the group tasked with defining its future: developers.

We analyzed key metrics including library installs, smart contract deploys, and testnet activity to measure developer activity, then overlay that data with key moments and trends to better understand what’s happening under the hood in web3.

One of those key moments happened in June when Vitalik published The Three Transitions, a vision for Ethereum’s next steps as a mature tech stack. The paper highlights:

L2s moving to rollups

Wallets moving to smart contract wallets

A renewed focus on privacy-preserving technology

Developers were quick to respond to his call to action:

Arbitrum One, an optimistic rollup, hit 9.5M unique addresses and more than doubled in Q2

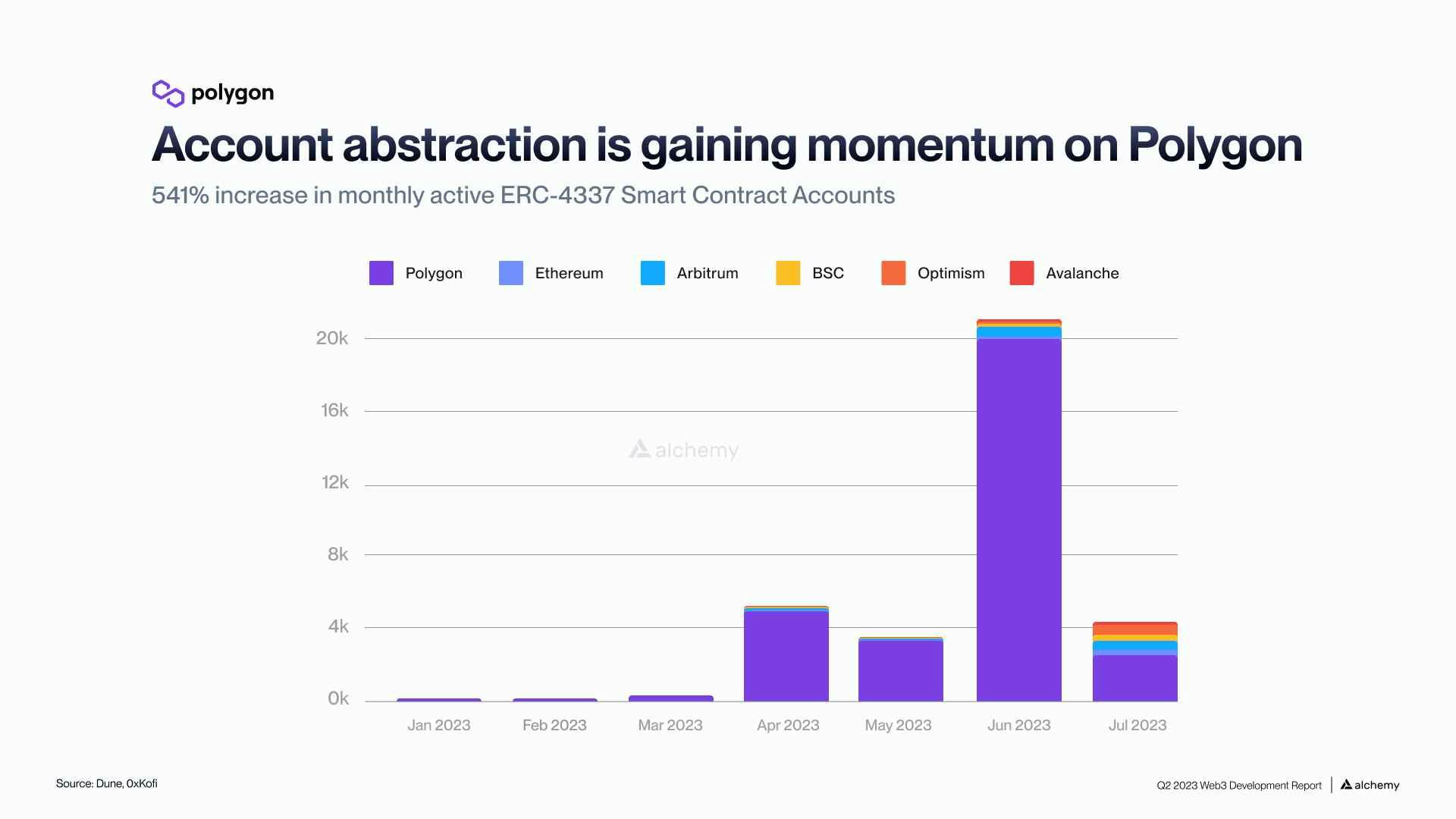

Polygon saw a 541% increase in monthly active smart contract accounts

On-chain active Account Abstraction users surged 27,360% Q/Q

According to our survey of 600+ developers, smart contract security, account abstraction, and ZK-rollups were the top three topics they were most interested in, indicating that developers are all in on scaling Ethereum.

Testnets also offer unique insights into the industry. The Goerli and Sepolia “sandboxes” allow devs to test new dapps before deploying. Activity on these testnets typically portent trends to come.

Testnet activity showed that smart contracts deployed on Goerli were up year over year by 282%. However, this quarter painted a different picture with Goerli supplies running scarce due to the emergence of pricey secondary markets and faucets running dry. As a result, Sepolia made huge headway toward becoming the favored testnet of choice.

The entirety of the Q2 2023 Web3 Development Report can be downloaded for free or read in more detail below. As you’ll see, the report offers a much deeper dive into the emerging trends driving the blockchain industry forward. When taken in aggregate, we think the web3 market data provides well-founded grounds to be bullish.

Our aim

This report aims to provide an accurate and useful representation of web3 development. The following sources were used for data collection purposes: Dune (verified smart contracts), DappRadar (dapp count), Github and NPM (SDK installations and metadata), CoinGecko (token prices), and npmtrends.com.

What are blockchain developers building in 2023?

Emerging trends among blockchain developers in 2023 include web3 data products, smart contract wallets and Account Abstraction infrastructure, and zero knowledge infrastructure like generalized provers.

In this section of the report, we review data from Alchemy Ventures, Alchemy's annual developer survey, and trends we're observing from the Alchemy Dapp Store, a community-supported directory for discovering web3 applications.

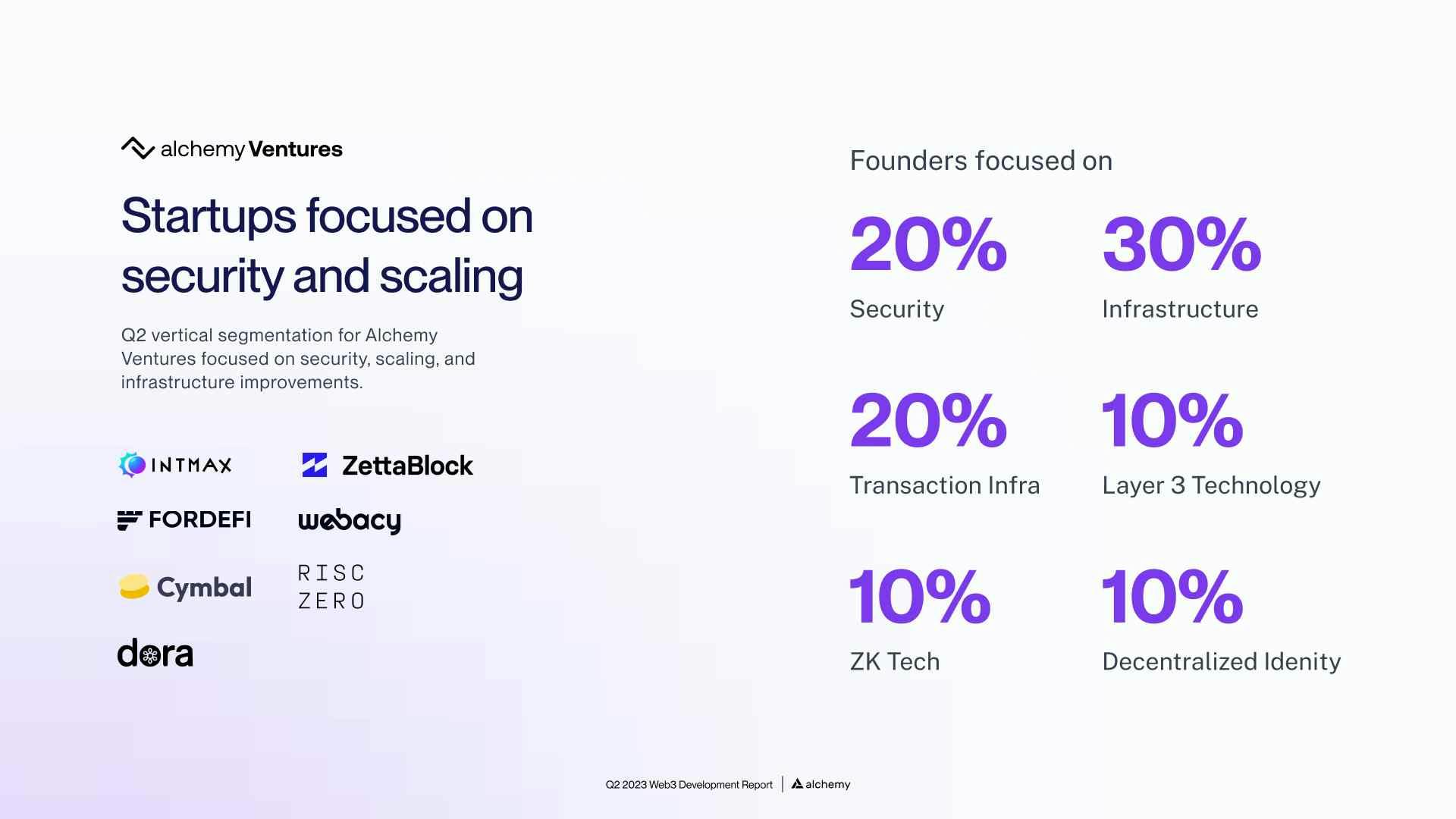

Alchemy Ventures Statistics

Alchemy Ventures invests in early-stage blockchain startups that are committed to building products, tooling, and infrastructure to help the entire blockchain industry scale. Alchemy Ventures typically invests during the earliest funding rounds including pre-seed, seed, and series A rounds.

In what verticals are web3 startups building products and raising capital in 2023?

The types of blockchain startups raising money in 2023 are web3 data and analytics (40%), web3 security (20%), and 10% each for DeFi, Layer 3, Zero Knowledge, and wallet tech.

Some of Alchemy’s Q1 2023 investments include:

Intmax - stateless zero knowledge rollup

Risc Zero - a general purpose zero knowledge virtual machine

Cymbal - a human-readable block explorer

If you're a blockchain developer interested in funding from Alchemy, applying for our web3 accelerator program, or receiving a web3 developer grant, reach out to our team through the Alchemy Ventures website!

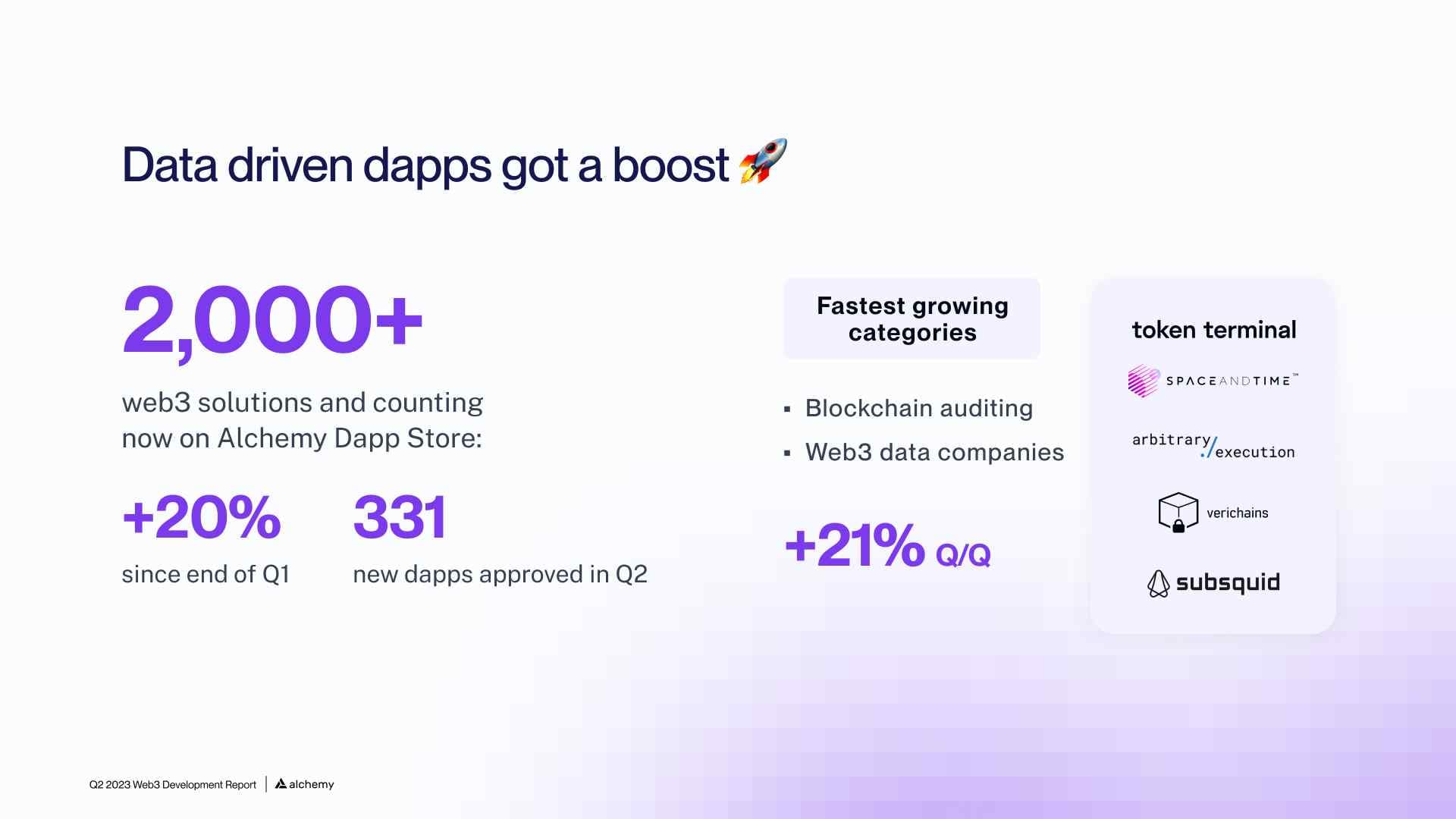

Alchemy Dapp Store Statistics

In Q4 2022, Alchemy launched the Alchemy Dapp Store, a directory of web3 developer tools and applications to help increase the visibility of projects. In Q2 2023, over 330 new applications were approved, and the platform today hosts over 2,000 dapps across the most popular blockchains.

Some of the fastest growing web3 niches include:

Web3 Data Tools - tools for reading, storing, indexing, and transforming blockchain data

Blockchain Auditing Companies - companies that verify the security of smart contracts

Smart Contract Wallets - crypto wallets that use Account Abstraction infra

Popular companies that recently launched on the Dapp Store include:

Space and Time

Arbitrary Execution

Verichains

Subsquid

Token Terminal

Alchemy Developer Survey Results

Every years Alchemy sends out a web3 developer survey to our free, growth, and enterprise customers to get insights into what engineers are building, their challenges, and ways we, as an industry, and support emerging needs.

This year, 625 respondents provided feedback on what their most interested in:

Smart contract security

Account abstraction

ZK-rollups

Smart contract development

AI

And also what their biggest challenges are:

Funding

Awareness

Regulation

Resource Bandwidth

With the increased scrutiny from regulators and sideways price movement through the current bear market, it's not surprising to see many young web3 startups concerned about raising money and optimizing their runways until they find product-market fit (PMF).

What libraries and SDKs are growing the most in 2023?

Developers use web3 libraries like ethers.js and SDKs like the Alchemy SDK to build decentralized applications. Measuring the activity and usage for the most popular open-source libraries is a helpful proxy for the overall developer community's activity.

How fast are Ethereum SDK installs growing?

Ethereum libraries like Ethers.js, Web3.js, Hardhat and Web3.py grew 37% Y/Y with a total of 26.8 million downloads in Q2 2023 compared to Q2 2022 despite the crypto market spending the last 12 months in a horizontal bear market.

Here's how the installations compare Y/Y since 2019:

2019 Q2 - 2.9 million

2020 Q2 - 4.7 million (+66% Y/Y)

2021 Q2- 7.4 million (+58% Y/Y)

2022 Q2 - 19.5 million (+163% Y/Y)

2023 Q2 - 26.8 million (+37% Y/Y)

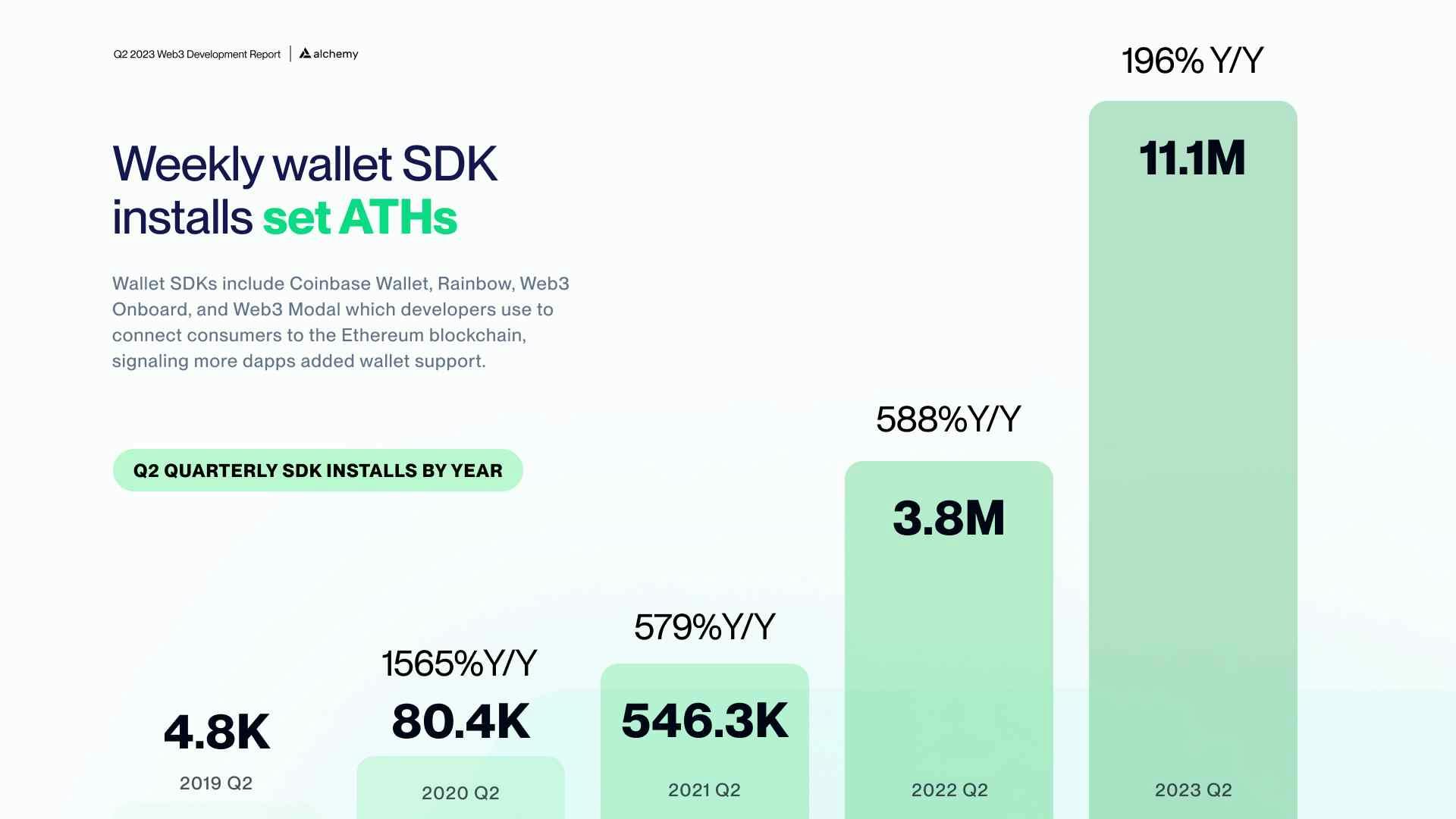

How fast are web3 wallet SDK installs growing?

Web3 wallet SDK installs grew 196% Y/Y in Q2 2023 with a total of 11.1M downloads. Wallet SDKs analyzed include Coinbase Wallet, Rainbow, Web3 Onboard, and Web3 Modal which developers use to connect consumers to blockchain networks.

Here's how the installations of wallet SDKs compare Y/Y since 2019:

2019 Q2 - 4,800

2020 Q2 - 80,400 (+1565% Y/Y)

2021 Q2 - 546,300 (+579% Y/Y)

2022 Q2 - 3,800,000 (+588% Y/Y)

2023 Q2 - 11,100,000 (+196% Y/Y)

What testnets are growing the most in 2023?

After testing locally, blockchain devs typically get test ETH from a faucet and deploy applications on test networks (i.e. testnets) to validate, iterate, and refine their product on a test blockchain that mirrors a production environment without spending real money on the gas required to execute transactions.

How fast is the Sepolia testnet growing?

In Q2 2023 the Sepolia testnet approach parity with the total number of requests sent through Alchemy compared to the Goerli testnet. With the deprecation of the Goerli testnet, monetization of Goerli ETH, many developers are migrating towards Sepolia as the default testnet.

If you're still building on Goerli, learn how to migrate to Sepolia and how to get Sepolia ETH tokens from Alchemy's free SepETH faucet.

How fast is the Goerli testnet declining?

The scarcity of Goerli ETH and the emergence of secondary markets for buying and selling test ETH in Q1 2023 led to 34% less smart contract deployments on the Goerli testnet in Q2 2023 compared to the previous quarter.

If you're unsure about switching off of Goerli, explore the differences between the Sepolia and Goerli testnets.

How fast are Ethereum and L2 smart contract deployments growing in 2023?

Once developers confirm that their applications are working as designed, they are ready to deploy their app onto a live blockchain. Popular blockchains include L1s like Ethereum and L2 blockchains like Polygon, Optimism, and Arbitrum.

How fast are Ethereum smart contract deployments growing?

Ethereum smart contract deployments grew 64% Q/Q compared to Q1 2023 and 277% Y/Y compared to Q2 2022.

The resurgence from Q2 2022 and continued growth from last quarter is a healthy signal that Ethereum development velocity is increasing.

How fast are smart contract deployments growing on layer 2s and sidechains?

Smart contracts on layer 2 (L2) blockchains like Optimism, Arbitrum, and sidechains like Polygon grew 1106% Y/Y compared to Q2 2022, and saw a 302% increase Q/Q compared to Q1 2023.

Layer 2 blockchains provide users with cheaper transaction fees, more transactions per second, and faster confirmation times. These features, along with a maturing ecosystem of applications and adoption from users is one explanation for continued strength from L2 smart contract deployments.

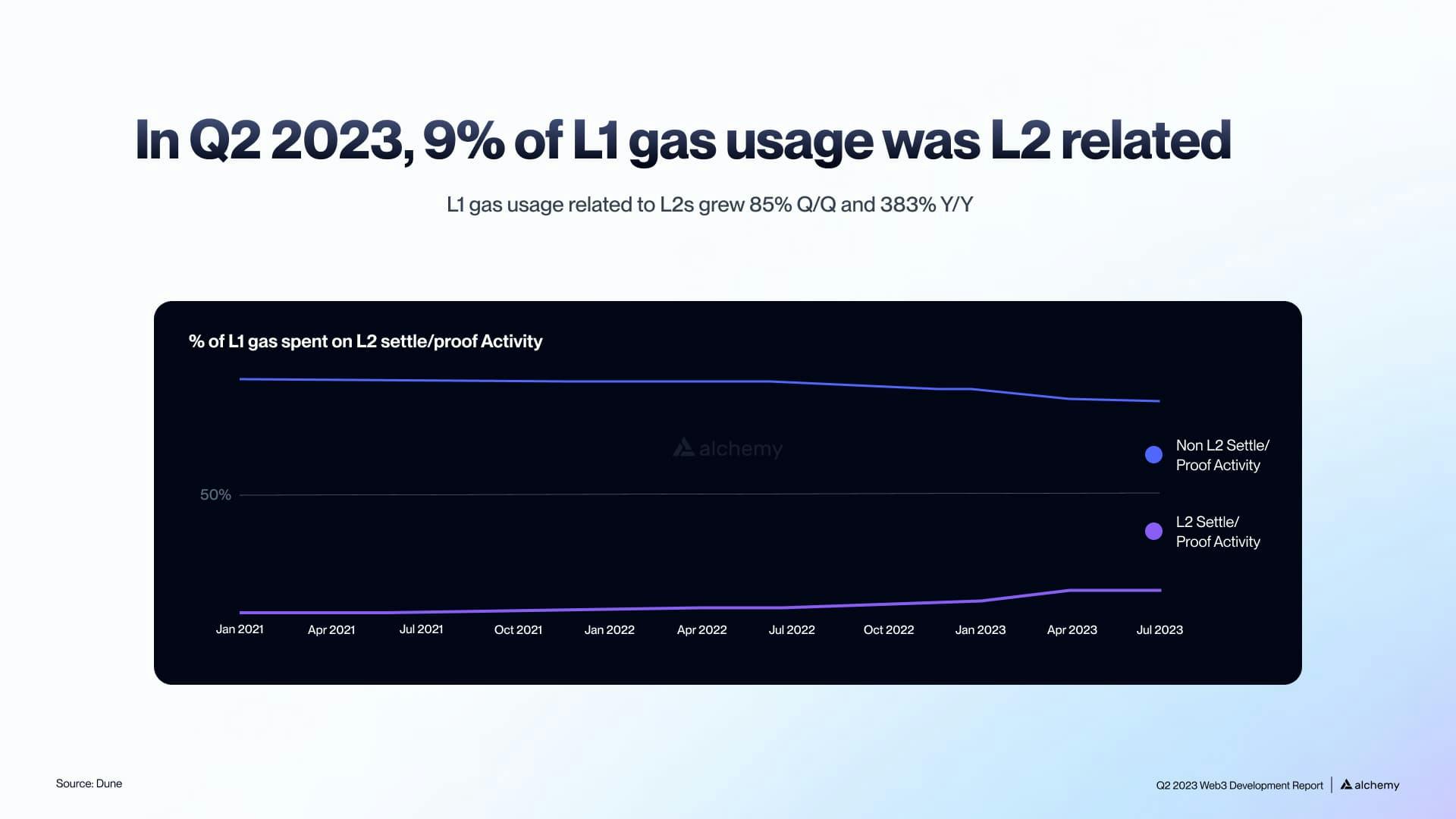

How much L1 gas usage is being used by L2s?

L1 gas being used by Layer 2 blockchains is increasing at a rapid rate: 88% Q/Q compared to Q1 2023 and 383% Y/Y compared to Q2 2022.

With the rise of L2 developer and user activity, the total amount of L1 gas being consumed by L2s is expected to continue to increase.

How fast is layer 2 bridging growing?

Users bridging tokens to layer 2s remained flat Q/Q, decreasing only 0.25% Q/Q.

This flat volume of L2 bridging despite low NFT and DEX trading volumes gives confidence that while trading activity across the industry is down, the adoption of L2s has real staying power.

How much is developer activity growing across L2s, EVM chains, and networks supported by Alchemy?

As web3 products attract real users and find product-market fit, developers need to scale their systems to support the increased consumer demand. Much of today's scaling involves developing applications on Layer 2 blockchains.

How fast are Polygon developers growing on Alchemy?

In Q2 2023, active Polygon developer teams building on Alchemy grew 74% Y/Y since Q2 2022. Polygon builders also grew:

Total Requests Sent Through Alchemy: +33% Y/Y

Total Free Tier Requests: +70% Y/Y

Total Enhanced API Requests: +535% Y/Y

Polygon also saw momentum on ERC-4337 smart contract accounts with a 541% increase in monthly active smart contract accounts (SCAs) since Q1 2023:

For more information about building with AA infrastructure, explore our documentation for Polygon Bundler and Polygon Gas Manager APIs (i.e. Paymaster).

How fast are Arbitrum devs growing on Alchemy?

In Q2 2023 active Arbitrum developer teams building on Alchemy grew 213% Y/Y since Q2 2022. Arbitrum devs also grew:

Total Requests Sent Through Alchemy: +295% Y/Y

Total Free Tier Requests: +485% Y/Y

Total Enhanced API Requests: +7,589% Y/Y

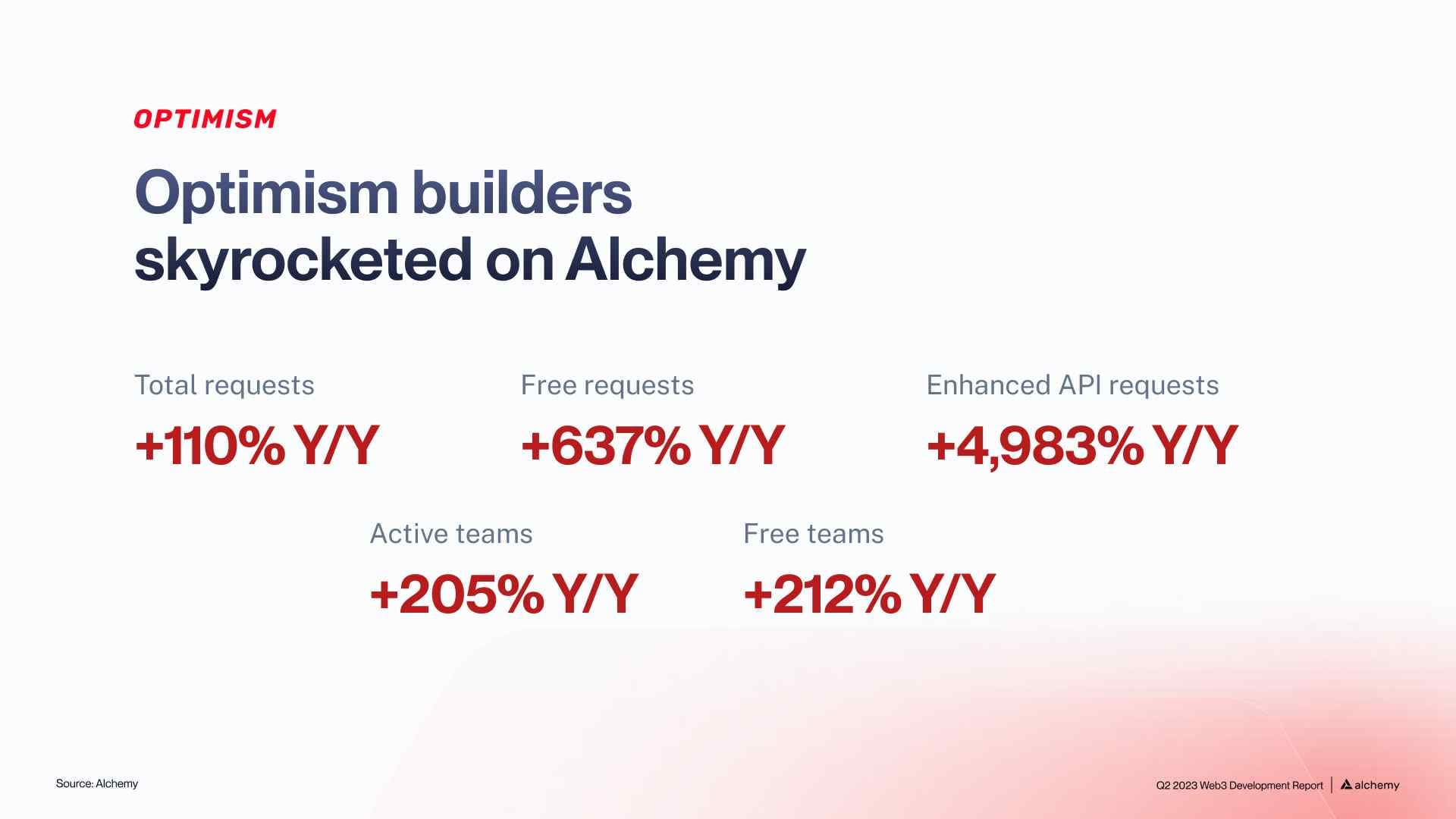

How fast are Optimism devs growing on Alchemy?

In Q2 2023 active Optimism developer teams building on Alchemy grew 205% Y/Y since Q2 2022. Optimism developers also grew:

Total Requests Sent Through Alchemy: +110% Y/Y

Total Free Tier Requests: +637% Y/Y

Total Enhanced API Requests: +4,983% Y/Y

With the proliferation of the the OP Stack and rollups-as-a-service (RaaS), Optimism developer activity continues to skyrocket!

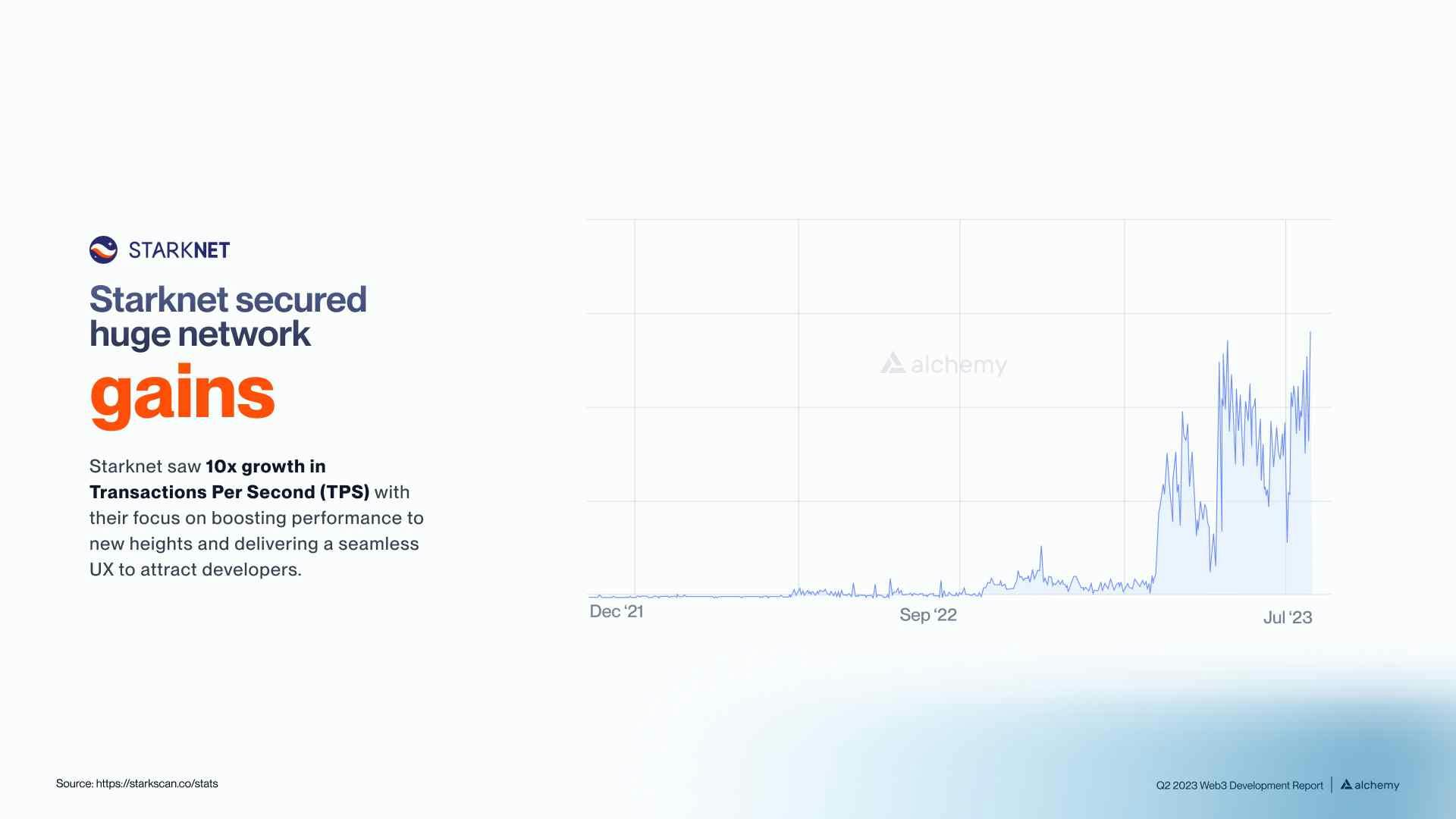

How is Starknet development progressing on Alchemy?

Alchemy made Starknet development support publicly available in May 2023, and early demand from developers is promising due to their rich ecosystem of devs, tooling, and applications, along with native account abstraction.

While still early to provide Alchemy developer statistics, Starknet saw 10x TPS performance gains due to focused optimizations led by their core development team.

How fast are Solana devs growing on Alchemy?

In Q2 2023 active Solana dev teams building on Alchemy grew 56% and their total requests grew 164% Y/Y since Q2 2022 with free tier teams seeing 197% Y/Y growth.

Despite the bear market, builders are still developing products on Solana.

How fast are Astar devs growing on Alchemy?

In Q2 2023 active Astar developer teams building on Alchemy grew 175% Y/Y since Q2 2022 and the total number of requests sent through Alchemy grew 7%.

Astar hit additional milestones including:

Eclipsed 500k holders

Reached 20k stakers

Launched smart contracts 2.0

How is Account Abstraction adoption growing?

Quarterly user operations (UserOps) grew 11,837%, users grew over 27,000%, and Paymaster volume grew 5,182% in Q2 2023 compared to the previous quarter. The best way to enter the Account Abstraction paradigm is with Alchemy's new Account Kit!

Account Abstraction was a major theme in Q2 2023 with many infrastructure providers, smart contract wallets, and consumer applications getting to market at the same time. With such explosive growth the desire for AA support on Ethereum and L2s is evident.

Discover More Q2 2023 Blockchain Trends

In addition to the data and analysis provided on this page, download the Q2 2023 blockchain development report to get additional insights such as:

DeFi Volume and User Statistics

NFT Volume and User Statistics

Web3 Use Cases and Verticals

Previous Web3 Development Reports

To explore previous reports, find them on our blog:

Legal Disclaimer

This report is for informational purposes and does not constitute investment, legal, or tax advice. You should not put undue reliance onany statements of historical trends or interpret them as guarantees of future performance or results.

In addition to providing information based on our internal sources, this report contains statistical data and estimates that are based onpublic information. You should not give undue weight to such data or estimates as we have not verified them.

We make no representations or warranties as to the accuracy or completeness of the data presented nor do we commit to updating such data after the date of this report. By reviewing, sending, receiving, or sharing this report, you acknowledge that you will be solely responsible for your own assessment of the market, our company, and the other organizations mentioned, and you will conduct your own analysis and be solely responsible for forming your own view of any potential future performance.

As indicated on our website (www.Alchemy.com), we have a business relationship with certain chains including Ethereum, Polygon,Optimism, Arbitrum, and Solana. However, this report is not intended to promote the token of any particular chain.

@2023 Alchemy Insights, Inc. All rights reserved worldwide.

Alchemy Newsletter

Be the first to know about releases

Sign up for our newsletter

Get the latest product updates and resources from Alchemy

By entering your email address, you agree to receive our marketing communications and product updates. You acknowledge that Alchemy processes the information we receive in accordance with our Privacy Notice. You can unsubscribe anytime.

Related articles

TRON Support Is Live on Alchemy

You can now build on TRON, the second largest blockchain by stablecoin marketcap, with Alchemy.

Built for Solana: 20x Faster, 99.99% Uptime, 2x Throughput

We’ve completely rearchitected our RPC and Streaming API for Solana.

AWS Veteran Bill Platt Joins Alchemy as COO

Alchemy welcomes AWS veteran Bill Platt as Chief Operating Officer to help lead the next era of AI-powered blockchain infrastructure.